Woodward (WWD): Reassessing Valuation After Governance Changes to Voting Rights and Board Power

Woodward (WWD) just moved to update its corporate rulebook, proposing to scrap some supermajority voting thresholds while also eliminating cumulative voting in director elections. This governance tweak could subtly reshape shareholder influence.

See our latest analysis for Woodward.

These governance moves come after a powerful run, with the share price up 73.85% year to date and a 1 year total shareholder return of 71.02%. This hints that momentum is still firmly on Woodward's side despite a recent dip.

If these changes have you rethinking aerospace exposure, it could be a good moment to scout other aerospace and defense stocks that might fit a similar long term thesis.

With the stock near record highs, analysts leaning bullish, and governance tilting further toward the board, is Woodward still trading below its true potential, or are markets already pricing in years of future growth?

Most Popular Narrative: 6% Undervalued

With Woodward last closing at $297.95 against a narrative fair value of $317.13, the most widely followed view sees more upside still to capture.

Strategic capital allocation toward next-generation manufacturing capabilities, vertical integration, and automation is set to improve operational efficiency and cost structure, which, combined with pricing power from value-added innovation, is likely to drive net margin expansion in the medium to long term.

Curious how modest revenue growth, rising margins, and a premium future earnings multiple combine to support that target? The narrative spells out the full playbook.

Result: Fair Value of $317.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy capital spending on new facilities and ongoing supply chain pressures could squeeze free cash flow and delay the expected narrative of margin expansion.

Find out about the key risks to this Woodward narrative.

Another View: Earnings Multiple Flags Rich Pricing

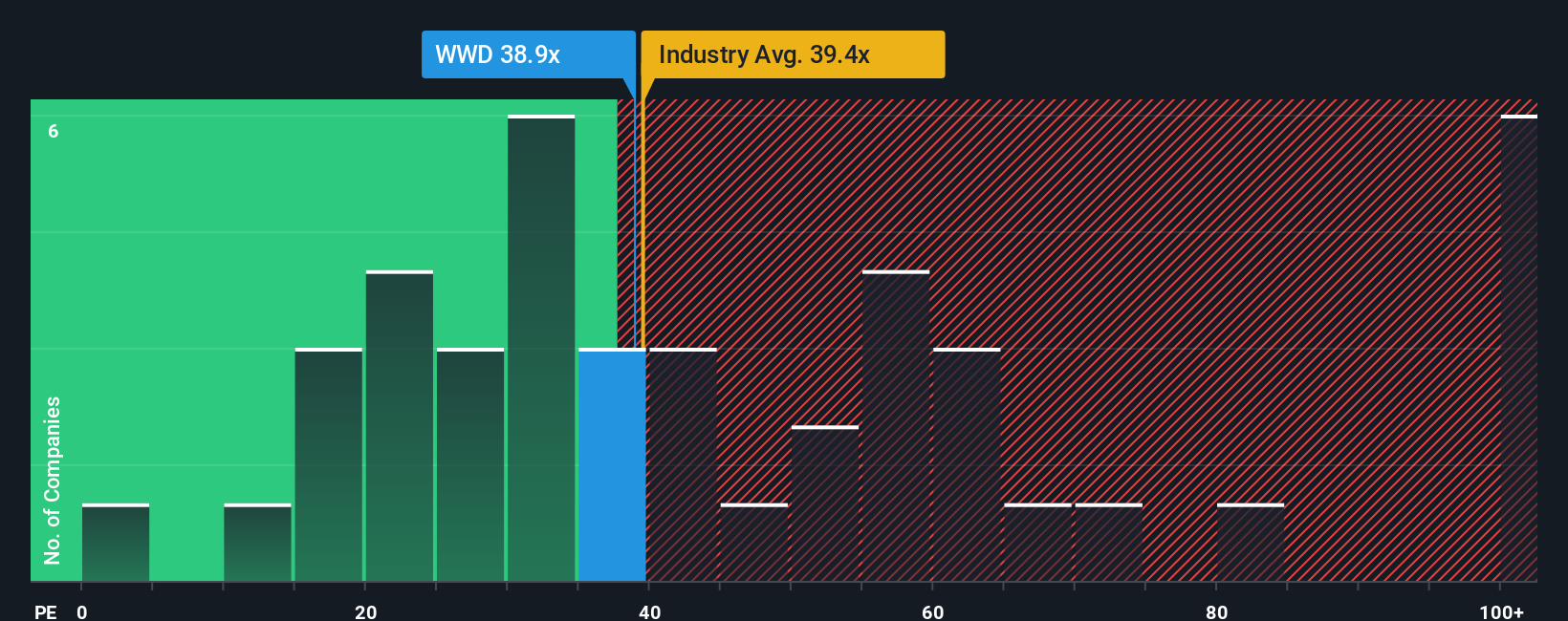

While the dominant narrative pegs Woodward as about 6% undervalued, its current price to earnings ratio of 40.3x tells a different story. That is richer than the US Aerospace and Defense average at 38.7x and well above a 27.4x fair ratio our models suggest the market could drift toward.

This gap implies investors are paying a sizable premium today for future execution on margins and growth. If sentiment cools or estimates slip, that premium could unwind quickly. Is this a leadership multiple you are comfortable funding, or a signal to wait for a better entry point?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Woodward for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Woodward Narrative

If you would rather challenge these assumptions and dig into the numbers yourself, you can build a personalized thesis in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Woodward.

Looking for more investment ideas?

Want a stronger watchlist fast? Use the Simply Wall Street Screener to target high conviction opportunities before they become crowded trades and keep your edge sharp.

- Capture mispriced potential by scanning these 908 undervalued stocks based on cash flows that pair solid fundamentals with attractive entry points.

- Identify innovation trends by focusing on these 26 AI penny stocks positioned to benefit from the adoption of intelligent technologies.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3% that can help balance growth with cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal