China Index Research Institute: It is expected that the real estate market will continue to be divided in 2026, and “good cities+good houses” will still have structural opportunities

The Zhitong Finance App learned that the China Index Research Institute said that December is a sprint point for housing companies' performance. It is expected that the market entry of high-quality projects in key cities will increase, and market turnover is expected to maintain a certain scale. Looking ahead to next year, according to China Index estimates, the sales area of newly built commercial housing across the country is expected to drop 6.2% year on year in 2026. The decline is narrower than this year. The market differentiation trend continues, and “good city+good house” still has structural opportunities. Guided by growth control and inventory removal policies, the new construction area is expected to drop by 8.6% in 2026. The decline is significantly narrower than in the past few years. Supply-side contraction will help reduce market inventories and promote an improvement in supply and demand relationships.

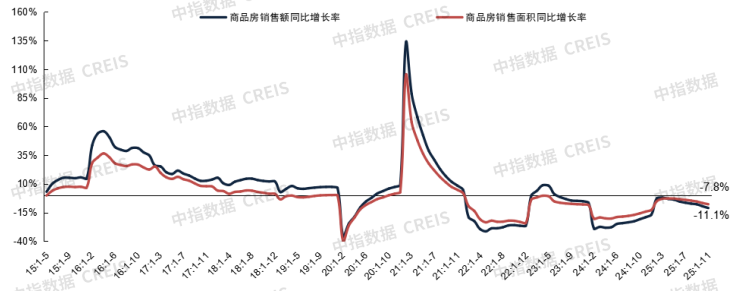

01. Demand: From January to November, the sales area of newly built commercial housing nationwide was 790 million square meters, a year-on-year decrease of 7.8%

Sales area: According to data from the National Bureau of Statistics, in January-November, the sales area of newly built commercial housing nationwide was 787 million square meters, down 7.8% year on year; residential sales area was 658 million square meters, down 8.1% year on year.

Sales: In January-November, sales of newly built commercial housing were 7.51 trillion yuan, down 11.1% year on year; of these, residential sales were 6.60 trillion yuan, down 11.2% year on year.

Currently, the real estate market has gradually entered a stage where stocks are the dominant, and second-hand housing is the main force for market transactions. In core cities, most of the new supply is being upgraded through the construction of “good house” products, and demand for improvement has become an important support for the market. Second-hand housing mainly satisfies groups in immediate need. Since this year, low-total price second-hand housing transactions of less than 3 million in Beijing and Shanghai have increased significantly over the same period last year. The share of properties under 5 million is around 70%, making up the mainstream demand in the second-hand housing market. According to data from the China Index, the number of second-hand residential units sold in the 30 key cities increased by 2% year-on-year in January-November, driving the overall online sales volume of new and second-hand housing to remain basically flat year over year.

Figure: The cumulative sales area of newly built commercial housing across the country and the year-on-year growth rate of sales

Data source: National Bureau of Statistics, China Index Data CREIS

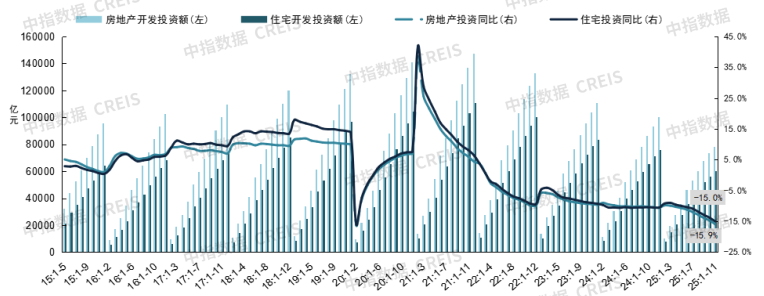

02. Supply: Real estate development investment fell 15.9% year-on-year in January-November

Real estate development investment: From January to November, the national real estate development investment amount was 7.86 trillion yuan, down 15.9% year on year; of these, investment in residential development was 6.04 trillion yuan, down 15.0% year on year.

Figure: The cumulative investment in real estate and residential development from 2015 to the present and its year-on-year growth rate

Data source: National Bureau of Statistics, China Index Data CREIS

Housing construction area: From January to November, the country's housing construction area was 6.561 billion square meters, down 9.6% year on year; of these, residential construction area was 4.576 billion square meters, down 10.0% year on year.

New housing construction area: In January-November, the country's new housing construction area was 535 million square meters, a year-on-year decrease of 20.5%; of these, 392 million square meters of new housing construction area, a year-on-year decrease of 19.9%.

Housing completed area: From January to November, the country's completed housing area was 395 million square meters, a year-on-year decrease of 18.0%. Among them, the completed residential area was 281 million square meters, a year-on-year decrease of 20.1%.

Overall, the current new housing market is still in the “inventory removal” stage. On the supply side, development investment and new construction continued to shrink, which contributed to a certain extent to the decline in market inventories and the improvement of supply and demand relationships.

Figure: The country's cumulative new housing construction and construction area and its year-on-year growth rate

Data source: National Bureau of Statistics, China Index Data CREIS

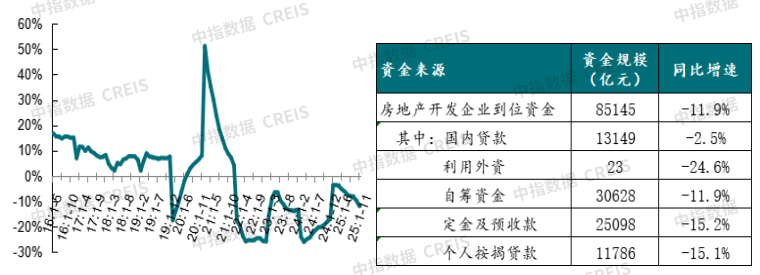

03. Source of funding: From January to November, housing enterprises received 8.51 trillion yuan in capital, a year-on-year decrease of 11.9%

Capital available for real estate development companies: In January-November, the amount of capital available to real estate development companies was 8.51 trillion yuan, a year-on-year decrease of 11.9%.

Domestic loans: From January to November, domestic loans were 1.31 trillion yuan, down 2.5% year on year, and continued to decline year on year, accounting for 15.4%.

Use of foreign capital: From January to November, the amount of foreign capital used was 2.3 billion yuan, a year-on-year decrease of 24.6%.

Self-financing: In January-November, self-financing was 3.06 trillion yuan, a year-on-year decrease of 11.9%, accounting for 36.0%.

Deposit and advance payments: In January-November, deposits and advance payments were 2.51 trillion yuan, a year-on-year decrease of 15.2%, accounting for 29.5%.

Personal mortgage loans: From January to November, personal mortgage loans were 1.18 trillion yuan, a year-on-year decrease of 15.1%, accounting for 13.8%.

Figure: Comparison of the year-on-year growth rate of capital available to housing enterprises and the year-on-year growth rate of various funding sources

Data source: National Bureau of Statistics, China Index Data CREIS

04. Policy developments

On November 21, the Ministry of Housing and Construction held a national conference to promote urban renewal work, stating that “it is necessary to earnestly implement the “Opinions of the General Office of the CPC Central Committee and the General Office of the State Council on Continuing to Promote Urban Renewal Actions”, adapt to local conditions, explore and innovate, and focus on the four aspects of planning, capital, operation, and governance. On December 10-11, the Central Economic Work Conference was held in Beijing. In order to do a good job in the economy next year, the conference emphasized “implementing more active and promising macroeconomic policies, enhancing forward-looking and targeted synergy of policies, continuing to expand domestic demand, optimize supply, improve growth, and revitalize stocks,... We will continue to prevent and mitigate risks in key areas, focus on stabilizing employment, stabilizing enterprises, stabilizing markets, and stabilizing expectations, and promote effective qualitative and quantitative growth in the economy.” Real estate-related arrangements are still in the “Mitigating Risks in Key Areas” section, which proposes “focusing on stabilizing the real estate market, controlling growth, removing inventory, and improving supply, and encouraging the acquisition of existing commercial housing to focus on affordable housing, etc. Deepen the reform of the housing provident fund system and promote the construction of 'good houses' in an orderly manner. Accelerate the construction of a new model for real estate development.”

At the local level, Hangzhou, Chengdu, Tianjin Binhai New Area and other places are promoting the revitalization of existing resources. Among them, Hangzhou publicly solicited opinions on the “Hangzhou Implementation Rules for Temporary Housing Use Changes” to implement operating rules for temporary changes in housing use; Foshan optimizes overseas individual housing purchase conditions; Chongqing, Foshan and other places optimize provident fund loan policies; and at the end of the month, Beijing issued a “15th Five-Year Plan” plan proposal to “continue to promote living and living. Accelerate the construction of a new model for real estate development, and improve the 'market+guarantee' housing supply system and a housing system combining rental and purchase”. Also, in November, provinces and cities such as Chongqing and Hubei issued nearly 35 billion yuan of special bonds to collect and buy unused land stocks.

05. Prospects

Looking at policy trends, the Central Economic Work Conference clearly proposed “implementing more active and promising macroeconomic policies”. The policy approach emphasizes “maintaining steady progress, improving quality and efficiency,” and “leveraging the integrated effects of stock policies and incremental policies to increase countercyclical and cross-cycle adjustment efforts.” As the first year of the “15th Five-Year Plan,” it is expected that both macroeconomic policies and real estate policies will advance. The conference made “adhering to domestic demand leadership and building a strong domestic market” as the top priority. The real estate industry is not only related to consumption, but also an important field for investment, and is an important gripper for expanding domestic demand. The conference clearly emphasized “focusing on stabilizing the real estate market,” and its core path is to “control growth, remove inventory, and improve supply through urban policies.” The focus is on the direction of next year's “inventory removal” incremental policy and how to solve the blockages in inventory policies such as collection and storage. At the same time, the housing provident fund policy is still an important gripper to support the release of demand for housing, and in terms of excellent supply, the expression “good house” construction was adjusted to “promote in an orderly manner”, which helps avoid short-term impact on existing banks, thus guiding the market to achieve a smooth transition.

In terms of market trends, December is a sprint point for housing companies' performance. It is expected that the entry into the market of high-quality projects in key cities will increase, and market turnover is expected to maintain a certain scale. Looking ahead to next year, according to China Index estimates, the sales area of newly built commercial housing across the country is expected to drop 6.2% year on year in 2026. The decline is narrower than this year. The market differentiation trend continues, and “good city+good house” still has structural opportunities. Guided by growth control and inventory removal policies, the new construction area is expected to drop by 8.6% in 2026. The decline is significantly narrower than in the past few years. Supply-side contraction helps to reduce market inventories and drive improvements in supply and demand.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal