Is Berkshire Hathaway Still Attractive After Portfolio Shifts and Strong Multi Year Gains?

- Wondering if Berkshire Hathaway is still a smart buy at around $499 a share, or if most of the upside has already been priced in? You are not alone. That is exactly what this piece is going to unpack.

- Despite a modest dip of 1.0% over the last week and 1.9% over the last month, the stock is still up 10.7% year to date and 9.1% over the last year, with a 66.5% gain over three years and 123.6% over five years that keeps long term holders smiling.

- Recent headlines have focused on Berkshire's continued portfolio reshuffles and high cash balance, which many investors see as dry powder for future opportunities. At the same time, ongoing discussion about Warren Buffett's capital allocation decisions and succession planning has kept sentiment active and helped shape how the market reacts to every strategic move.

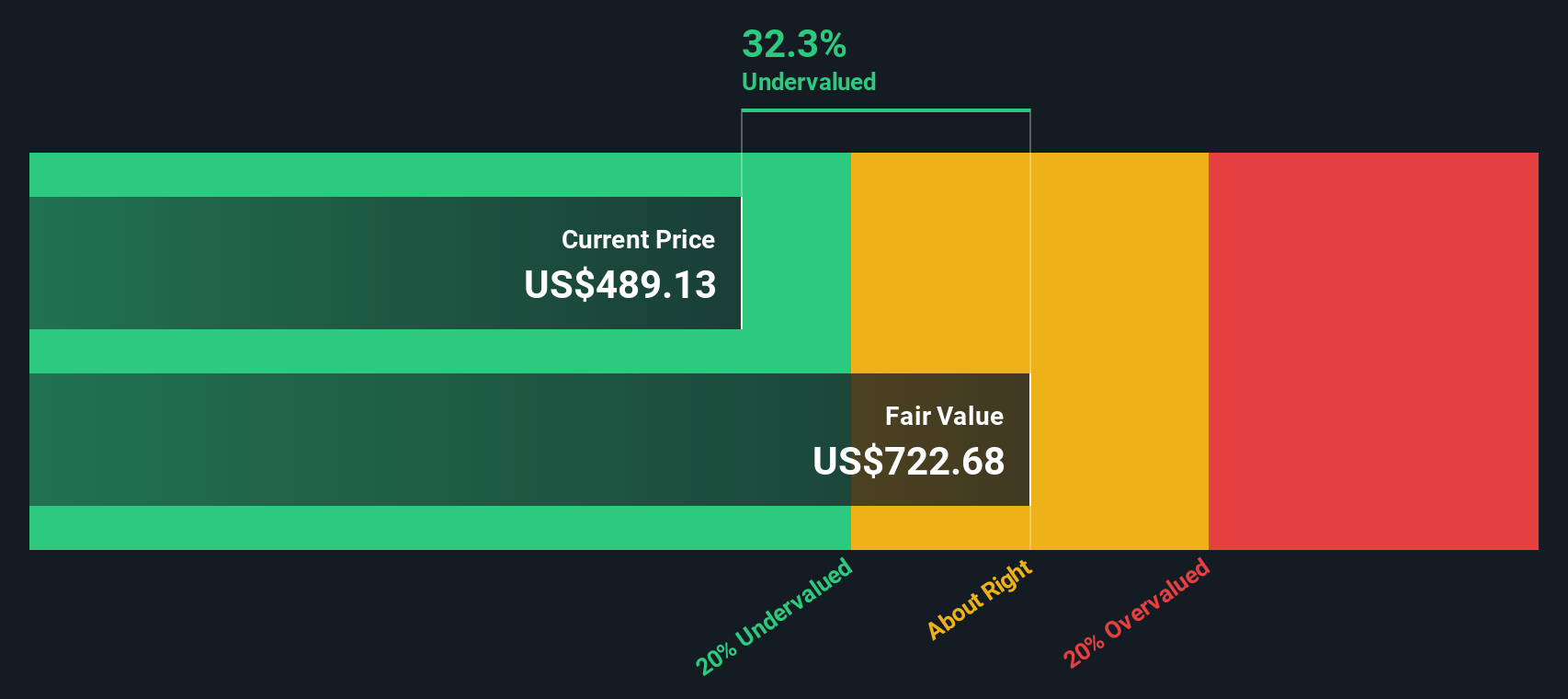

- On our framework, Berkshire scores a 4 out of 6 on undervaluation checks, suggesting there may still be value here, but the story is more nuanced than one number. Next, we will walk through different valuation lenses to see what they say about Berkshire today, before ending with a more holistic way to think about its true worth.

Approach 1: Berkshire Hathaway Excess Returns Analysis

The Excess Returns model looks at how much profit Berkshire generates above the return that shareholders reasonably require on their capital, and then projects how long that value creation can continue.

For Berkshire, the starting point is a very large Book Value base of $485,274.36 per share and an Average Return on Equity of 12.85%. That translates into a Stable EPS of $66,154.88 per share, compared with a Cost of Equity of $38,909.59 per share. The difference, an Excess Return of $27,245.29 per share, reflects the value Berkshire is expected to add each year beyond a normal required return.

Using a Stable Book Value of $514,986.06 per share, based on weighted future estimates from two analysts, the model capitalizes these excess returns to arrive at an intrinsic value of roughly $766.58 per share. With a recent share price around $499, this framework suggests Berkshire may be about 34.8% undervalued.

Result: UNDERVALUED

Our Excess Returns analysis suggests Berkshire Hathaway is undervalued by 34.8%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Berkshire Hathaway Price vs Earnings

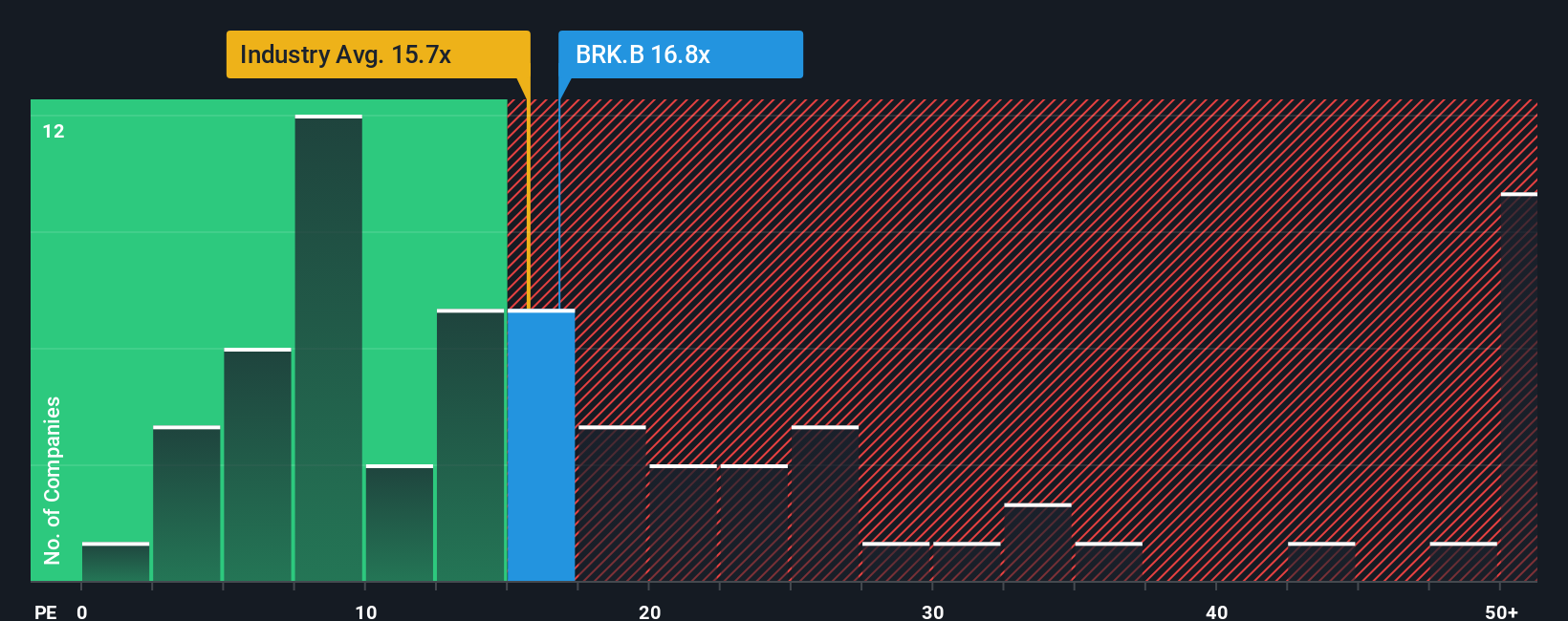

For a profitable, mature business like Berkshire Hathaway, the price to earnings (PE) ratio is a useful way to gauge what investors are willing to pay for each dollar of current earnings. In general, higher growth and lower perceived risk justify a higher PE, while slower growth or higher uncertainty should pull a normal or fair PE lower.

Berkshire currently trades on a PE of about 16.0x. That is above the Diversified Financial industry average of roughly 13.6x, but well below the broader peer group average of around 26.4x. This suggests investors are paying a moderate premium to the sector, but not a frothy multiple by market standards.

Simply Wall St also calculates a Fair Ratio of 16.9x for Berkshire. This is a proprietary estimate of what its PE should be once its earnings growth profile, risk, profit margins, industry characteristics and market cap are factored in. This is more tailored than a simple comparison with peers, which can be skewed by very fast growing or very risky companies. Because Berkshire is trading slightly below this Fair Ratio, the multiple based view points to the shares being modestly undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Berkshire Hathaway Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Berkshire’s story with the numbers behind it. A Narrative is your own investment storyline, where you spell out how you think revenue, earnings and margins might evolve, and then link that forecast to a fair value estimate for the stock. On Simply Wall St’s Community page, used by millions of investors, Narratives turn these assumptions into an accessible tool that compares your Fair Value with today’s Price to help you decide whether Berkshire looks like a buy, a hold or a sell. Because Narratives automatically update when fresh information, such as earnings releases or major news, comes in, your view stays dynamic instead of static. For Berkshire, one investor might build a Narrative with conservative growth and a lower fair value, while another expects stronger compounding and a higher fair value, yet both can clearly see how their different stories translate into different price signals.

Do you think there's more to the story for Berkshire Hathaway? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal