3 Asian Growth Companies With Insider Ownership Up To 36%

As global markets navigate a landscape marked by interest rate adjustments and shifting economic indicators, Asia's growth companies continue to capture investor attention with their potential for expansion despite broader market fluctuations. In this context, high insider ownership can be a compelling indicator of confidence in a company's future prospects, suggesting alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Techwing (KOSDAQ:A089030) | 19.1% | 96.3% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

Let's review some notable picks from our screened stocks.

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★★☆

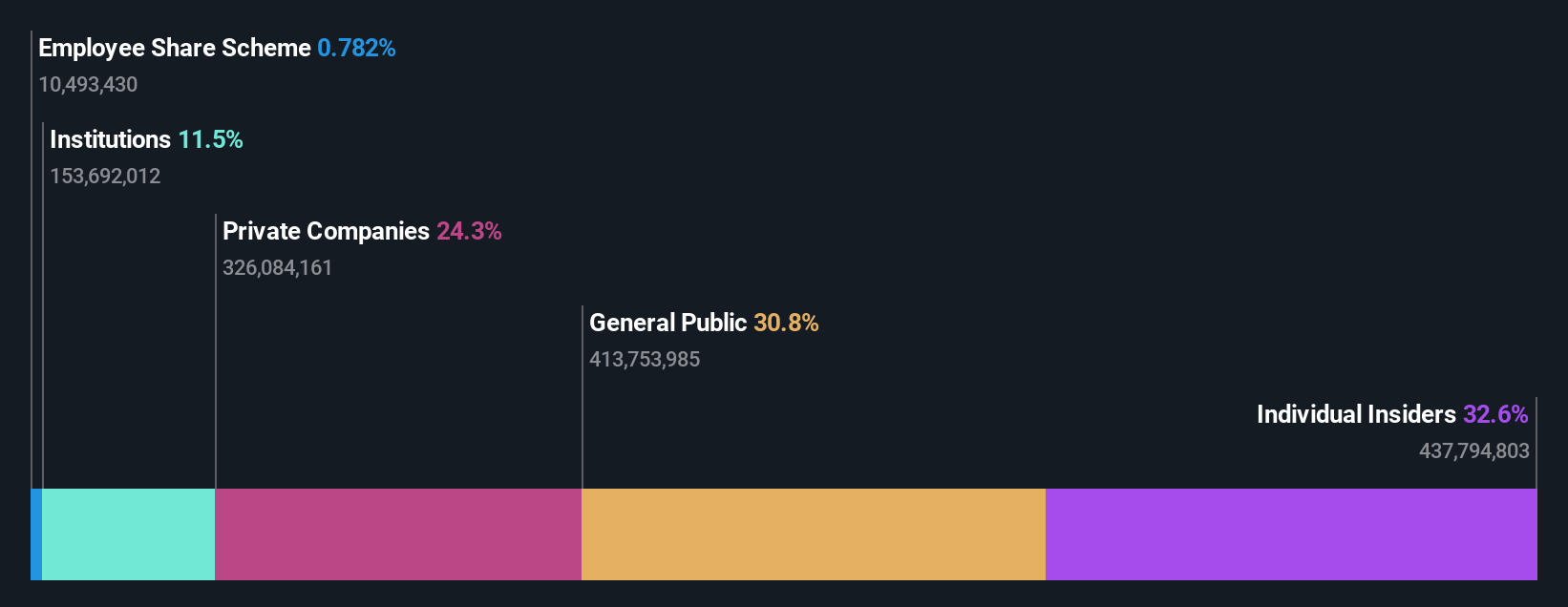

Overview: Newborn Town Inc., an investment holding company, operates in the global social networking sector with a market cap of HK$14.10 billion.

Operations: The company generates revenue from its innovative business segment, which contributed CN¥603.10 million, and its social networking business, which brought in CN¥5.40 billion.

Insider Ownership: 32.6%

Newborn Town is positioned for robust growth, with earnings forecasted to increase by 24.18% annually, outpacing the Hong Kong market's average. The company's recent guidance indicates significant revenue growth of approximately 37.6% to 39.9% year-on-year for nine months ending September 2025, reaching RMB 4.91 billion to RMB 4.99 billion. Despite past shareholder dilution, the stock trades at a substantial discount relative to its estimated fair value and peers in the industry, suggesting potential upside.

- Click here and access our complete growth analysis report to understand the dynamics of Newborn Town.

- Insights from our recent valuation report point to the potential undervaluation of Newborn Town shares in the market.

Ningbo Sanxing Medical ElectricLtd (SHSE:601567)

Simply Wall St Growth Rating: ★★★★★☆

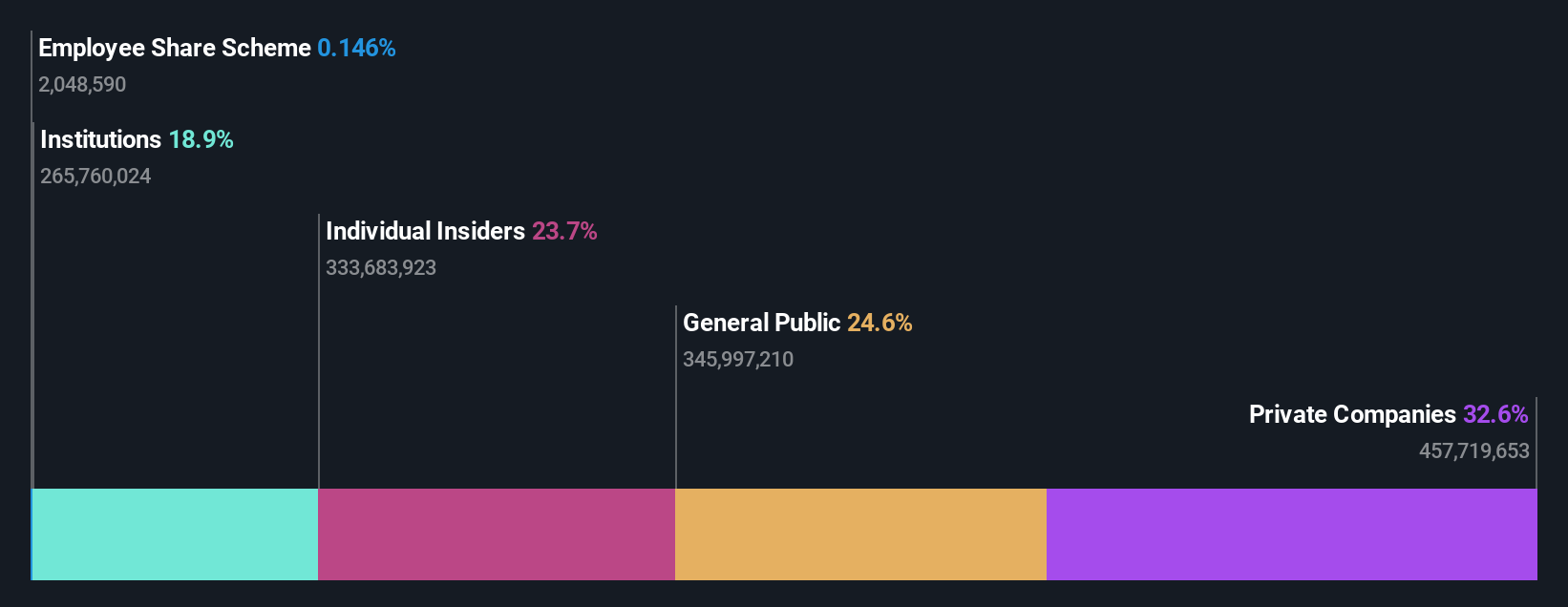

Overview: Ningbo Sanxing Medical Electric Co., Ltd. manufactures and sells power distribution products in China and internationally, with a market cap of CN¥33.96 billion.

Operations: Ningbo Sanxing Medical Electric Co., Ltd. generates revenue by manufacturing and selling power distribution products both domestically and abroad.

Insider Ownership: 23.7%

Ningbo Sanxing Medical Electric Ltd. is trading at a discount to its estimated fair value and peers, with analysts predicting a 25.5% stock price increase. Despite recent earnings decline, revenue rose to CNY 11.08 billion for the nine months ending September 2025 from CNY 10.43 billion the previous year. Forecasts suggest robust annual earnings growth of 28.15%, surpassing China's market average, though dividends remain unsustainably covered by earnings or free cash flows.

- Navigate through the intricacies of Ningbo Sanxing Medical ElectricLtd with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Ningbo Sanxing Medical ElectricLtd's current price could be quite moderate.

Gan & Lee Pharmaceuticals (SHSE:603087)

Simply Wall St Growth Rating: ★★★★☆☆

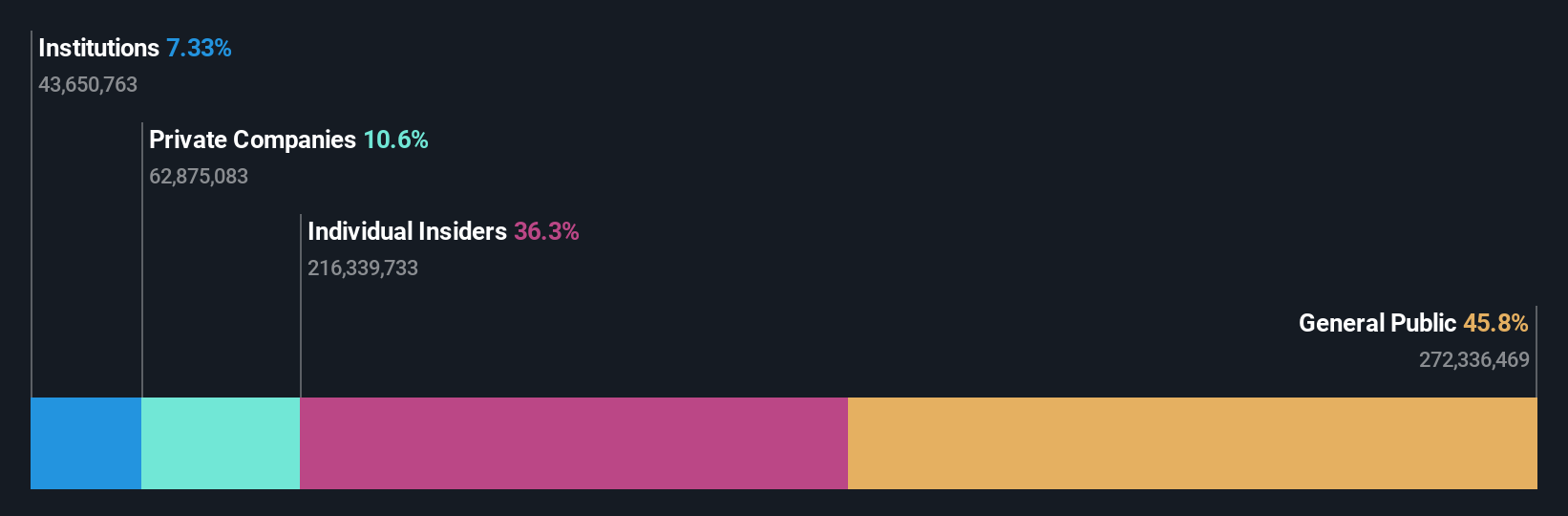

Overview: Gan & Lee Pharmaceuticals is a biopharmaceutical company focused on the research, development, production, and sale of insulin analog APIs and injections in China, with a market cap of CN¥39.45 billion.

Operations: The company's revenue primarily comes from the development, production, and sales of insulin and related products, amounting to CN¥3.85 billion.

Insider Ownership: 36.3%

Gan & Lee Pharmaceuticals is experiencing significant earnings growth, projected at 28.6% annually, outpacing the Chinese market. Despite a lower forecasted return on equity of 12.5%, its revenue growth remains robust compared to the market average. Recent EMA approval for its insulin glargine product in Europe enhances its competitive positioning internationally. The company's strategic agreements in Brazil and leadership changes further bolster its global expansion efforts, despite dividends not being well-covered by free cash flows.

- Take a closer look at Gan & Lee Pharmaceuticals' potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Gan & Lee Pharmaceuticals' share price might be too optimistic.

Key Takeaways

- Explore the 633 names from our Fast Growing Asian Companies With High Insider Ownership screener here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal