Financial Report Preview | Even if the Q1 earnings report is amazing, does MU.US (MU.US)'s “storage supercycle” narrative still need more confirmation?

The Zhitong Finance App learned that as Micron Technology (MU.US) will announce financial results for the first quarter of fiscal year 2026 after the US stock market on December 17 EST (morning of December 18, Beijing time), a question gradually emerged in the market: is HBM (high bandwidth memory) actually a cyclical product like traditional memory chips in the past? The answer to this question will probably determine whether Micron's increase in market value of 200 billion US dollars since April of this year is reasonable, and this week's Q1 earnings report may become a “litmus test” for the US storage giant.

Wall Street expects Micron's earnings per share to reach $3.93 this quarter, a significant increase from $1.79 in the same period last year. Revenue is expected to reach US$12.82 billion, an increase of more than 45% year over year.

Micron benefits from storage supercycles

At a time when both sides of the market are fiercely debating whether HBM is cyclical and whether Micron's storage business is still in a boom-bust cycle, the company's stock price is booming in the market. Earlier this month, Micron announced its withdrawal from its “Innova” consumer-grade business, which undoubtedly fueled the cyclical controversy of its business. The market expects this week's earnings report to provide more clear answers.

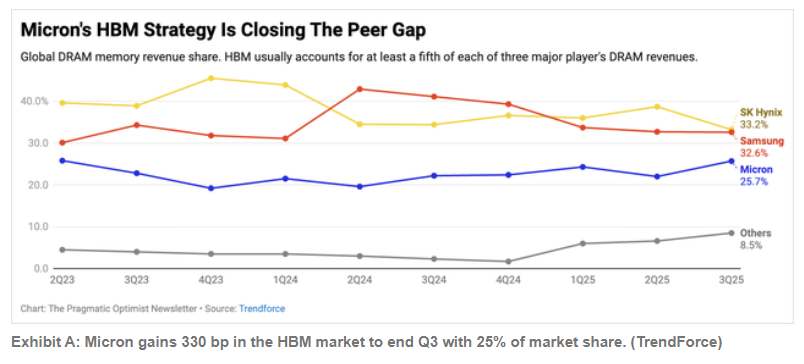

Currently, Micron is “fiercely competing and leading the competition” in the HBM field. According to the latest data, Micron's growth advantage in the HBM market continues to expand — its market share increased by 330 basis points to 25.7% compared to the previous year, and achieved the target it was originally planned to achieve next year ahead of schedule.

In fiscal year 2025, the core driving force behind Micron's development was the rapid growth of its HBM business, which brought the company's annualized HBM revenue to US$8 billion, accounting for about 21% of its total revenue of US$37.4 billion. Throughout fiscal year 2025, Micron benefited from an increase in HBM3 (especially HBM3E) production capacity. Furthermore, one point that has been extremely beneficial to Micron so far this year is that its larger industry competitor Samsung (SSNLF.US) has failed to obtain Nvidia (NVDA.US) Blackwell GPU certification for its HBM3 products due to cooling issues. Although the successor to Samsung's HBM3E has been certified, this may slow the almost oligopoly dividends that Micron and industry leader SK Hynix enjoyed during the HBM3E climbing phase.

At a macro level, what is driving the entire storage industry is undoubtedly soaring storage prices — prices have soared 172% since this year alone. At the same time, storage bit shipments are also expected to jump by about 25% or more this year, forming a strong combination of average sales price and a sharp rise in shipment volume. The unit economics of the storage business have never been better.

This probably explains why Micron management decided to exit the consumer business and focus all resources on the data center business segment. Currently, the data center business contributes 56% of Micron's total revenue, and gross margin is as high as 52%. Notably, the gross margin of its data center business is higher than the company's overall level (overall gross margin of about 45% for the fourth quarter of fiscal year 2025, and about 40% for the whole year). The expansion of gross margin is a very good sign that Micron's business will further accelerate growth, and factory utilization will continue to increase. Investors can also see that Micron's current inventory days have dropped to 125 days, far lower than the 150 days two years ago.

In addition to these developments in business fundamentals, investors are also expected to focus on two other key elements in its Q1 earnings report.

First, the market is eager to hear the magic phrase “sold out” of Micron's future HBM production capacity. In the previous quarter, management did not bluntly say that the supply was sold out, but rather stated that it “expects to reach an agreement within the next few months to sell the remainder of our total HBM supply for the calendar year 2026.” This is because the price of the HBM3E has basically been locked in, and “active discussions” with customers about HBM4 production capacity are still ongoing, and the first batch of HBM4 is expected to begin shipping in the second quarter of the 2026 natural year. Next week, the market will be eagerly looking forward to hearing the word “sold out.”

Since Micron released its Q4 earnings report in September, a series of multi-billion dollar orders involving data center GPUs and XPUs have been announced one after another, which has undoubtedly expanded the total market potential of Micron HBM. The market's revenue expectations for Micron's 2026 fiscal year have risen sharply. According to the consensus forecast on Seeking Alpha, the 2026 revenue forecast has been raised 8% since September this year. Currently, revenue is expected to reach US$57.4 billion, an increase of 54% over the previous year.

The second element that the market is concerned about is Micron's capital expenditure guidelines. According to previously known guidelines, the capital expenditure is approximately $18 billion. Based on the September revenue forecast, this represents approximately 34% of the anticipated revenue for the 2026 fiscal year. If management drastically raised capital expenditure to a level close to the average of about 36% of revenue in previous years, it would have a real impact on Micron's stock price, which would be an extremely bullish sign.

At an investor conference last month, Micron Chief Financial Officer Mark Murphy did suggest that the $18 billion capital expenditure guidance will be revised in next week's Q1 earnings report: “The pressure in this area will increase this year. So I expect we'll probably be on the earnings call in about a month — we'll raise this and update you all at that time.” Therefore, investors will be sure to get the latest information on capital expenditure guidelines at that time.

Notably, Murphy's statement on capital expenditure guidance was made in response to an analyst's question about “whether Micron's business growth can surpass the storage industry's 8-10 quarterly upward cycle.” In addition to capital expenditure related suggestions, he also stated that “the current storage supply and beyond 2026 will not be sufficient to meet market demand.” This increase in demand is due in large part to the market's transition from a 12-layer stacked HBM3/HBM3E to a 16-layer stacked HBM4. This statement means that Micron's growth prospects are expected to surpass the traditional 8-10 quarter upward cycle of the industry, and the company is actively planning to grasp this trend.

Analysts' optimism heats up

Optimistic expectations prior to the release of earnings reports have already triggered a wave of rating-up by analysts. Top institutions such as Stifel, Mizuho, and UBS have all raised their target prices. Analysts pointed to improved memory price trends and increased demand for HBM as key drivers.

Deutsche Bank's Melissa Weathers raised the target price from $200 to $280. She believes Micron is ready to benefit from the next memory market cycle. HBM is driving changes in the industry, which may support higher valuations.

Deutsche Bank raised its earnings forecast for the full year of FY2026 by 26% to $20.63, while increasing its revenue forecast by 12% to $59.66 billion.

Citigroup analysts pointed out that Micron Technology's Q1 earnings report is expected to significantly exceed market expectations. The bank believes that the sharp rise in storage prices and the continued growth in demand for AI applications are the main driving force behind the strengthening of Micron's stock price, maintaining its “buy” rating and raising the target price from $275 to $300.

Analyst Christopher Danely said he expects Micron to “significantly exceed expectations and raise guidelines”, mainly due to “an unprecedented increase in DRAM prices.” The bank estimates that in the fourth quarter of 2025, DRAM prices will rise 50% month-on-month, far exceeding previous expectations.

Citi also pointed out that Micron “sold out of HBM production capacity in 2026,” adding that as the entire industry begins negotiations on long-term DRAM supply agreements, Micron is expected to receive “large capital injections from AI customers.”

Micron's stock price may have been ahead of schedule to reflect expectations

Needless to say, Micron may be at the beginning of a supercycle. The company has begun to see the value-added benefits of adequate investment, enabling it to take an advantageous position when time and place are favorable. The Q1 earnings report is likely to show Micron's strong performance. But at the same time, it should be noted that in terms of stock prices, the market may have already pushed Micron to a level that exceeded expectations in Q1.

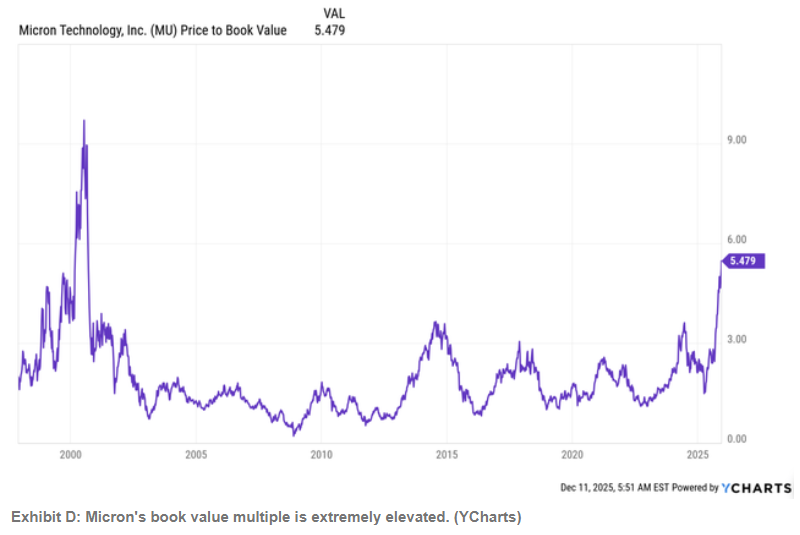

Currently, Micron's stock price is as high as 5.5 times its book value, which is the highest since the Internet bubble era.

Valuing Micron is no easy feat. Due to the cyclical nature of business in the past, the market usually tracks its book value to find the top of its cyclical boom phase. The current valuation clearly shows that the market no longer views Micron using the traditional boom-bust cycle theory, but rather anticipates that the company is entering some kind of supercycle, or that its business will finally break away from cyclicality and shift to long-term growth.

Therefore, in order to value Micron next year, we will instead analyze its revenue trends and market expectations to observe the market's estimate of its stock price.

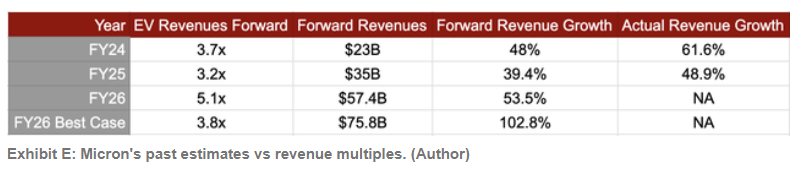

Looking back at Micron's forward revenue expectations for fiscal year 2023 and fiscal year 2024, the average revenue growth rate of the company in these two fiscal years was about 44%-45%, and the forward corporate value/revenue (EV/forward revenue) ratio corresponding to the stock price was about 3.4-3.5 times. As a matter of fact, Micron's revenue for the 2024 fiscal year increased by 62% and the 2025 fiscal year increased by about 49%, all exceeding previous expectations.

Based on these historical expectations, combined with the above assumptions about Micron's projected revenue of US$57 billion for fiscal year 2026 (implying 53-54% growth), Micron's valuation should be approximately 4.5 times the expected revenue for the 2026 fiscal year. However, the current market valuation of Micron is 5.1 times the expected revenue for the 2026 fiscal year, which means that the market expects Micron to eventually grow by about 63% this year, 10% higher than the general forecast of about 57 billion US dollars.

Summarize

Under the current storage supercycle, Micron's first quarter earnings report and conference call this week will definitely attract attention. The company may further confirm the trend that its storage business continues to benefit from the super cycle, thus ending the market debate over it.

Although the long-term business trend continues to support the fundamentals of Micron's growth, its stock price has risen sharply in the past few months, and it remains to be seen whether the market can finally continue to respond positively after the financial report is announced.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal