How New Holland’s Award‑Winning Biomethane Tractor And Fresh Debt Issue At CNH Industrial (CNH) Has Changed Its Investment Story

- CNH Industrial’s New Holland brand recently saw its T6.180 Methane Power tractor, launched commercially in 2022, win the 2025 ESG Award for Technological Innovation in ESG and the ECO Innovation and Sustainability Award in São Paulo for its biomethane-powered, low-emission design.

- At the same time, CNH Industrial has been reshaping its financial and market profile through a €500 million notes issuance, alongside mixed analyst views that reflect both its sustainability progress and concerns about weaker guidance and market fundamentals.

- We’ll now explore how New Holland’s award-winning biomethane tractor and CNH Industrial’s recent debt issuance reshape the company’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CNH Industrial Investment Narrative Recap

To own CNH Industrial, you need to believe its technology and precision offerings can offset weak agricultural demand, margin pressure, and cyclicality in key end markets. New Holland’s biomethane tractor awards reinforce CNH’s ESG and innovation credentials, but they do not materially change the immediate catalyst, which is how quickly agricultural equipment demand and dealer inventories normalize, nor the key risk around margin compression from soft markets and rising input costs.

The recent €500 million notes issuance at 3.625% due 2033 is the most relevant announcement here, because it shapes CNH’s financial flexibility while it invests in cleaner equipment like the T6.180 Methane Power tractor. Strengthening the balance sheet gives CNH more room to fund precision and low emission technologies, though investors will still be watching how slower revenue and weaker recent earnings interact with higher debt and ongoing end market uncertainty.

Yet while the sustainability story is compelling, investors should also be aware of the pressure that rising inventories and discounting risk could place on...

Read the full narrative on CNH Industrial (it's free!)

CNH Industrial's narrative projects $18.7 billion revenue and $1.6 billion earnings by 2028.

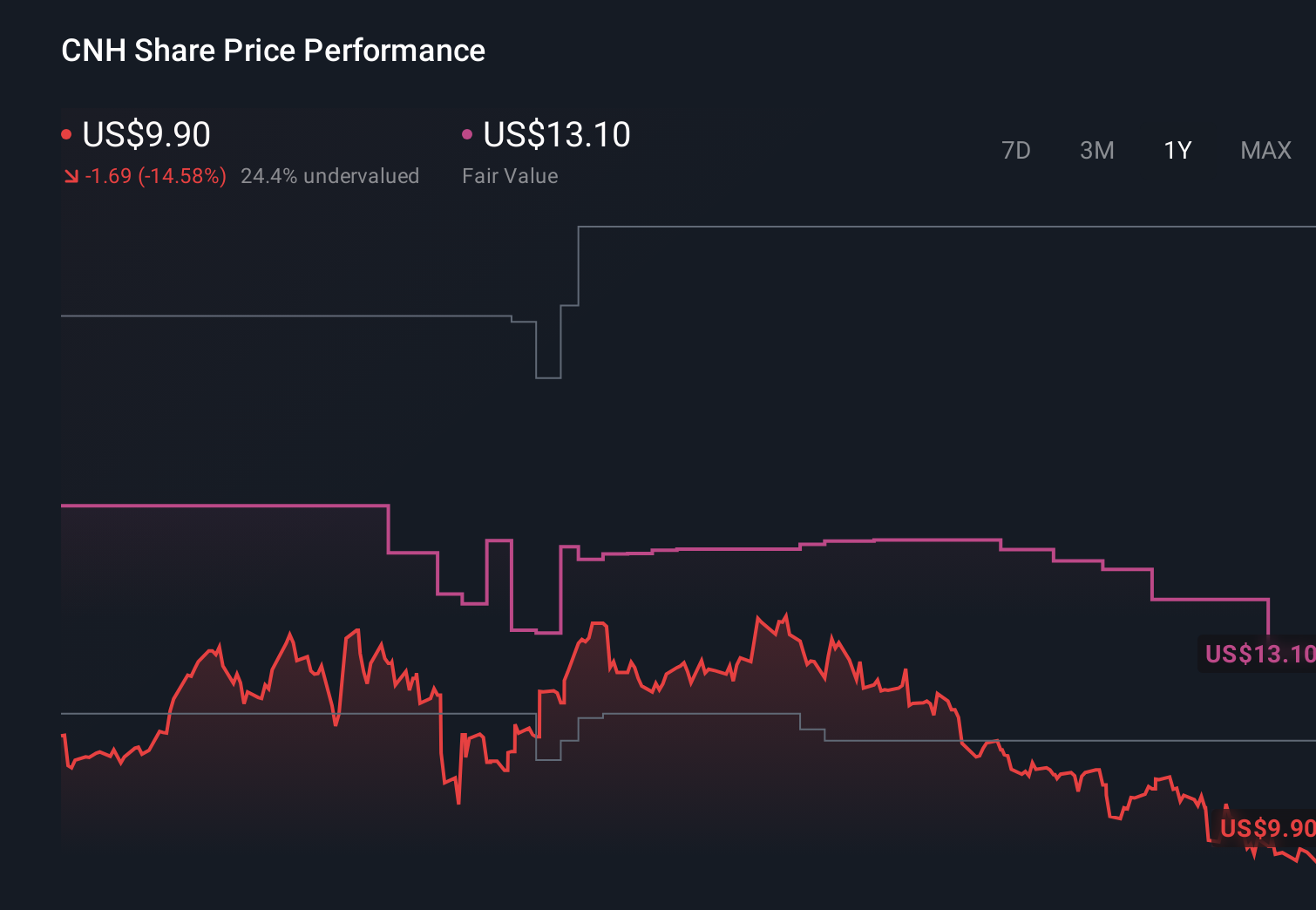

Uncover how CNH Industrial's forecasts yield a $13.10 fair value, a 32% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span from US$4.92 to US$19.54, showing how far apart individual views can be. You can set those against the current concerns about weak North American ag demand and margin pressure to see how different assumptions about recovery shape expectations for CNH’s performance.

Explore 5 other fair value estimates on CNH Industrial - why the stock might be worth as much as 97% more than the current price!

Build Your Own CNH Industrial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CNH Industrial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CNH Industrial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CNH Industrial's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal