Curaleaf (TSX:CURA) Valuation Check as U.S. Cannabis Rescheduling and Index Inclusion Shift Expectations

Regulatory Shift Puts Curaleaf in the Spotlight

Reports that President Trump may move to ease federal marijuana restrictions have pushed Curaleaf Holdings (TSX:CURA) into sharper focus, as investors reassess its prospects under a friendlier US regulatory regime.

See our latest analysis for Curaleaf Holdings.

The prospect of looser federal rules has lit a fire under Curaleaf, with a 1 month share price return of 76.47 percent and a year to date share price return of 121.74 percent. However, the 3 year total shareholder return is still negative, suggesting momentum is rebuilding as investors reassess regulatory and growth risks.

If this regulatory buzz has you rethinking the space, it could be a good moment to explore other cannabis and healthcare stocks that might benefit from similar sentiment shifts.

With Curaleaf’s shares rocketing ahead of an anticipated regulatory reset but still trading below some fair value estimates, are investors staring at an overlooked upside, or has the market already baked in the next leg of growth?

Most Popular Narrative: 5.9% Overvalued

With Curaleaf’s shares last closing at CA$5.10 versus a narrative fair value of about CA$4.81, the prevailing view reflects a modest premium to bullish long term assumptions.

Fair Value Estimate has risen slightly to approximately CA$4.81 per share from about CA$4.75, reflecting modestly stronger fundamentals.

Future P/E multiple has risen modestly from about 54.6 times to roughly 56.3 times, implying a somewhat higher valuation premium on expected earnings.

Curious why a loss making cannabis operator is being modelled on a profit multiple usually reserved for elite growth franchises, and what revenue, margin, and earnings inflection path could possibly underpin that kind of premium valuation over the next few years?

Result: Fair Value of $4.81 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained pricing pressure and lingering regulatory uncertainty could undercut those ambitious growth assumptions and delay the premium multiple the market is betting on.

Find out about the key risks to this Curaleaf Holdings narrative.

Another Lens on Value: Sales Ratio Signals Caution

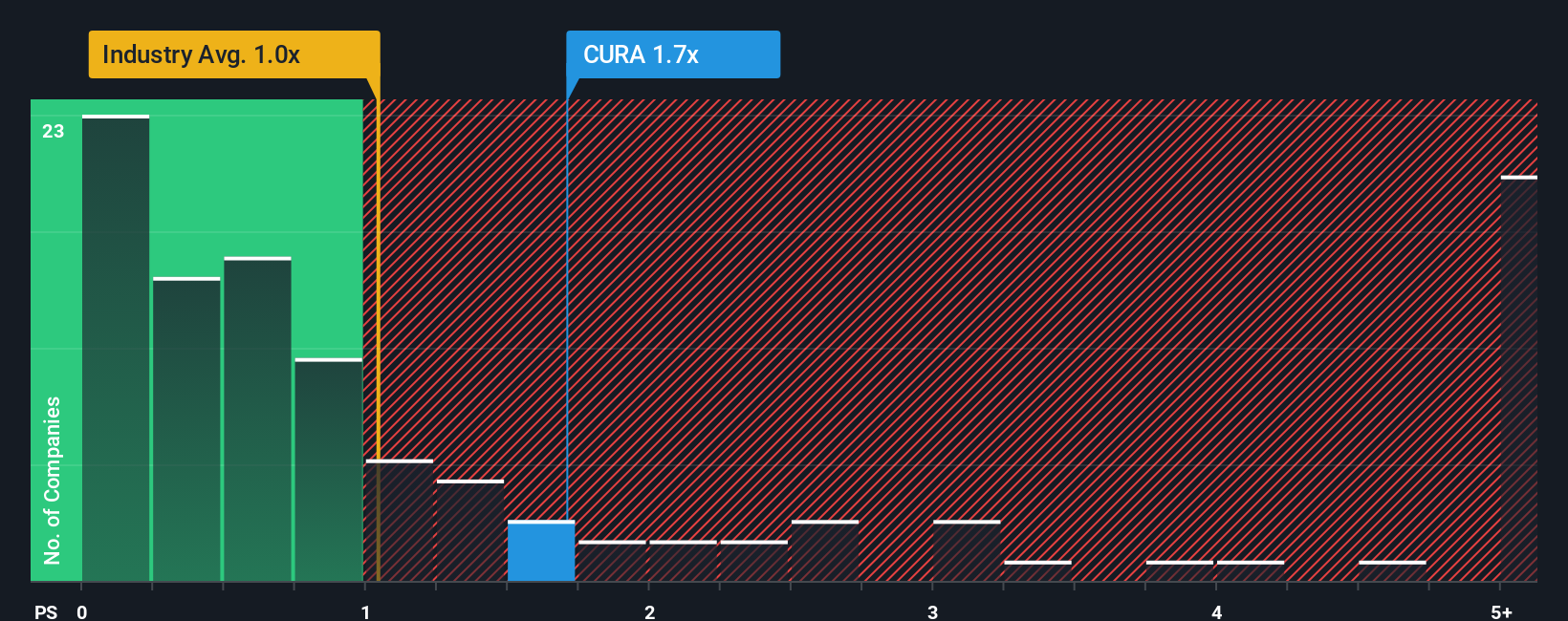

While the narrative fair value suggests Curaleaf is only modestly overvalued, its 2.2 times price to sales ratio looks punchy versus the Canadian pharma average of 1 times and a fair ratio of 1.9 times. This hints that expectations, not fundamentals, may be driving a lot of today’s price. Could that premium hold if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Curaleaf Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Curaleaf Holdings Narrative

If this perspective does not quite align with your own or you would rather dive into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way

A great starting point for your Curaleaf Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next smart move?

Curaleaf might be compelling, and you can stack the odds in your favor by scanning fresh opportunities across sectors using the Simply Wall St Screener today.

- Explore potential rebound stories by targeting quality names among these 3612 penny stocks with strong financials that still have solid balance sheets and credible growth runways.

- Participate in the technology transformation by focusing on these 26 AI penny stocks positioned at the intersection of data, automation, and scalable software economics.

- Identify potentially compelling entry points with these 908 undervalued stocks based on cash flows that trade below their estimated cash flow value before sentiment and prices change.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal