General Electric (GE) Is Up 5.6% After New Navy Engine Orders And Dividend Affirmation - What's Changed

- Earlier this month, GE Aerospace’s Marine Engines & Systems division secured orders for eight LM2500 marine gas turbine engines to power two future U.S. Navy Flight III Arleigh Burke-class destroyers, while the Board also affirmed a US$0.36 per-share dividend payable in January 2026.

- These developments highlight GE Aerospace’s strengthening role in defense propulsion alongside continued cash returns to shareholders, reinforcing interest in its aerospace-focused business model.

- We’ll now examine how GE Aerospace’s new U.S. Navy engine orders could influence the company’s investment narrative and longer-term earnings profile.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

General Electric Investment Narrative Recap

To own GE Aerospace today, you have to believe in its focused aerospace model, with commercial engines and high-margin services still driving the story, while execution on new platforms and supply chain stability remain critical near-term catalysts and risks. The new U.S. Navy LM2500 orders modestly enhance the defense mix but do not materially change the key short term swing factor, which is how reliably GE can meet rising commercial and defense production schedules without margin slippage.

The Board’s affirmation of a US$0.36 per share dividend payable in January 2026 reinforces GE Aerospace’s commitment to regular cash returns alongside growth in its aero programs. For investors, that consistency in capital return sits alongside upcoming earnings reports and production ramp milestones as important checkpoints for whether the current premium valuation is supported by delivery performance and sustained profitability.

Yet against this positive backdrop, investors should still be alert to the risk that heavy reliance on commercial aviation...

Read the full narrative on General Electric (it's free!)

General Electric's narrative projects $50.8 billion revenue and $9.5 billion earnings by 2028. This requires 6.9% yearly revenue growth and about a $1.9 billion earnings increase from $7.6 billion today.

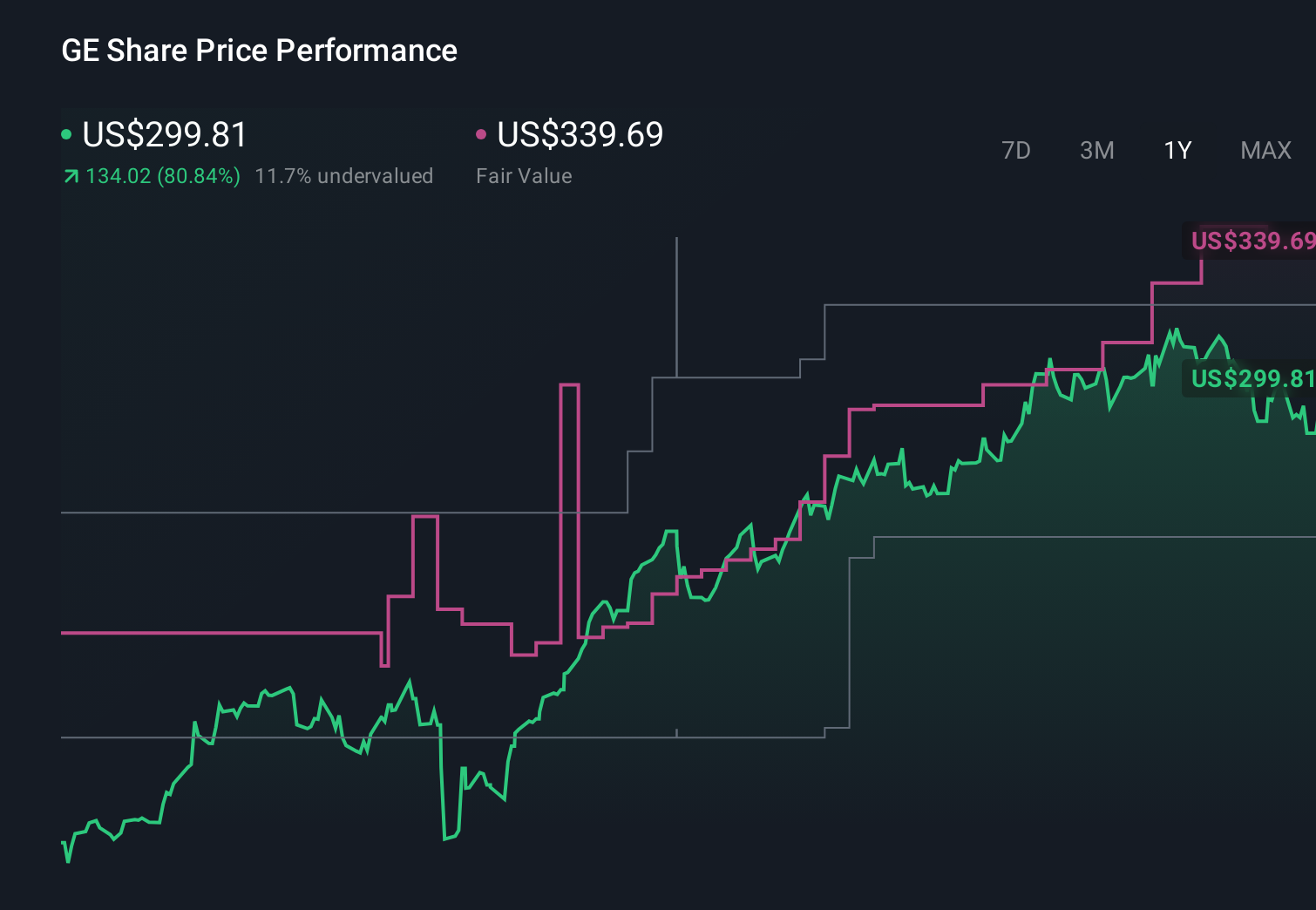

Uncover how General Electric's forecasts yield a $339.69 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Twelve fair value estimates from the Simply Wall St Community span roughly US$198 to US$340 per share, highlighting how far apart individual views can be. That spread sits against a business where commercial aviation exposure remains the key earnings driver and risk factor, so it is worth comparing these community views with how you see long term air travel demand and GE’s engine programs.

Explore 12 other fair value estimates on General Electric - why the stock might be worth as much as 14% more than the current price!

Build Your Own General Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your General Electric research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free General Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate General Electric's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal