European Dividend Stocks To Enhance Your Income Portfolio

As the pan-European STOXX Europe 600 Index experienced a slight decline, with mixed performances across major stock indexes such as Germany's DAX and France's CAC 40, investors are closely watching the European Central Bank's potential policy moves amid resilient economic indicators. In this environment of cautious optimism and potential rate hikes, dividend stocks can offer a reliable income stream for investors seeking stability and growth in their portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.23% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.61% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.10% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.80% | ★★★★★★ |

| Evolution (OM:EVO) | 4.85% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.13% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.08% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.51% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.36% | ★★★★★★ |

| Afry (OM:AFRY) | 4.02% | ★★★★★☆ |

Click here to see the full list of 205 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Industria de Diseño Textil (BME:ITX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Industria de Diseño Textil, S.A., known for its retail and online distribution of clothing, footwear, accessories, and household products worldwide, has a market cap of approximately €173.68 billion.

Operations: Industria de Diseño Textil, S.A. generates revenue through its global retail and online sales of clothing, footwear, accessories, and household products across various regions including Spain, the rest of Europe, the Americas, and Asia.

Dividend Yield: 3%

Industria de Diseño Textil's dividend is supported by a payout ratio of 59.8%, indicating coverage by earnings, while the cash payout ratio stands at 88.4%. Despite past volatility and unreliability in dividend payments, there has been growth over the last decade. The current yield of 3.01% is below top-tier Spanish dividends but remains covered by both earnings and cash flow. Recent results show increased sales and net income, reinforcing financial stability for future dividends.

- Click to explore a detailed breakdown of our findings in Industria de Diseño Textil's dividend report.

- Our valuation report unveils the possibility Industria de Diseño Textil's shares may be trading at a premium.

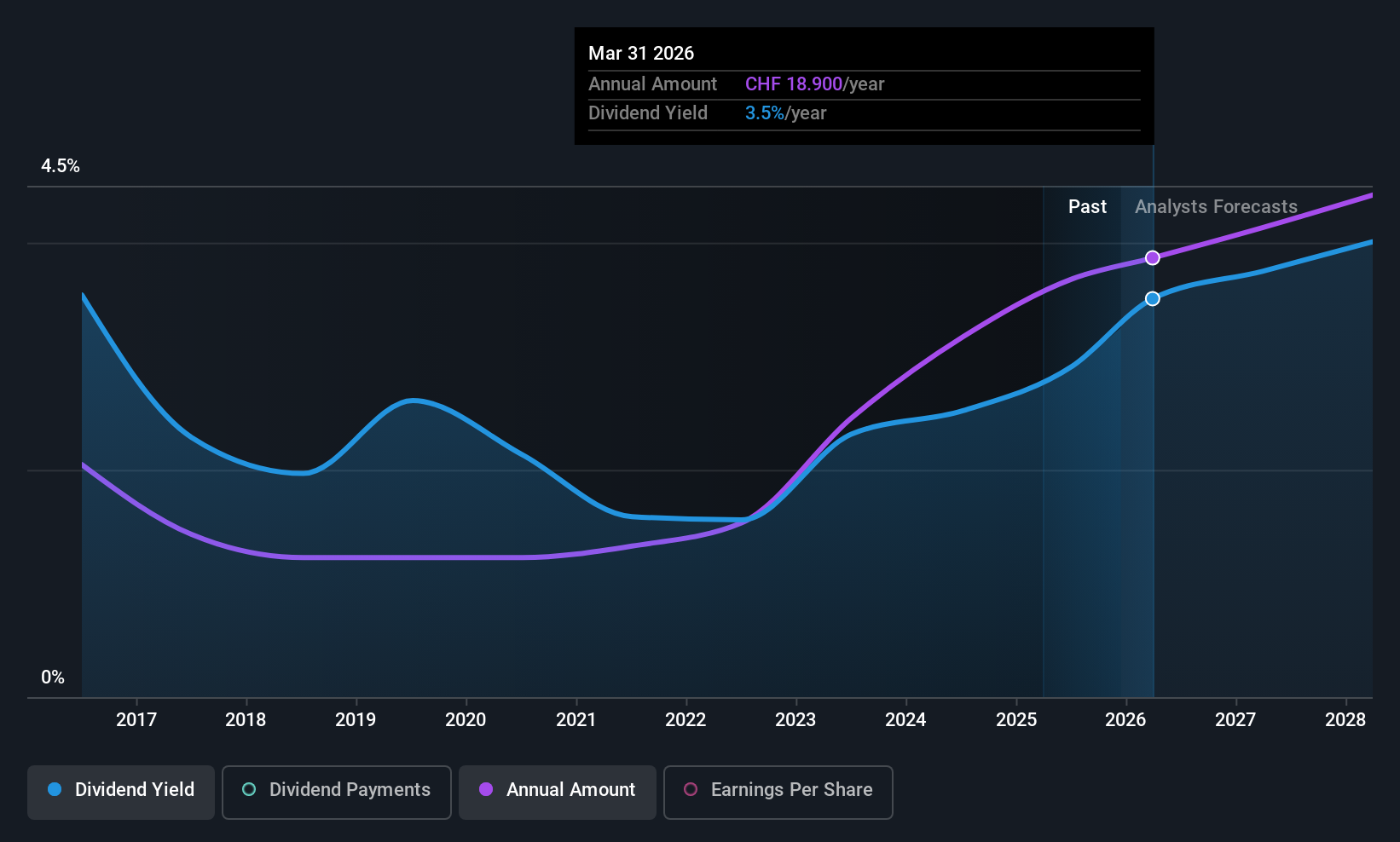

Burckhardt Compression Holding (SWX:BCHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Burckhardt Compression Holding AG is a global manufacturer and seller of reciprocating compressor technologies, with a market cap of CHF1.85 billion.

Operations: Burckhardt Compression Holding AG generates revenue through its Systems Division, which accounts for CHF790.29 million, and its Services Division, contributing CHF319.43 million.

Dividend Yield: 3.3%

Burckhardt Compression Holding's dividends are supported by a payout ratio of 57.9% and a cash payout ratio of 40.4%, ensuring coverage by both earnings and cash flows. Despite past volatility in dividend payments, the company has shown growth over the last decade. The current yield of 3.3% is below top-tier Swiss dividends but remains sustainable due to strong financials, with recent earnings results showing stable sales and net income figures for continued support.

- Click here and access our complete dividend analysis report to understand the dynamics of Burckhardt Compression Holding.

- Insights from our recent valuation report point to the potential undervaluation of Burckhardt Compression Holding shares in the market.

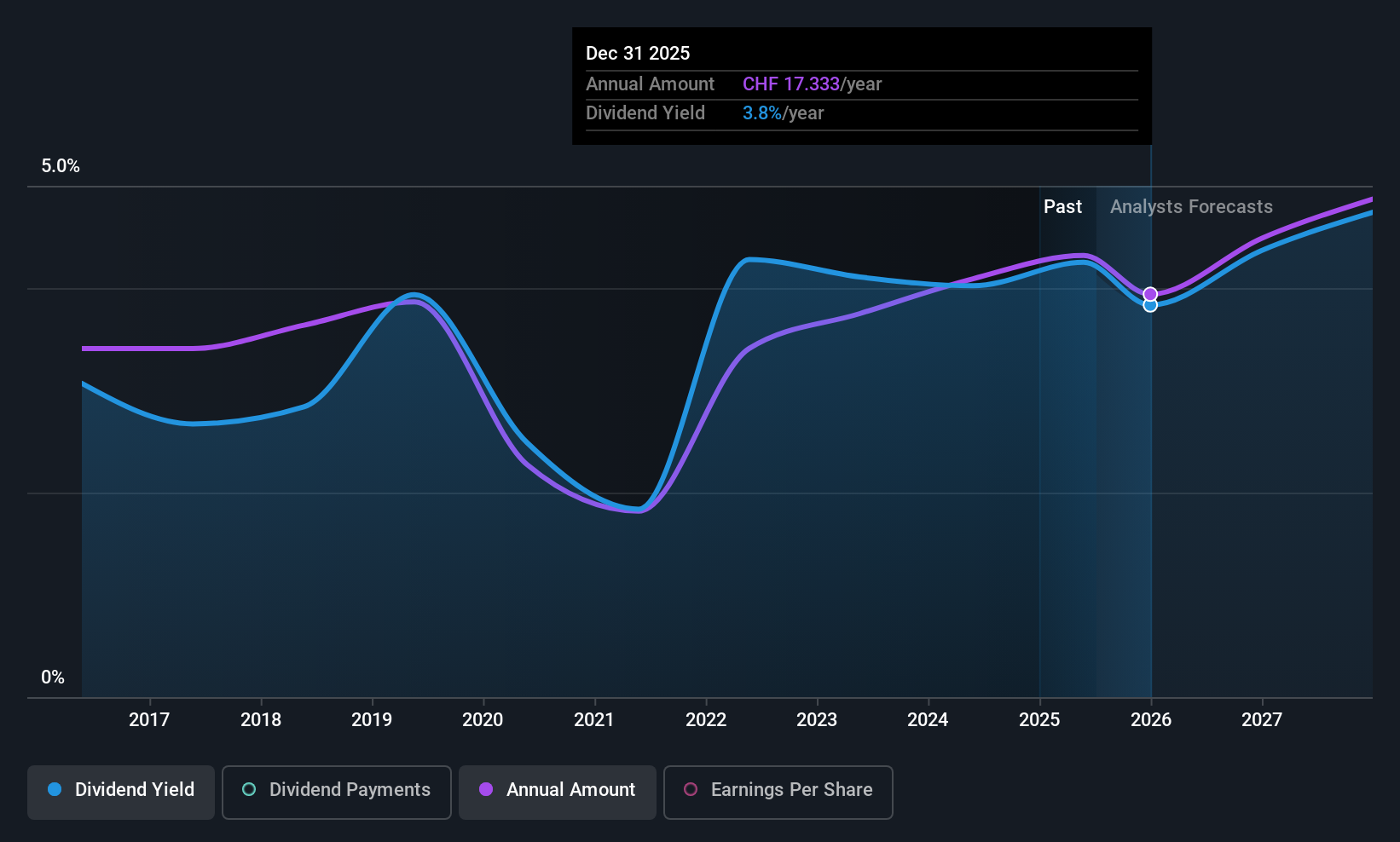

Phoenix Mecano (SWX:PMN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Phoenix Mecano AG, with a market cap of CHF402.76 million, manufactures and sells components for industrial customers globally through its subsidiaries.

Operations: Phoenix Mecano AG's revenue segments include Enclosure Systems (€215.03 million), Industrial Components (€186.42 million), and Dewertokin Technology Group (€370.23 million).

Dividend Yield: 4.3%

Phoenix Mecano's dividend yield of 4.33% ranks in the top 25% of Swiss dividend payers, yet its sustainability is questionable due to a high cash payout ratio of 110.3%, indicating dividends are not well covered by free cash flows. Despite trading at a significant discount to estimated fair value, past volatility and unreliable payments over the last decade pose concerns for investors seeking stable income. Recent buyback plan expiration may influence future financial strategies.

- Get an in-depth perspective on Phoenix Mecano's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Phoenix Mecano's share price might be too pessimistic.

Taking Advantage

- Take a closer look at our Top European Dividend Stocks list of 205 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal