Reassessing Bloom Energy (BE) Valuation After Oracle-Linked Volatility and AI Infrastructure Sentiment Shift

Bloom Energy (BE) has been on a roller coaster after Oracle’s earnings miss and data center delays rattled expectations for near term fuel cell demand, prompting investors to rethink how much future AI growth is already priced in.

See our latest analysis for Bloom Energy.

That Oracle driven pullback has been brutal in the short term, with a 1 week share price return of minus 20.31 percent. However, it comes after a 306.42 percent year to date share price return and a 271.16 percent one year total shareholder return, suggesting momentum is cooling rather than disappearing.

If you are weighing Bloom’s volatility against other AI infrastructure stories, this is a good moment to scan high growth tech and AI stocks and see what else fits your watchlist.

With the stock still trading below analyst targets but scoring weakly on value checks, investors now face a tougher question: is Bloom temporarily mispriced after the AI shakeout, or is the market already baking in years of growth?

Most Popular Narrative: 15.6% Undervalued

With Bloom Energy last closing at $94.98 against a narrative fair value of $112.50, the valuation gap reflects punchy assumptions about future profitability and growth.

Ongoing product cost reductions and digital twin enabled operational improvements, fueled by AI driven analytics from a large installed base, are lowering cost per watt and raising manufacturing efficiency. This is poised to drive continued operating margin and net margin expansion.

Expansion of recurring, profitable service revenues as the installed base grows, including through international and sector diversification (data centers, marine, microgrids), underpins cash flow stability, earnings quality, and increases forward revenue visibility.

Want to see how aggressive revenue ramps, widening margins, and a rich future earnings multiple combine into that fair value? The full narrative unpacks the math behind it.

Result: Fair Value of $112.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that bullish setup could unravel if cheaper zero emission rivals undercut Bloom’s gas based systems or if data center build outs slow, potentially stranding new capacity.

Find out about the key risks to this Bloom Energy narrative.

Another View: Market Ratios Flash Caution

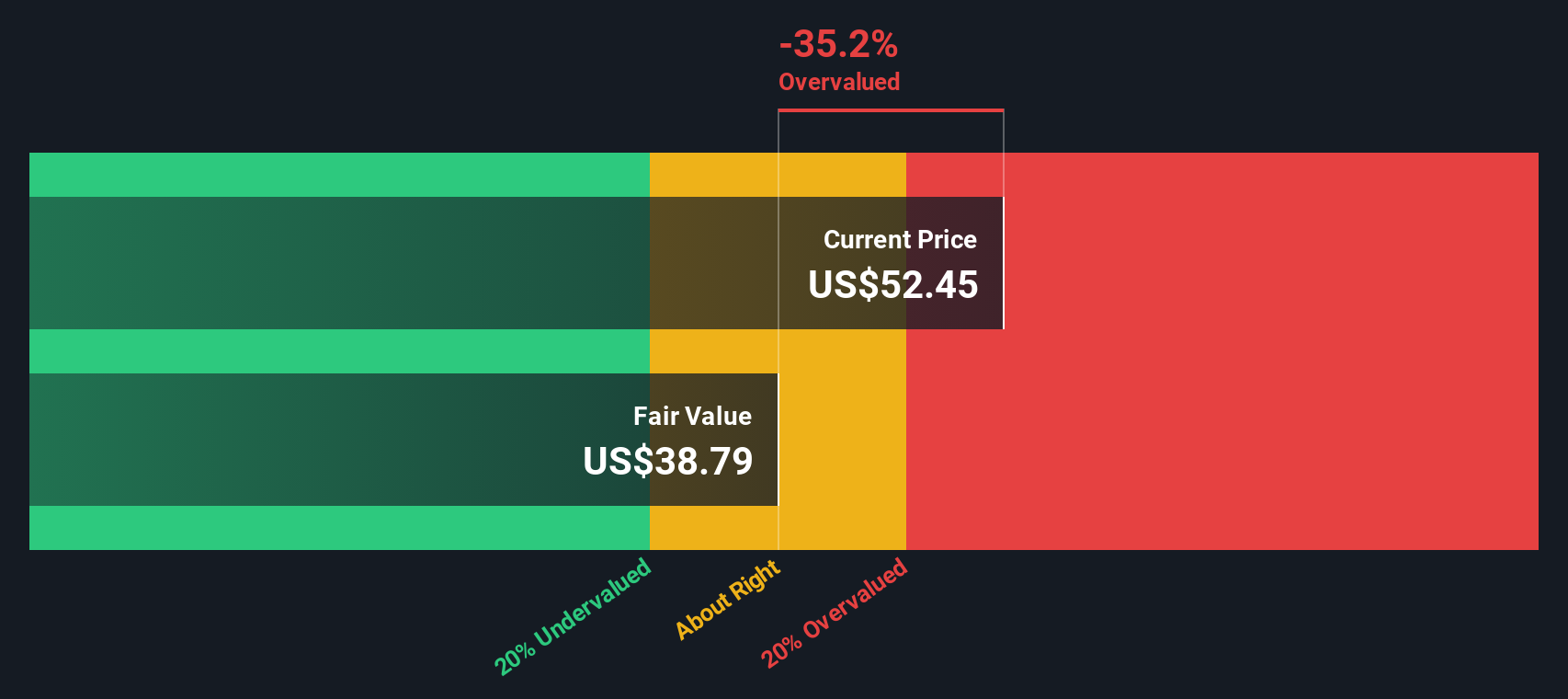

Our DCF model sees Bloom trading about 35.8 percent below fair value, but the market is not convinced. On sales, the stock looks stretched, leaving investors to decide whether strong growth justifies paying up today for cash flows that are still largely ahead.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bloom Energy Narrative

If you are skeptical of this framing or simply prefer to dig into the numbers yourself, you can craft a personalized view in minutes with Do it your way.

A great starting point for your Bloom Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single stock when you can quickly scan broader opportunities on Simply Wall St and consider how to position your portfolio for potential future moves.

- Explore early stage growth potential by reviewing these 3612 penny stocks with strong financials that combine smaller market caps with stronger balance sheets and fundamentals than typical speculative names.

- Consider the AI infrastructure theme by looking at these 26 AI penny stocks that feature data centric business models and scalable, real world demand.

- Assess risk and reward by focusing on these 908 undervalued stocks based on cash flows where company fundamentals and cash flows can be compared with current market prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal