High Growth Tech Stocks in Asia to Watch

As global markets experience fluctuations with interest rate adjustments and evolving economic conditions, the tech sector in Asia remains a focal point, particularly amid renewed concerns about technology stock valuations and the impact of AI infrastructure spending. In this environment, identifying high growth potential stocks involves looking at companies that demonstrate strong innovation capabilities and resilience to market volatility.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Zhongji Innolight | 34.93% | 35.60% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Hancom (KOSDAQ:A030520)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hancom Inc. is a company that develops and sells office software products and solutions both in South Korea and internationally, with a market capitalization of approximately ₩583.68 billion.

Operations: The primary revenue stream for Hancom Inc. comes from its Non-Financial - SW Division, generating approximately ₩194.59 billion, followed by the Non-Financial - Manufacturing Sector at around ₩93.66 billion. The company also earns significant income from its Non-Financial - Other Sectors, contributing about ₩31.21 billion to overall revenue.

Hancom, a key player in the Asian tech market, showcases robust growth with its earnings projected to surge by 34.4% annually, outpacing Korea's average of 30%. Despite a challenging year with earnings contracting by 6.7%, the company's strategic focus on innovation is evident from its significant R&D investments, aligning well with industry demands for advanced software solutions. Recently, Hancom announced a KRW 10 billion share repurchase plan aimed at enhancing shareholder value and employee compensation, reflecting confidence in its financial health and commitment to growth. This move underscores Hancom’s proactive approach in capital management and its potential resilience in a competitive sector.

- Click here and access our complete health analysis report to understand the dynamics of Hancom.

Explore historical data to track Hancom's performance over time in our Past section.

NEXON Games (KOSDAQ:A225570)

Simply Wall St Growth Rating: ★★★★★☆

Overview: NEXON Games Co., Ltd. is a South Korean game developer with international operations and a market cap of ₩786.72 billion.

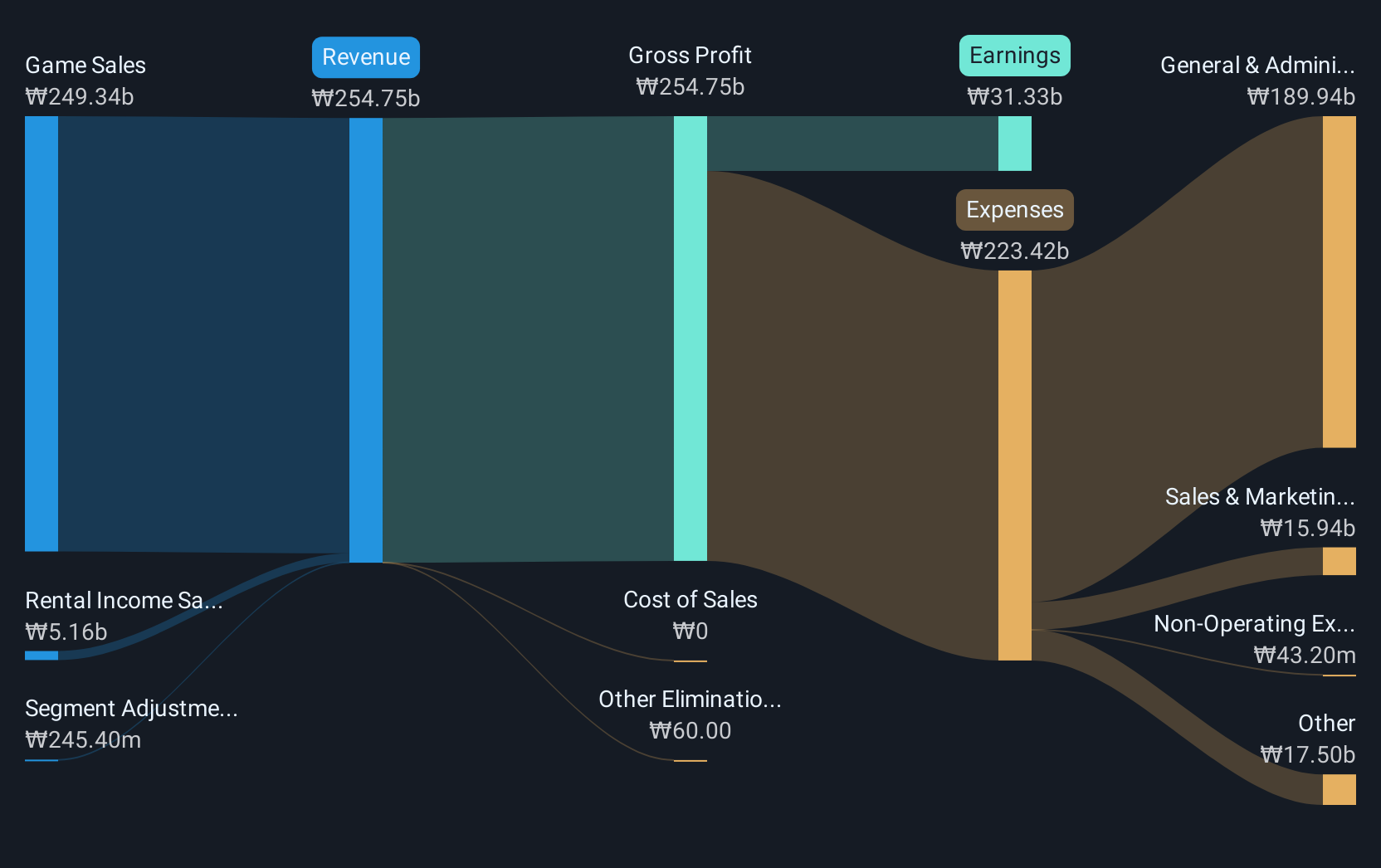

Operations: The company generates revenue primarily from its Game Development Division, contributing ₩183.52 billion, while the Rental Sector adds ₩4.86 billion.

NEXON Games, navigating through a challenging landscape with a recent net loss, still signals robust potential with an expected annual revenue growth of 29.7% and a surge in earnings forecast at 113% per year. This growth trajectory is complemented by strategic share repurchases totaling KRW 14.99 billion, underscoring confidence in its recovery and future prospects. Despite current unprofitability, the firm's commitment to innovation is reflected in substantial R&D investments aimed at capturing emerging opportunities within the gaming sector.

- Click to explore a detailed breakdown of our findings in NEXON Games' health report.

Assess NEXON Games' past performance with our detailed historical performance reports.

LuxNet (TPEX:4979)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LuxNet Corporation, along with its subsidiaries, is engaged in the manufacturing, processing, and sale of electronic and active components for optical communication in Taiwan with a market capitalization of NT$36.69 billion.

Operations: The company focuses on the production and sale of active components for optical communication, generating NT$4.28 billion in revenue from this segment.

LuxNet's recent financial results underscore its robust position in the tech industry, with third-quarter sales rising to TWD 1.08 billion from TWD 946 million year-over-year and net income increasing significantly to TWD 218 million from TWD 138 million. This performance is part of a broader trend, as LuxNet's earnings are expected to grow by an impressive 62.95% annually, outpacing both the local market's growth of 20.4% and the communications industry's growth rate. The company not only demonstrates strong revenue growth at an annual rate of 47%, but also shows a commitment to maintaining its competitive edge through substantial investments in R&D, positioning it well for sustained future growth despite a highly volatile share price recently.

- Dive into the specifics of LuxNet here with our thorough health report.

Understand LuxNet's track record by examining our Past report.

Summing It All Up

- Discover the full array of 188 Asian High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal