Reassessing Schneider National (SNDR) Valuation After Its Recent 26% One-Month Share Price Rebound

Schneider National (SNDR) has quietly outperformed the market over the past month, climbing about 26%, even as its year to date and 1 year returns remain in negative territory for patient shareholders.

See our latest analysis for Schneider National.

The recent 30 day share price return of roughly 26 percent, alongside a 12 percent gain over 90 days, suggests momentum is starting to rebuild even though the 1 year total shareholder return is still negative.

If Schneider’s rebound has you rethinking the transport space, it could also be worth exploring fast growing stocks with high insider ownership as a way to uncover other fast moving opportunities.

With earnings rebounding, revenue still growing, and the share price trading close to analyst targets, investors now face a key question: Is Schneider National undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 6.2% Overvalued

With Schneider National last closing at $27.01 against a narrative fair value near $25.42, expectations for future execution are doing heavy lifting in this story.

Schneider's continued investments and focus on technology driven efficiency, AI, automation, digital freight platform, and cost reduction initiatives are set to drive sustainable operational improvements, containing expenses even in inflationary environments, which should support higher net margins and earnings growth as volumes recover.

Curious how modest top line assumptions can still translate into a much richer earnings profile and lower future multiple than the sector? The narrative quietly bakes in expanding margins and a transformed profit engine without needing breakneck sales growth. Want to see exactly how those moving parts add up to today’s fair value call?

Result: Fair Value of $25.42 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent freight overcapacity and rising equipment, insurance, and compliance costs could easily squeeze margins and derail those optimistic earnings and valuation assumptions.

Find out about the key risks to this Schneider National narrative.

Another View On Value

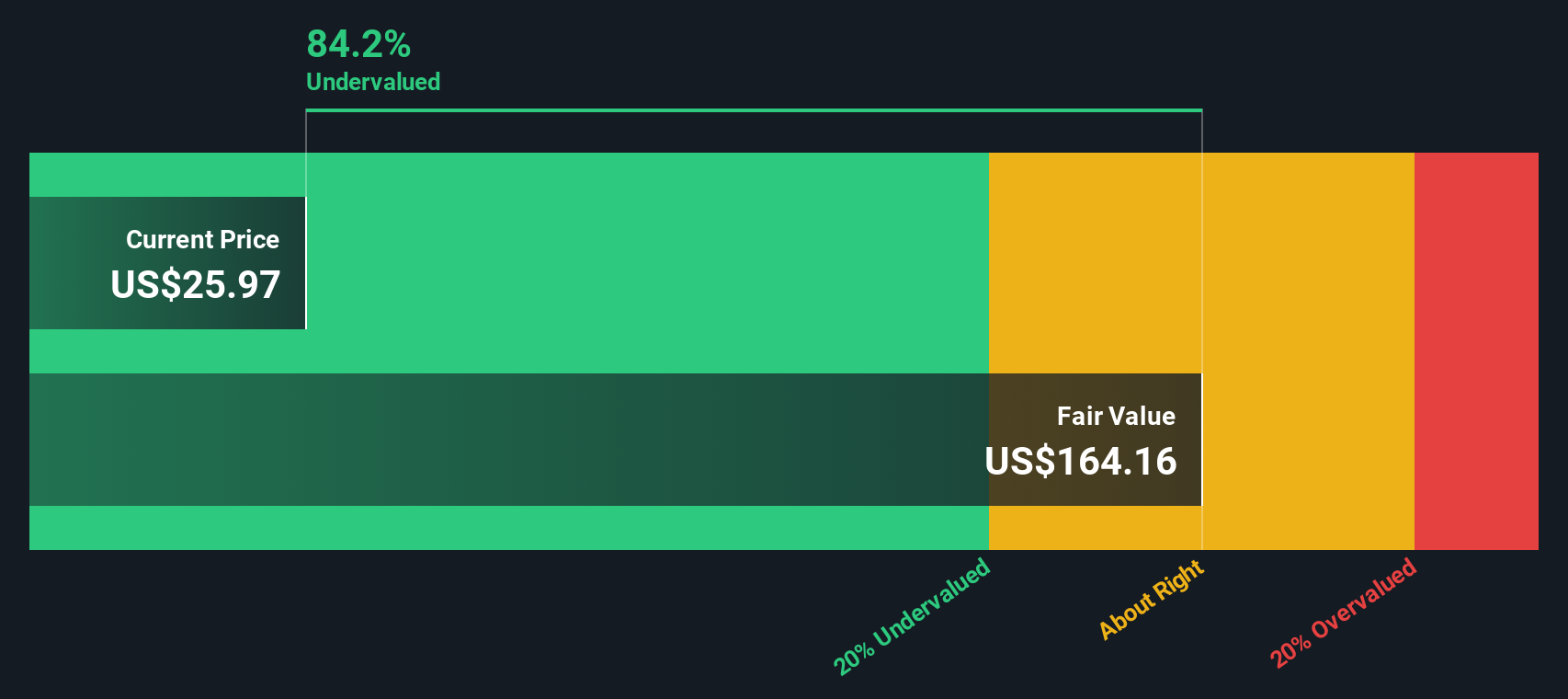

Our SWS DCF model paints a very different picture, suggesting Schneider National is trading about 83.6 percent below its estimated fair value of roughly $164.74 per share. If the cash flow story is closer to reality than the narrative fair value, the market may be significantly underestimating this cycle.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Schneider National for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Schneider National Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can shape a personalized Schneider National story in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Schneider National.

Ready For Your Next Investing Move?

Do not stop with a single stock when smarter opportunities sit in plain sight. Use the Simply Wall Street Screener now so you do not miss them.

- Capture potential mispricings by scanning these 907 undervalued stocks based on cash flows that look cheap against their future cash flows before the crowd catches on.

- Target income you can actually plan around by zeroing in on these 13 dividend stocks with yields > 3% that may support reliable, above average payouts.

- Position yourself ahead of structural change by reviewing these 80 cryptocurrency and blockchain stocks at the intersection of traditional markets and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal