Assessing Amprius Technologies (AMPX) Valuation After Nokia Selects Its SiCore Batteries for Next‑Gen Drones

Amprius Technologies (AMPX) just landed a meaningful validation of its battery tech, with Nokia selecting its SiCore cells for next generation drone systems after extensive qualification and testing.

See our latest analysis for Amprius Technologies.

The Nokia win comes as Amprius shares cool off in the very short term, with a 7 day share price return of minus 10.4 percent. However, that pullback follows powerful underlying momentum, including a roughly 281 percent year to date share price return and a 538 percent one year total shareholder return that signals investors are steadily re-rating its growth story.

If this kind of niche battery deal has caught your eye, it is worth also seeing which other innovators are gaining traction across high growth tech and AI stocks right now.

Yet with shares having surged multiple times over the past year but still trading below analyst targets, investors now face a pivotal question: Is Amprius still mispriced, or is the market already discounting its next wave of growth?

Most Popular Narrative Narrative: 36.4% Undervalued

With Amprius closing at $10.91 against a narrative fair value near $17.17, the gap reflects ambitious expectations for future scaling and profitability.

Ongoing investment in automation and manufacturing capacity (supported by government contracts like the $10.5M Defense Innovation Unit award) positions Amprius to capture a larger share of future high margin opportunities in defense and critical infrastructure, enhancing both revenue visibility and earnings stability.

Curious how aggressive growth, margin expansion, and a lofty future earnings multiple all tie together to justify that upside gap? The full narrative unpacks the bold projections behind this valuation call.

Result: Fair Value of $17.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case depends on Amprius smoothly scaling production and avoiding major delays or disruptions in its highly concentrated aviation and drone end markets.

Find out about the key risks to this Amprius Technologies narrative.

Another Way to Look at Value

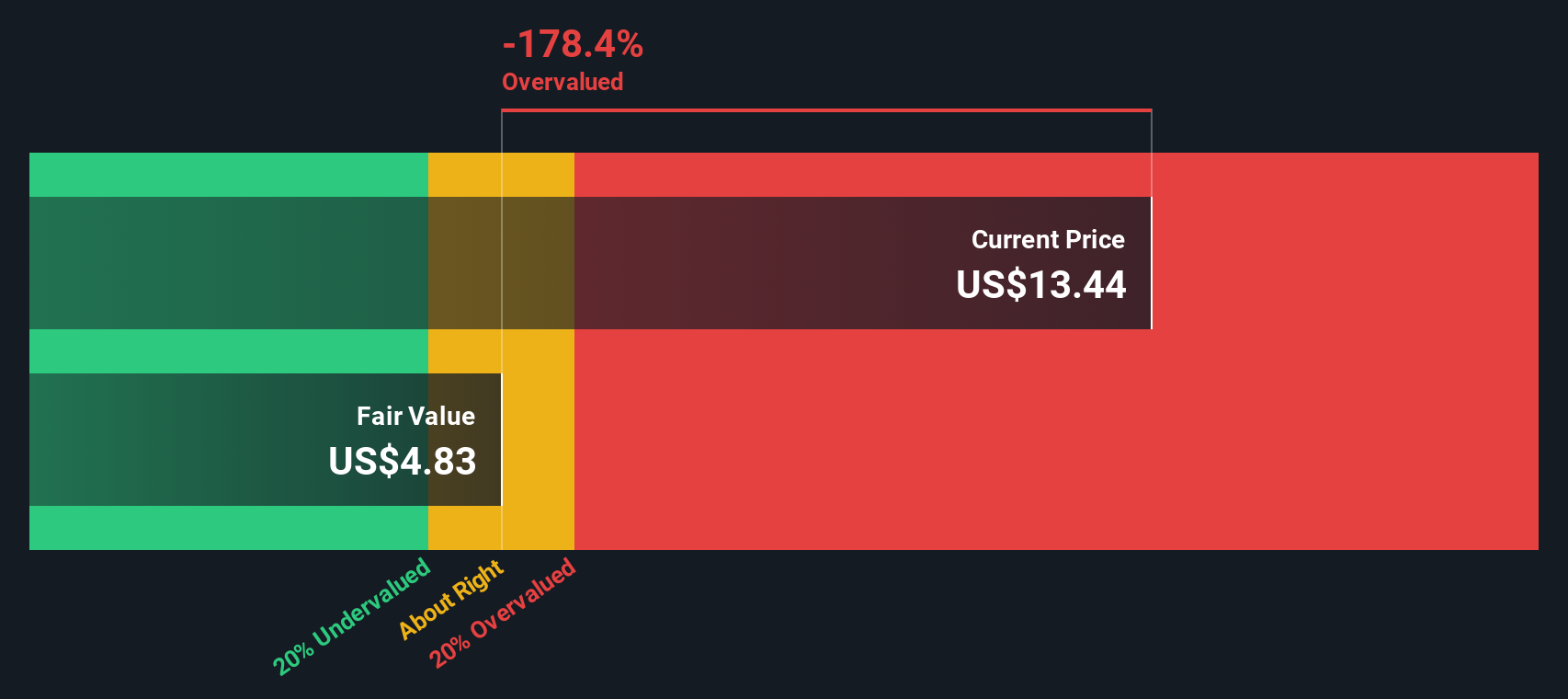

Our SWS DCF model paints a cooler picture, with fair value around $7.76 versus the current $10.91 share price, which implies Amprius may actually be overvalued. If the growth narrative wobbles, today’s enthusiasm could unwind faster than bullish targets suggest.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Amprius Technologies Narrative

If you are skeptical of this view or prefer to dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way

A great starting point for your Amprius Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single stock, use the Simply Wall Street Screener to uncover fresh opportunities that fit your strategy before the market moves on.

- Capitalize on emerging innovation by targeting these 26 AI penny stocks positioned at the intersection of transformative software, intelligent automation, and scalable digital ecosystems.

- Lock in potential income streams through these 13 dividend stocks with yields > 3% that can complement growth names like Amprius in a balanced portfolio.

- Position yourself ahead of the crowd with these 80 cryptocurrency and blockchain stocks capturing the structural shift toward tokenized networks and blockchain enabled financial rails.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal