Giant Biogene Holding (SEHK:2367): Valuation Check After New Buyback Plan and Fresh Broker Buy Ratings

Giant Biogene Holding (SEHK:2367) has put itself back on investors radar with a fresh share repurchase plan, paired with supportive calls from major brokerages that frame the stock as a value opportunity.

See our latest analysis for Giant Biogene Holding.

The buyback and upbeat broker coverage arrive after a tough stretch, with a 90 day share price return of negative 44.37 percent and a one year total shareholder return of negative 30.48 percent. This suggests momentum may be stabilising rather than collapsing at the current HK$35.1 level.

If this kind of recovery story has your attention, it could be worth comparing Giant Biogene with other healthcare stocks that might offer similar or stronger upside potential.

With revenue and earnings still growing at double digit rates and the share price trading well below analyst targets, is Giant Biogene now a mispriced value, or is the market already discounting its future growth potential?

Price-to-Earnings of 15.1x: Is it justified?

On a headline basis, Giant Biogene looks inexpensive, with its current share price of HK$35.1 implying a price to earnings ratio of 15.1 times that screens as undervalued against both peers and the wider Asian personal products space.

The price to earnings multiple compares what investors are paying today for each unit of current earnings, which is particularly relevant for a profitable and fast growing consumer healthcare business like Giant Biogene. When this multiple is low despite robust profit growth, it often signals that the market is either skeptical of how long that growth can last or has not yet fully recognised the company’s earnings power.

In Giant Biogene’s case, the market’s caution looks stark. The shares trade at 15.1 times earnings compared with 23.6 times for the broader Asian personal products industry and 21.4 times for its closest peer group, even though the company has delivered higher earnings growth than the sector and is expected to keep outpacing the Hong Kong market. Against an estimated fair price to earnings ratio of 23.7 times for the company, this discount suggests meaningful scope for the multiple to expand if investors become more confident in its growth trajectory.

Explore the SWS fair ratio for Giant Biogene Holding

Result: Price-to-Earnings of 15.1x (UNDERVALUED)

However, lingering concerns around China’s consumer demand and potential pricing pressure in skincare could cap valuation upside if growth expectations prove overly optimistic.

Find out about the key risks to this Giant Biogene Holding narrative.

Another View: What Does Our DCF Say?

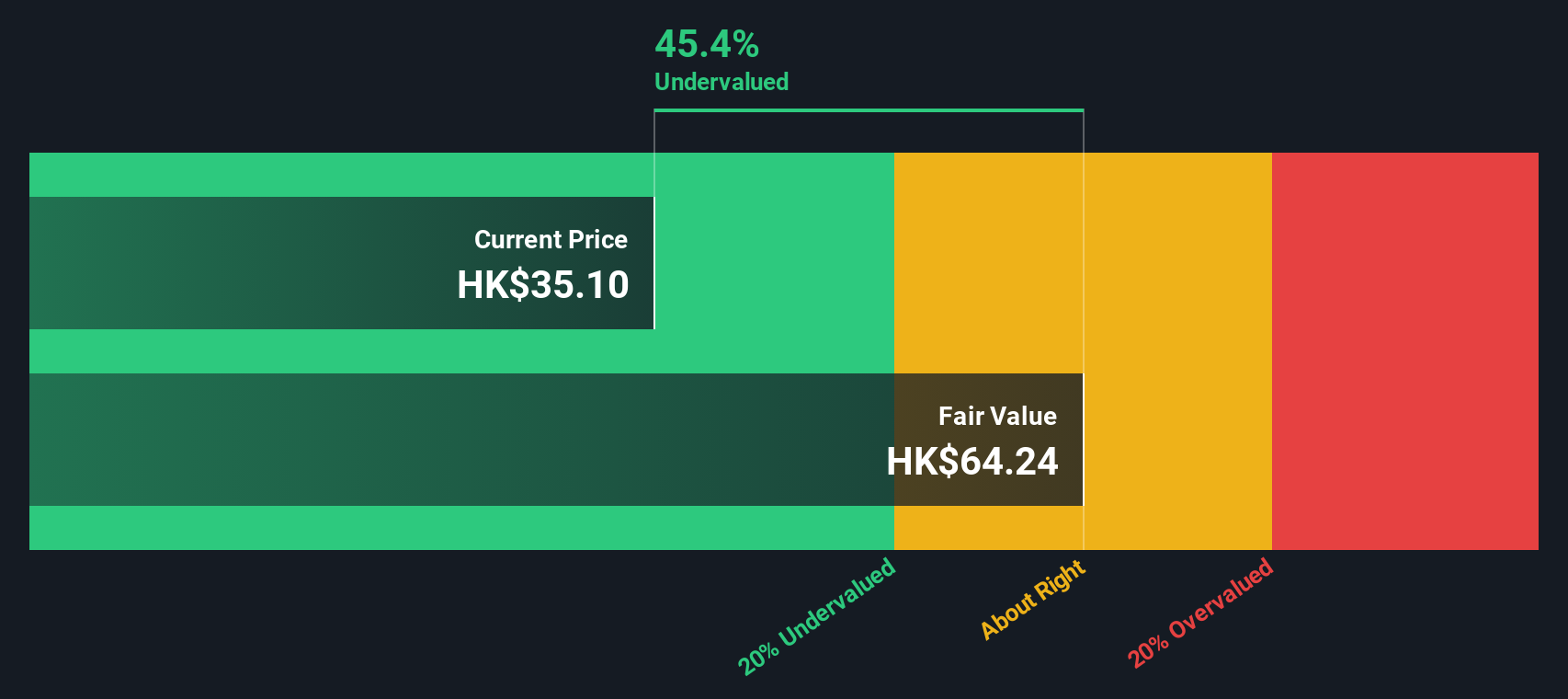

While earnings multiples flag Giant Biogene as cheap, our DCF model goes further and suggests the shares trade around 45% below a fair value estimate of roughly HK$64. That points to a deeper disconnect between price and cash flow potential. However, it is worth considering whether the growth assumptions are too generous.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Giant Biogene Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Giant Biogene Holding Narrative

If you would rather challenge these assumptions and put your own spin on the numbers, you can build a personalised view in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Giant Biogene Holding.

Ready for more smart investing ideas?

Before the market moves without you, use the Simply Wall St Screener to uncover focused opportunities that match your strategy and sharpen your portfolio decisions.

- Capture potential mispricings by screening for companies trading below their estimated cash flow value with these 908 undervalued stocks based on cash flows.

- Position yourself at the frontier of innovation by scanning for next generation opportunities across these 27 quantum computing stocks.

- Strengthen your income stream by uncovering reliable payout opportunities through these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal