Orica (ASX:ORI) Valuation Check as Buyback, AGM and Dividend Support Investor Optimism

Orica (ASX:ORI) ticked higher after investors warmed to its A$500 million share buyback ahead of the 16 December AGM and a dividend landing on 22 December, as Materials sector strength added support.

See our latest analysis for Orica.

At A$23.65, Orica’s share price has delivered a strong year to date, with a double digit 90 day share price return and robust one year total shareholder return. This suggests momentum is still building as buybacks and dividends reshape the risk reward profile.

If Orica’s move has you curious about what else is working in cyclicals, it might be worth scanning fast growing stocks with high insider ownership for other under the radar opportunities.

With the share price already up strongly this year and now trading only modestly below analyst targets, the key question is whether Orica still offers mispriced upside or if the market is already factoring in future growth.

Most Popular Narrative: 10% Undervalued

With Orica’s shares last closing at A$23.65 versus a narrative fair value of about A$23.68, the storyline leans on earnings durability rather than quick wins.

The robust execution of Orica's decarbonization and sustainability strategy positions the company well to capitalize on governmental and regulatory incentives, potentially boosting revenue streams and future net margins.

Want to see what is powering this valuation call? The narrative focuses on steadier sales, sharply higher margins, and a future earnings multiple that may surprise you.

Result: Fair Value of $23.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply constraints in sodium cyanide and integration challenges from recent acquisitions could compress margins and derail the expected earnings uplift.

Find out about the key risks to this Orica narrative.

Another View: Market Ratios Flash Caution

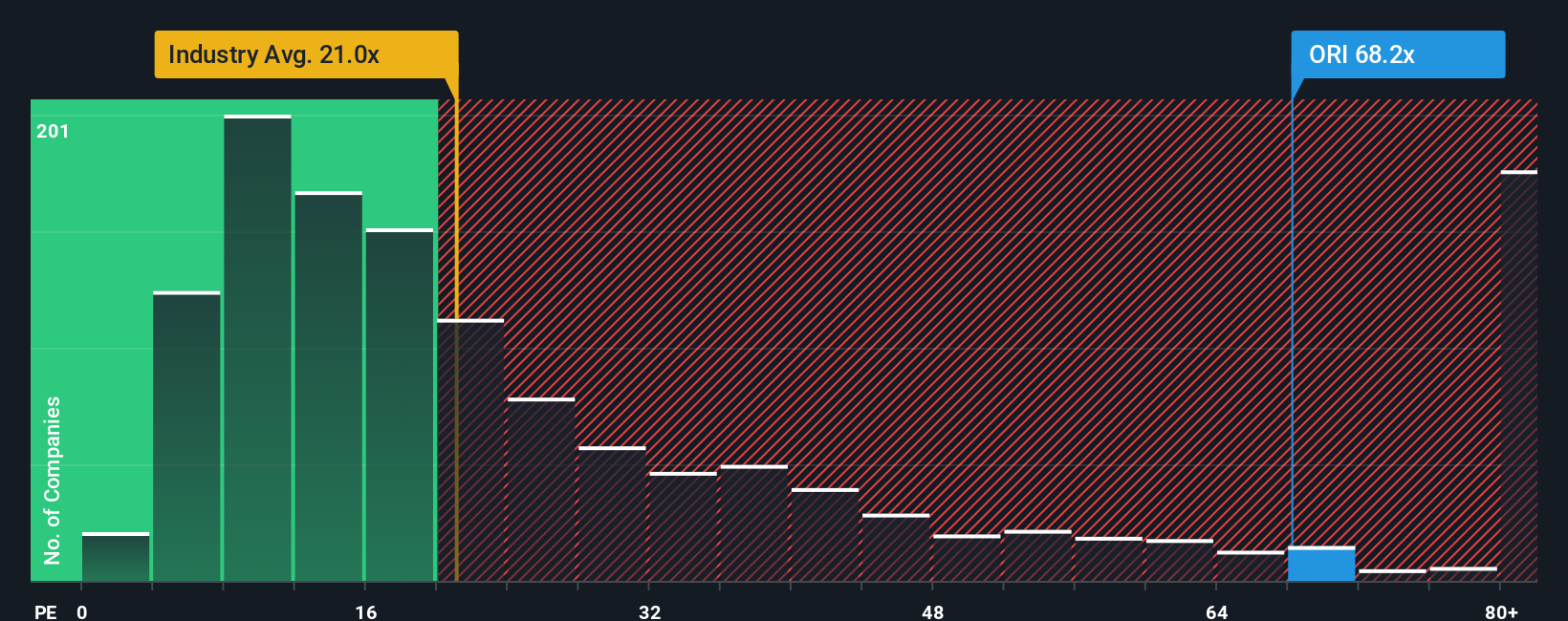

While the narrative fair value hints at mild upside, the earnings multiple paints a tougher picture. Orica trades on a P E of 68.1 times, richer than the global Chemicals average of 20.9 times and well above its 27.2 times fair ratio. This suggests real de rating risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Orica Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised narrative in just a few minutes: Do it your way

A great starting point for your Orica research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Orica might be on your radar, but you risk missing bigger opportunities if you are not actively hunting fresh ideas with the Simply Wall St Screener.

- Capture potential multibaggers early by scanning these 3612 penny stocks with strong financials that pair tiny market caps with credible balance sheets and real growth traction.

- Ride structural tailwinds in automation and machine learning by targeting these 26 AI penny stocks that are building the next generation of data driven platforms.

- Lock in mispriced quality by filtering these 908 undervalued stocks based on cash flows where strong cash flows and discounted valuations create compelling risk reward setups.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal