Assessing Singtel (SGX:Z74)’s Valuation After Upgraded FY2026 Outlook and Data Centre Growth Push

Singapore Telecommunications (SGX:Z74) is back in focus after lifting its FY2026 outlook following strong first half results and a bigger push into higher margin digital infrastructure, especially data centres.

See our latest analysis for Singapore Telecommunications.

The stronger FY2026 outlook and rising data centre narrative appear to be shifting sentiment, with the latest share price at SGD 4.66 and a robust year to date share price return of 50.81%, while the five year total shareholder return of 149.68% shows longer term momentum is firmly intact despite short term volatility and regulatory bumps.

If Singtel’s data centre pivot has caught your attention, it could be a good moment to explore other infrastructure enabled growth stories via fast growing stocks with high insider ownership.

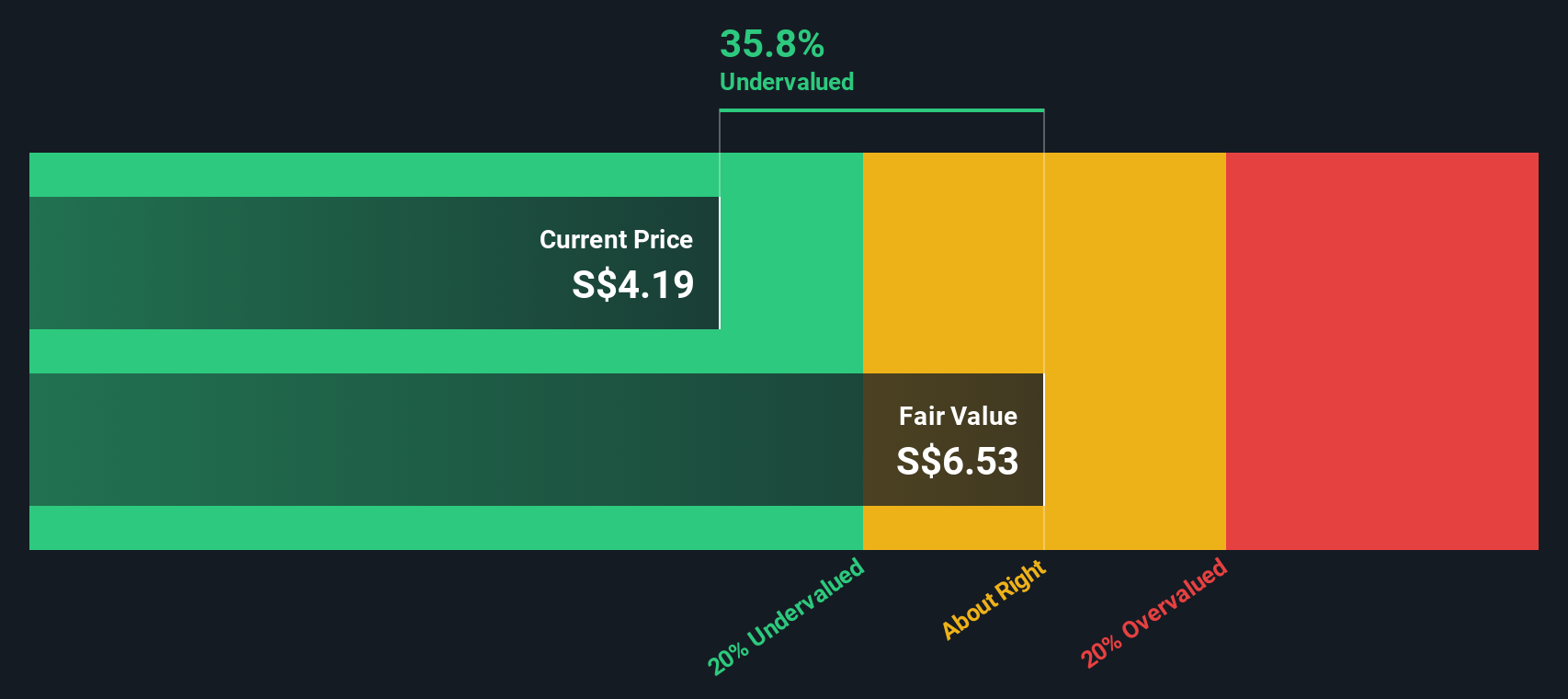

With the share price already up sharply and analysts seeing further upside, the key question now is simple: is Singtel still trading at a meaningful discount to its intrinsic value, or has the market already baked in its data centre driven growth?

Price-to-Earnings of 12.4x: Is it justified?

On a trailing price to earnings ratio of 12.4 times, Singapore Telecommunications looks undervalued versus both its own fundamentals and listed telecom peers at the current SGD 4.66 share price.

The price to earnings multiple compares what investors are paying today for each dollar of current earnings. This is a core yardstick for mature, cash generative businesses like telecom operators. For Singtel, this lens is particularly relevant because the company has recently swung back to profitability and now delivers a return on equity of 22.8%, supported by connectivity cash flows and digital infrastructure earnings.

On that basis, the current 12.4 times earnings multiple suggests the market is not fully pricing in the strength and quality of Singtel’s profit base. Our analysis indicates that, based on a regression driven fair price to earnings ratio of 17.6 times, there is room for the valuation multiple to expand from here if sentiment around the data centre strategy and earnings mix improves.

Relative value also looks notable when set against the wider landscape, with Singtel’s 12.4 times price to earnings multiple sitting below the Asian telecom industry average of 16.4 times and a peer group average of 21 times. These are levels that the share price could potentially move closer to if the company delivers on its infrastructure led growth narrative.

Explore the SWS fair ratio for Singapore Telecommunications

Result: Price-to-Earnings of 12.4x (UNDERVALUED)

However, risks remain, particularly potential execution missteps in Nxera data centres, as well as regulatory or competitive pressures that could crimp margins and slow earnings momentum.

Find out about the key risks to this Singapore Telecommunications narrative.

Another View: What Does Our DCF Say?

While earnings multiples point to value, our DCF model is even more optimistic, putting fair value around SGD 6.31 per share, about 26% above today’s SGD 4.66 price. If cash flows do not grow as planned, however, this potential upside may be more hopeful than a base case scenario.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Singapore Telecommunications for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Singapore Telecommunications Narrative

If you see the story differently or enjoy digging into the numbers yourself, you can build a personalised view in just minutes: Do it your way.

A great starting point for your Singapore Telecommunications research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, set yourself up for the next opportunity by using the Simply Wall St Screener to uncover fresh, data backed ideas beyond Singtel.

- Secure steadier portfolio income by targeting these 13 dividend stocks with yields > 3% that combine reliable payouts with solid fundamentals and the potential to cushion returns in choppy markets.

- Position yourself ahead of the next technology wave by focusing on these 26 AI penny stocks that could benefit as artificial intelligence reshapes business models worldwide.

- Strengthen your long term returns by zeroing in on these 908 undervalued stocks based on cash flows where market prices have not yet caught up with cash flow potential and intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal