TKO Group Holdings (TKO) Valuation After New Dividend, FIFA Tie-Up and Ram Partnership Fuel Investor Optimism

TKO Group Holdings (TKO) just put a spotlight on shareholder returns by declaring a fourth quarter cash dividend of 0.78 dollars per share, part of a roughly 150 million dollars aggregate payout.

See our latest analysis for TKO Group Holdings.

That dividend comes on top of a strong run, with the share price at 208.42 dollars after a roughly mid double digit year to date share price return and an even stronger one year total shareholder return, as recent FIFA hospitality and Ram partnership news helps keep momentum looking more like it is building than fading.

If TKO’s surge has you rethinking where growth could come from next, this is a good moment to scout auto manufacturers that might benefit from similar sports and entertainment tie ups.

But with revenue and earnings still growing briskly and the stock already up nearly 50 percent over the past year, investors now face a tougher call: is TKO still mispriced, or are markets already baking in the next leg of growth?

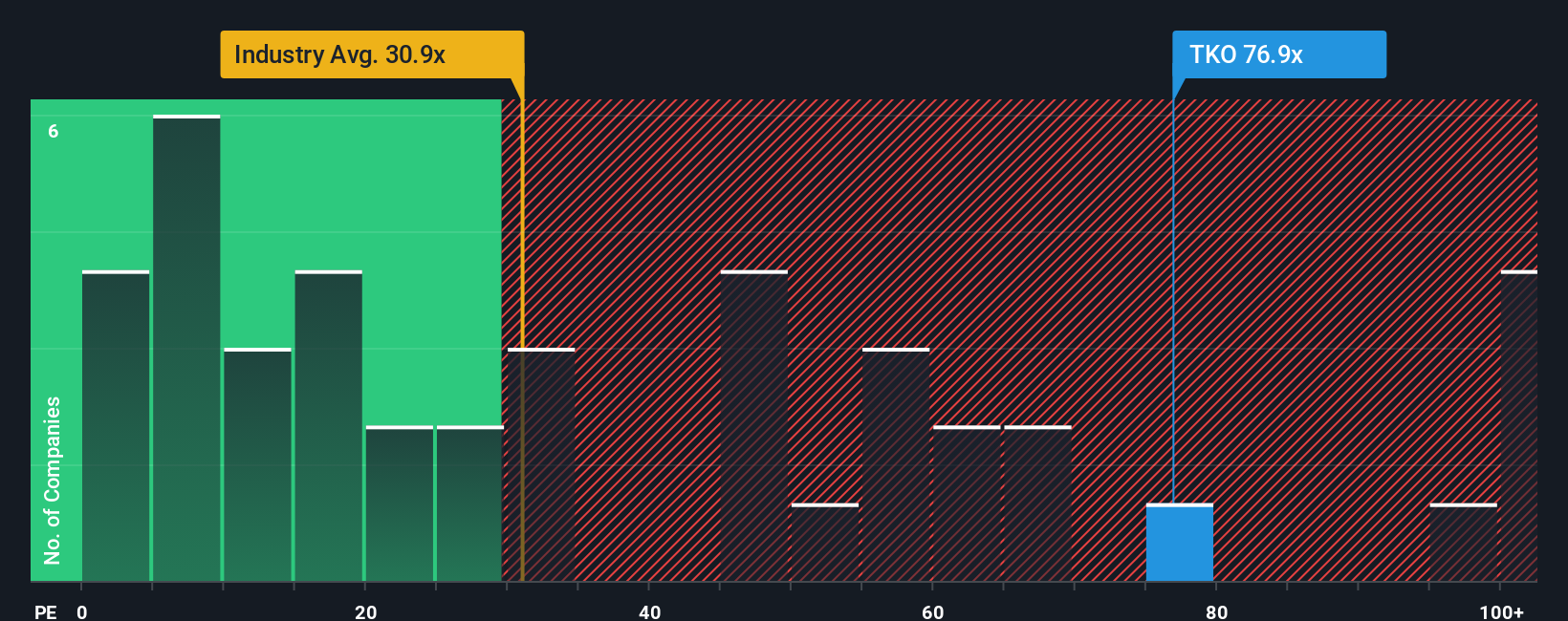

Price-to-Earnings of 71.9x: Is it justified?

Based on our DCF fair value estimate of 219.59 dollars per share, TKO looks modestly undervalued versus the latest 208.42 dollars close, even with its elevated earnings multiple.

The SWS DCF model projects TKO's future cash flows and discounts them back to today's dollars, essentially asking what those growing streams of profit are worth right now. For a fast growing, IP rich sports and entertainment business that just turned profitable, this lens focuses on long term cash generation rather than near term accounting noise.

On a headline basis, TKO's price to earnings ratio of 71.9 times screens expensive against the broader US entertainment sector. That premium is directly tied to expectations of outsized earnings growth. Our fair value work, which implies a fair price to earnings ratio of 35.3 times, suggests the current multiple is running far ahead of where the market could ultimately settle if growth normalises.

Relative to peers, the stock trades below the peer average price to earnings of 94.9 times, yet far above both the industry benchmark of 20.3 times and our estimated fair price to earnings of 35.3 times. This underlines how aggressively the market is capitalising TKO's profit outlook.

Explore the SWS fair ratio for TKO Group Holdings

Result: Price-to-Earnings of 71.9x (OVERVALUED)

However, surging expectations could unravel if live event demand softens or if key media and sponsorship partners push back harder on pricing and renewal terms.

Find out about the key risks to this TKO Group Holdings narrative.

Another View: Multiples Send a Louder Warning

Even though our fair value work suggests TKO trades about 5 percent below intrinsic value, the 71.9 times earnings tag versus a 20.3 times industry average and a 35.3 times fair ratio points to real downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TKO Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TKO Group Holdings Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a fully tailored view in just a few minutes: Do it your way.

A great starting point for your TKO Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by scanning focused stock lists on Simply Wall St, so you are not the one hearing about winners late.

- Target steady income by reviewing these 13 dividend stocks with yields > 3% that combine attractive yields with balance sheets strong enough to support long term payouts.

- Capture the next wave of innovation by assessing these 26 AI penny stocks that are pushing artificial intelligence from buzzword to real earnings power.

- Position yourself for asymmetric upside by analysing these 80 cryptocurrency and blockchain stocks reshaping finance, payments, and blockchain infrastructure before they become household names.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal