European Penny Stocks To Watch In December 2025

As the European market navigates a period of mixed performance, with indices like Germany's DAX showing gains while others such as France's CAC 40 experience declines, investors are keenly observing economic signals for future trends. In this climate, penny stocks—often representing smaller or newer companies—continue to capture attention due to their potential for unexpected returns. Despite being an outdated term, these stocks remain relevant and can offer valuable opportunities when they possess strong financial foundations and growth potential.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.68 | €83.11M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.02 | €15.15M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €1.96 | €27.08M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €224.21M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.04 | €64.48M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.325 | €382.26M | ✅ 4 ⚠️ 1 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.929 | €74.97M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.27 | €313.76M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.78 | €26.12M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 286 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cairo Communication (BIT:CAI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cairo Communication S.p.A. is a communication company operating in Italy and Spain with a market cap of €325.63 million.

Operations: The company's revenue is primarily derived from RCS (€850.6 million), Licensee (€350.4 million), Editoria periodici Cairo Editore (€77.7 million), and La7 Television Publishing and Network Operator (€124.1 million).

Market Cap: €325.63M

Cairo Communication S.p.A. presents a mixed picture as an investment in the European penny stock landscape. The company has demonstrated stability with its short-term assets exceeding liabilities and a seasoned board boasting an average tenure of 21.3 years. Despite a modest earnings growth of 1.1% over the past year, which surpasses industry averages, it falls short of its five-year trend of 8.5%. Trading at a significant discount to estimated fair value and maintaining high-quality earnings, Cairo's financial health is bolstered by cash exceeding debt and strong interest coverage ratios; however, long-term liabilities remain uncovered by current assets. Recent earnings showed slight declines in sales and net income compared to the previous year but remain relatively stable overall.

- Unlock comprehensive insights into our analysis of Cairo Communication stock in this financial health report.

- Evaluate Cairo Communication's prospects by accessing our earnings growth report.

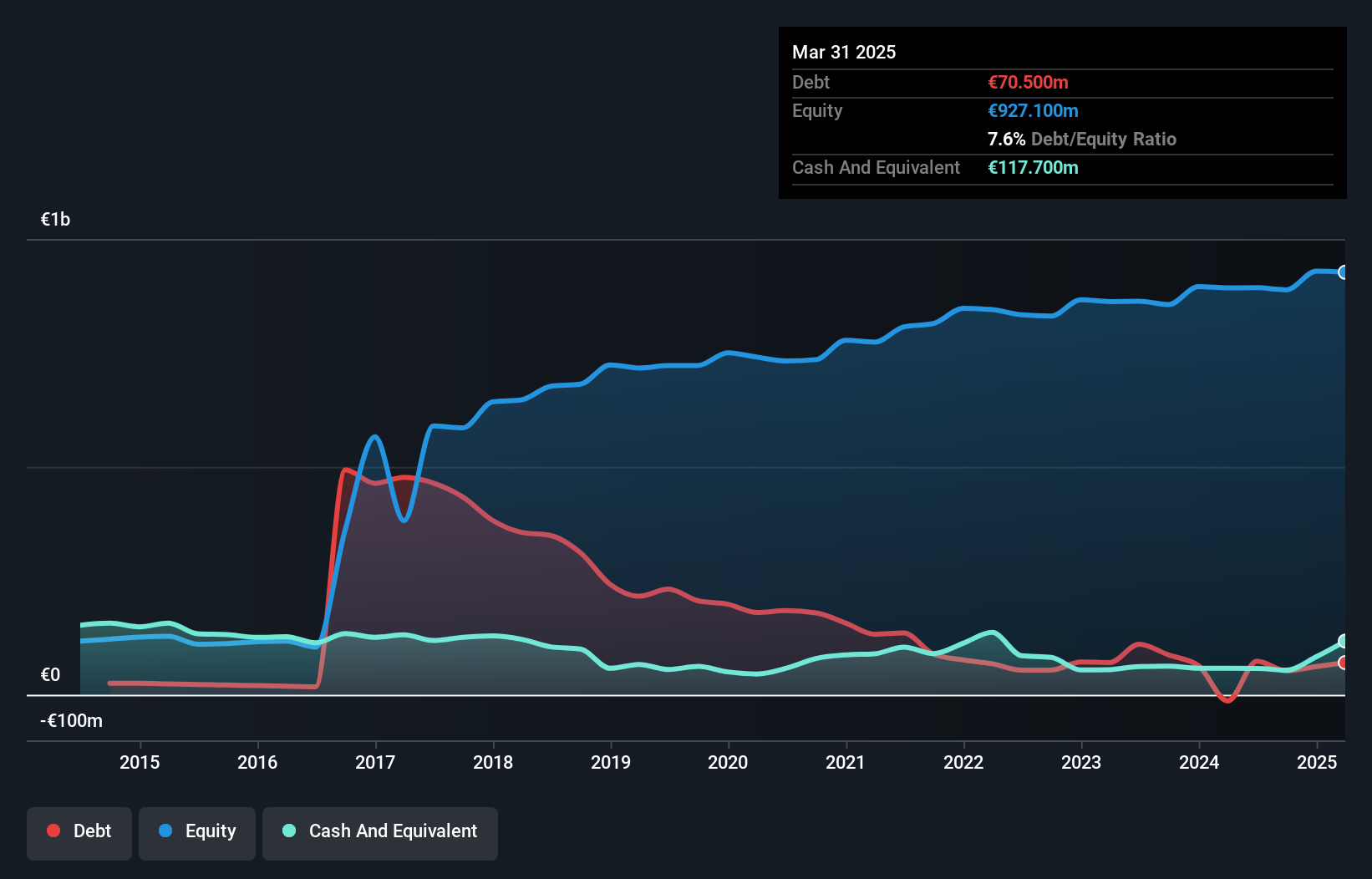

Aramis Group SAS (ENXTPA:ARAMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aramis Group SAS operates in the online sale of used vehicles across France, Belgium, the United Kingdom, Austria, Italy, and Spain with a market cap of €360.59 million.

Operations: The company's revenue is primarily derived from four segments: Refurbished Cars (€1.56 billion), Pre-Registered Cars (€554 million), B2B (€145.1 million), and Services (€123.7 million).

Market Cap: €360.59M

Aramis Group SAS, operating in the used vehicle market across Europe, offers a compelling profile within the penny stock sphere due to its robust financials and strategic initiatives. The company trades at nearly 60% below its estimated fair value, with strong cash flow covering debt and short-term assets exceeding both long-term and short-term liabilities. Aramis has shown impressive earnings growth of 296.3% over the past year, surpassing industry averages. Recent announcements include a share buyback program aimed at rewarding key managers and employees, reflecting confidence in future performance despite a modest net profit margin of 0.8%.

- Jump into the full analysis health report here for a deeper understanding of Aramis Group SAS.

- Learn about Aramis Group SAS' future growth trajectory here.

Kongsberg Automotive (OB:KOA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kongsberg Automotive ASA develops, manufactures, and sells products to the automotive industry worldwide, with a market cap of NOK2.21 billion.

Operations: The company generates revenue through its Flow Control Systems segment, which accounts for €306.5 million, and its Drive Control Systems segment, contributing €324.6 million.

Market Cap: NOK2.21B

Kongsberg Automotive ASA, with a market cap of NOK2.21 billion, presents an intriguing case in the penny stock landscape. Despite being unprofitable, it maintains a satisfactory net debt to equity ratio of 34.1% and has not diluted shareholders recently. The company’s short-term assets (€329.3M) comfortably exceed both its short-term (€175.1M) and long-term liabilities (€221.3M), indicating solid financial footing despite negative return on equity (-14.62%). While the board and management team are relatively new, Kongsberg's positive free cash flow provides a cash runway exceeding three years, suggesting financial resilience amidst ongoing restructuring efforts.

- Take a closer look at Kongsberg Automotive's potential here in our financial health report.

- Review our historical performance report to gain insights into Kongsberg Automotive's track record.

Turning Ideas Into Actions

- Access the full spectrum of 286 European Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal