Global's December 2025 Stock Selections For Estimated Value Opportunities

As global markets navigate a landscape marked by the Federal Reserve's interest rate cuts and mixed signals from major indices, investors are increasingly focused on identifying value opportunities amid uncertainty. In this context, finding undervalued stocks that demonstrate strong fundamentals and resilience against economic fluctuations can be a strategic approach to potentially capitalize on market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.70 | CN¥25.23 | 49.7% |

| Taiwan Union Technology (TPEX:6274) | NT$434.50 | NT$867.93 | 49.9% |

| Sanoma Oyj (HLSE:SANOMA) | €9.19 | €18.35 | 49.9% |

| NEXON Games (KOSDAQ:A225570) | ₩12310.00 | ₩24473.28 | 49.7% |

| KoMiCo (KOSDAQ:A183300) | ₩84100.00 | ₩166235.75 | 49.4% |

| Kitron (OB:KIT) | NOK68.00 | NOK134.76 | 49.5% |

| JINS HOLDINGS (TSE:3046) | ¥5500.00 | ¥10944.46 | 49.7% |

| Inission (OM:INISS B) | SEK48.20 | SEK96.19 | 49.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €2.56 | €5.07 | 49.5% |

| Beijing HyperStrong Technology (SHSE:688411) | CN¥260.52 | CN¥515.52 | 49.5% |

Let's review some notable picks from our screened stocks.

STMicroelectronics (ENXTPA:STMPA)

Overview: STMicroelectronics N.V. is a company that designs, develops, manufactures, and sells semiconductor products across Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of approximately €19.88 billion.

Operations: The company's revenue segments include Power and Discrete Products at $2.54 billion and Analog, MEMS & Sensors Group at $4.32 billion.

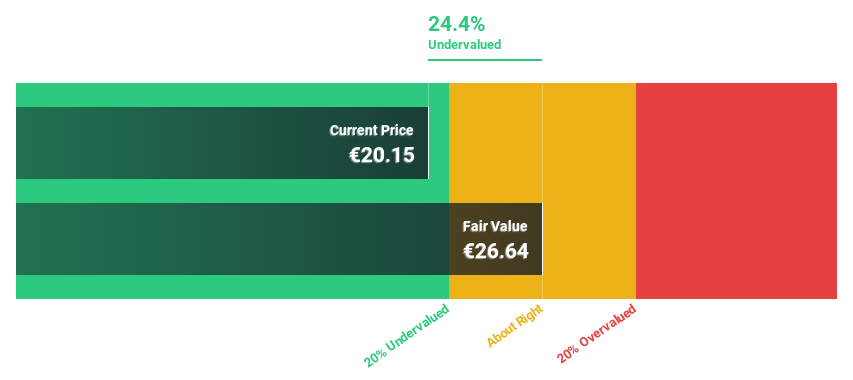

Estimated Discount To Fair Value: 26.4%

STMicroelectronics is trading at €22.37, significantly below its estimated fair value of €30.39, suggesting potential undervaluation based on cash flows. Despite recent challenges with profit margins and net income, the company expects robust earnings growth of 37.8% annually over the next three years, outpacing the French market's growth rate. A recent €500 million financing agreement with the European Investment Bank aims to enhance competitiveness in strategic sectors like automotive and industrial applications.

- Our expertly prepared growth report on STMicroelectronics implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of STMicroelectronics here with our thorough financial health report.

Anker Innovations (SZSE:300866)

Overview: Anker Innovations Limited develops and sells mobile charging products, with a market cap of CN¥59.35 billion.

Operations: Revenue Segments (in millions of CN¥):

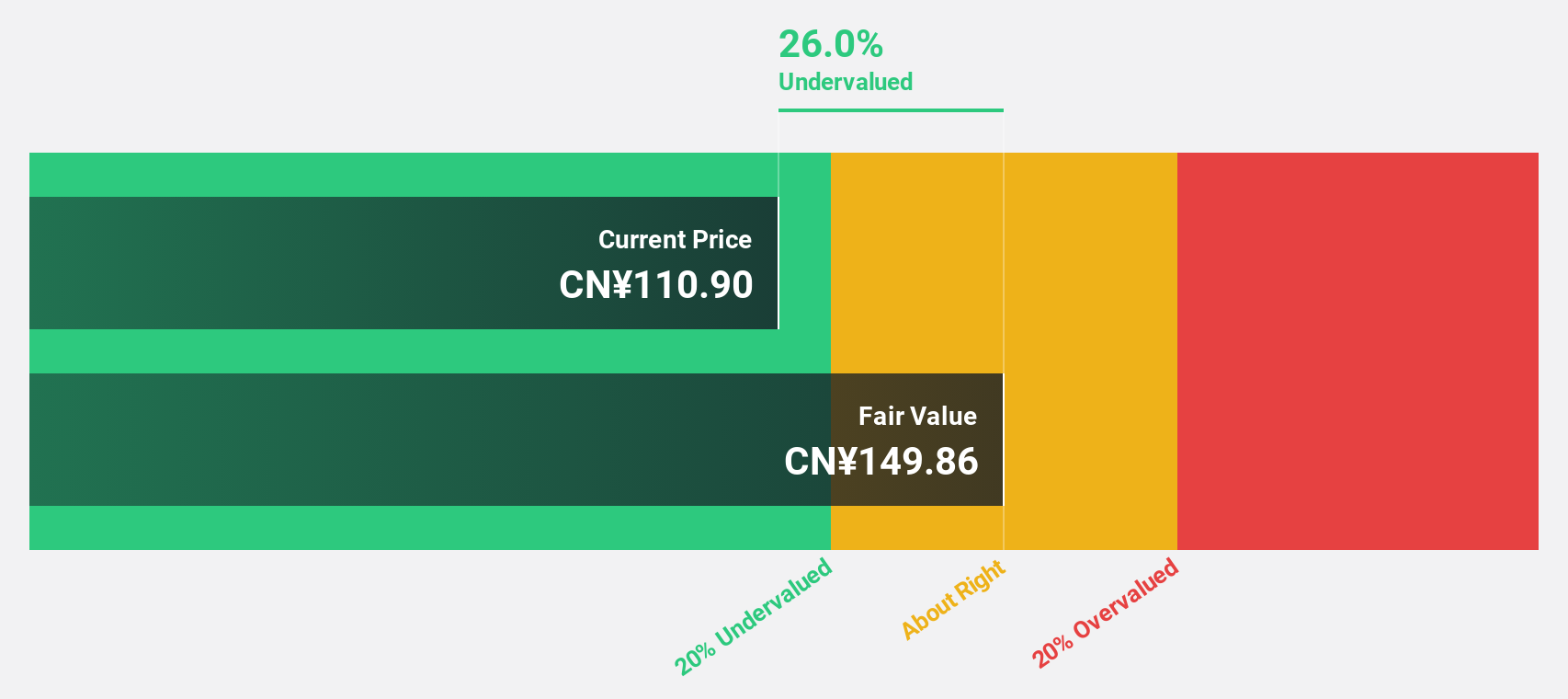

Estimated Discount To Fair Value: 26.2%

Anker Innovations, trading at CN¥110.7, is undervalued based on cash flow analysis with a fair value estimate of CN¥149.96. The company has demonstrated strong revenue growth, with sales increasing to CN¥21 billion for the first nine months of 2025 from CN¥16.45 billion a year ago. However, its dividend yield of 1.08% isn't well-covered by free cash flows. Recent amendments to its articles and potential Hong Kong listing could influence future valuation dynamics.

- The growth report we've compiled suggests that Anker Innovations' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Anker Innovations.

Daiichi Sankyo Company (TSE:4568)

Overview: Daiichi Sankyo Company, Limited is a pharmaceutical manufacturer and seller operating in Japan, the United States, Europe, and internationally with a market cap of ¥6.22 trillion.

Operations: The company's revenue primarily stems from its Pharmaceutical Operation segment, which generated ¥1.98 trillion.

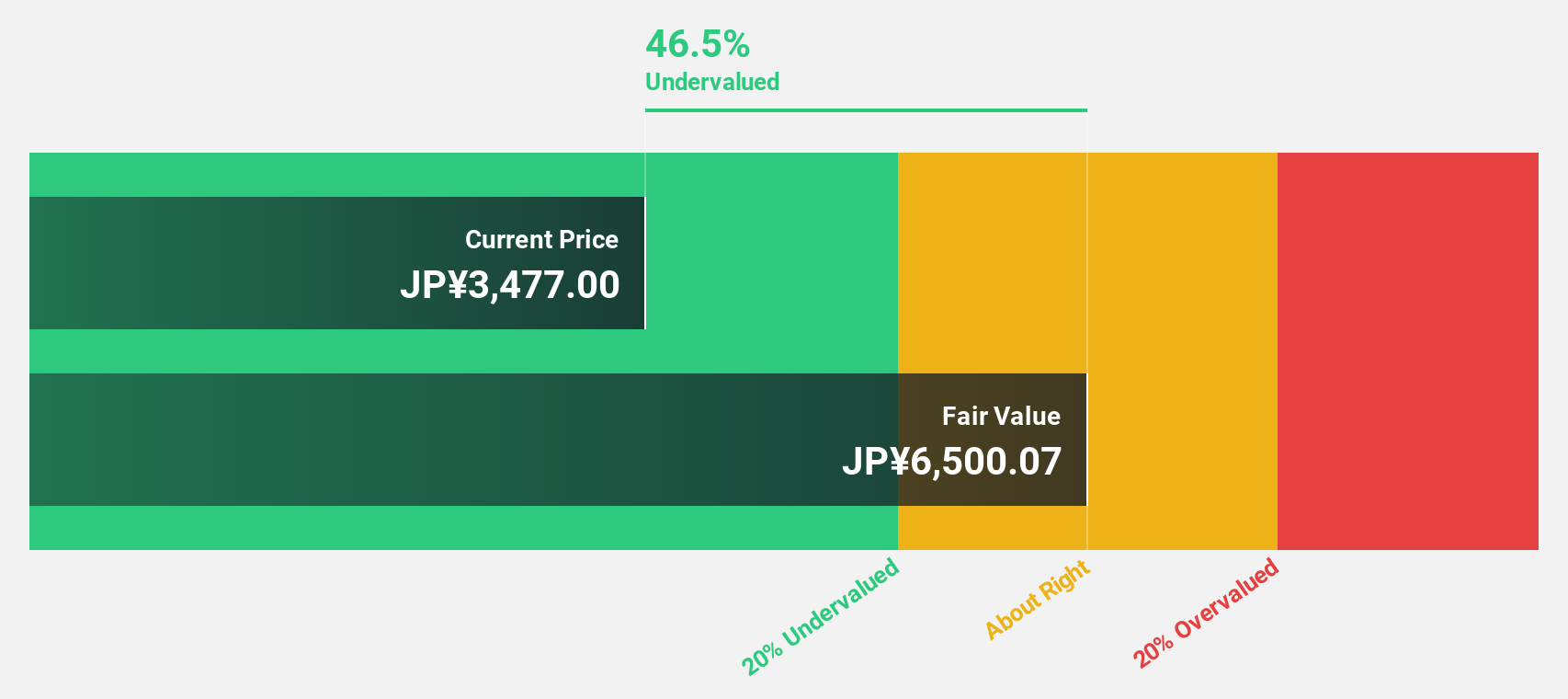

Estimated Discount To Fair Value: 46.8%

Daiichi Sankyo, trading at ¥3479, appears undervalued with an estimated fair value of ¥6544.37. Despite volatile share prices, its earnings are forecast to grow 14.8% annually, outpacing the Japanese market's growth rate. However, its dividend yield of 2.24% is not well-covered by free cash flows. Recent legal victories and ongoing clinical trials in oncology may enhance future revenue streams and support the company's valuation prospects.

- Our earnings growth report unveils the potential for significant increases in Daiichi Sankyo Company's future results.

- Navigate through the intricacies of Daiichi Sankyo Company with our comprehensive financial health report here.

Where To Now?

- Navigate through the entire inventory of 496 Undervalued Global Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal