SoFi’s $1.5 Billion Equity Raise and Smart Card Launch Might Change The Case For Investing In SoFi Technologies (SOFI)

- Earlier this month, SoFi Technologies completed a US$1.50 billion follow-on equity offering of 54,545,454 common shares at US$27.50 each, while also rolling out its new SoFi Smart Card with up to 5% cash back on groceries and high-yield savings for new SoFi Plus members.

- The capital raise strengthens SoFi’s balance sheet just as it launches the Smart Card, a bundled charge, checking, and savings product that could deepen member engagement and support its all-in-one financial platform ambitions.

- We’ll now examine how this large equity raise and Smart Card launch interact with SoFi’s existing growth expectations and valuation assumptions.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

SoFi Technologies Investment Narrative Recap

To own SoFi today, you have to believe it can grow from a fast-rising digital bank into a broad, fee-rich financial platform while justifying a premium valuation multiple. The US$1.50 billion equity raise and Smart Card launch reinforce that long-term platform story, but in the near term the key catalyst remains execution on profitable member and product growth, while the biggest risk is that growth normalizes faster than the market expects, leaving little room for error at today’s price.

The Smart Card announcement is particularly relevant here, because it directly targets SoFi’s core thesis of deeper engagement and higher products per member, with 5% grocery cashback and high-yield savings aimed at everyday financial activity. If SoFi can use this kind of all-in-one product to increase cross-sell and fee-based revenues across banking, lending, and crypto-related services, it could help balance the dilution from the equity raise and support the company’s ambition to scale beyond its lending roots.

Yet despite all this progress, investors still need to be aware that SoFi’s premium valuation leaves limited protection if member or product growth starts to...

Read the full narrative on SoFi Technologies (it's free!)

SoFi Technologies' narrative projects $5.1 billion revenue and $954.1 million earnings by 2028.

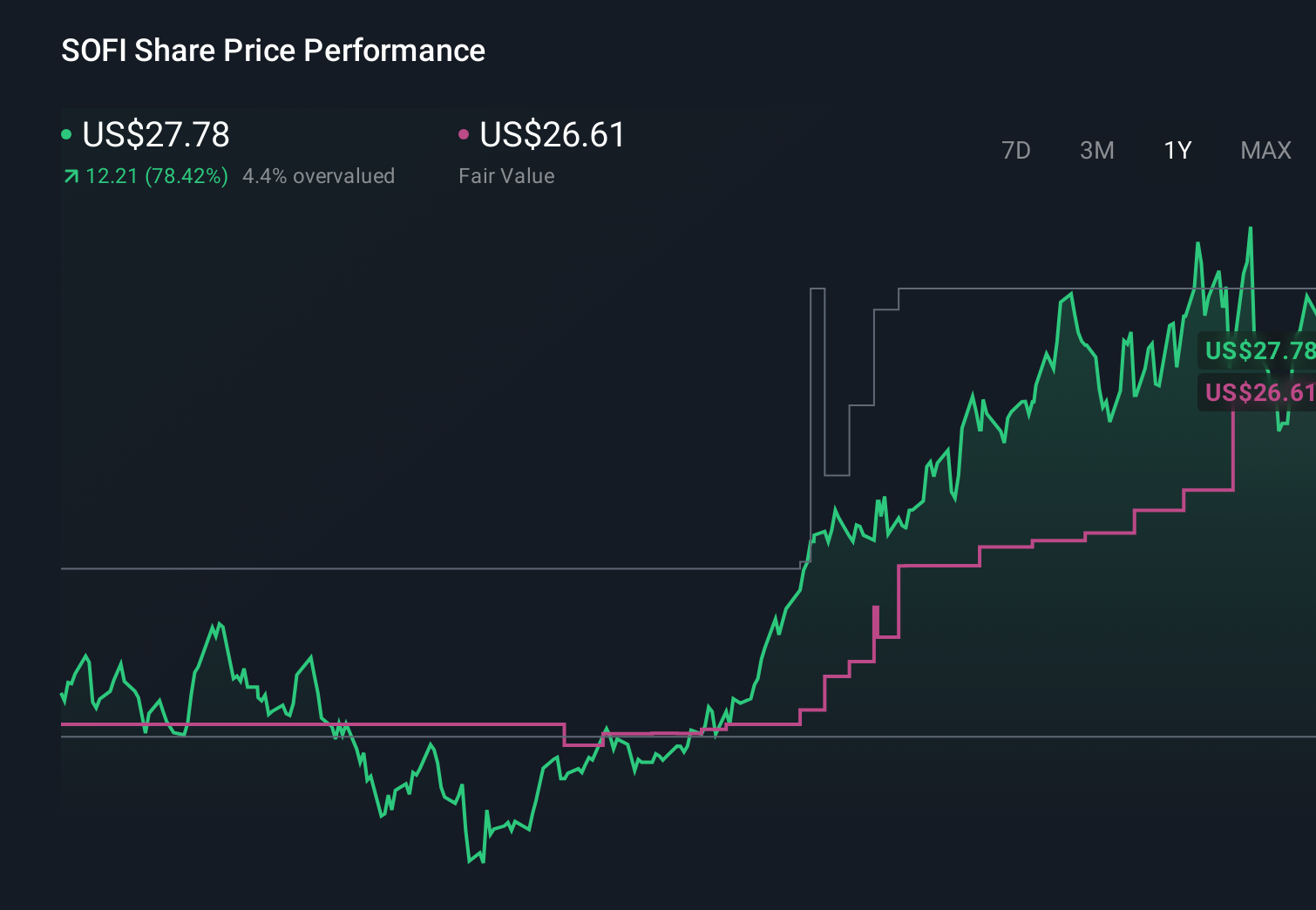

Uncover how SoFi Technologies' forecasts yield a $27.15 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members see SoFi’s fair value anywhere between about US$9.47 and US$35, across 64 independent views. With expectations already baking in rapid digital banking growth and richer cross sell, it pays to compare several of these perspectives before deciding how SoFi’s execution risk fits into your own portfolio.

Explore 64 other fair value estimates on SoFi Technologies - why the stock might be worth less than half the current price!

Build Your Own SoFi Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SoFi Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SoFi Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SoFi Technologies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal