Intercontinental Exchange (ICE): Revisiting Valuation After New Expero Data Deal and Strong November Trading Metrics

Intercontinental Exchange (ICE) is drawing fresh attention after Expero agreed to embed ICE cross asset data into its Connected Finance platform, just as November trading volumes and open interest showed solid year over year gains.

See our latest analysis for Intercontinental Exchange.

Those data wins and solid November metrics come against a backdrop where the share price, now around $163.21, has posted a roughly mid single digit 1 year total shareholder return, but a much stronger multi year total shareholder return profile, suggesting momentum is pausing rather than breaking.

If this kind of infrastructure growth story appeals, it might be worth seeing which other financial and trading platforms are catching attention through fast growing stocks with high insider ownership.

Between resilient revenue growth, expanding data partnerships and a share price still trading at a discount to analyst targets, is Intercontinental Exchange quietly setting up a buying opportunity, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 14.2% Undervalued

With the narrative fair value near $190 versus ICE's $163.21 close, the story assumes upside still ahead if its growth roadmap plays out.

The continued expansion and integration of ICE's global electronic trading platforms across asset classes including record energy, interest rate, and equity contract volumes suggests ongoing benefits from digitization and greater market electronification, which are likely to drive sustained double digit growth in transaction revenues and operating leverage.

Want to see why steady revenue growth, fatter margins and a richer future earnings multiple all converge on that higher fair value? The full narrative unpacks the specific growth runway, profit profile and valuation leap management is expected to deliver.

Result: Fair Value of $190.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a deeper downturn in energy markets or missteps integrating large mortgage tech deals could quickly challenge the growth and valuation assumptions behind that upside.

Find out about the key risks to this Intercontinental Exchange narrative.

Another Angle on Valuation

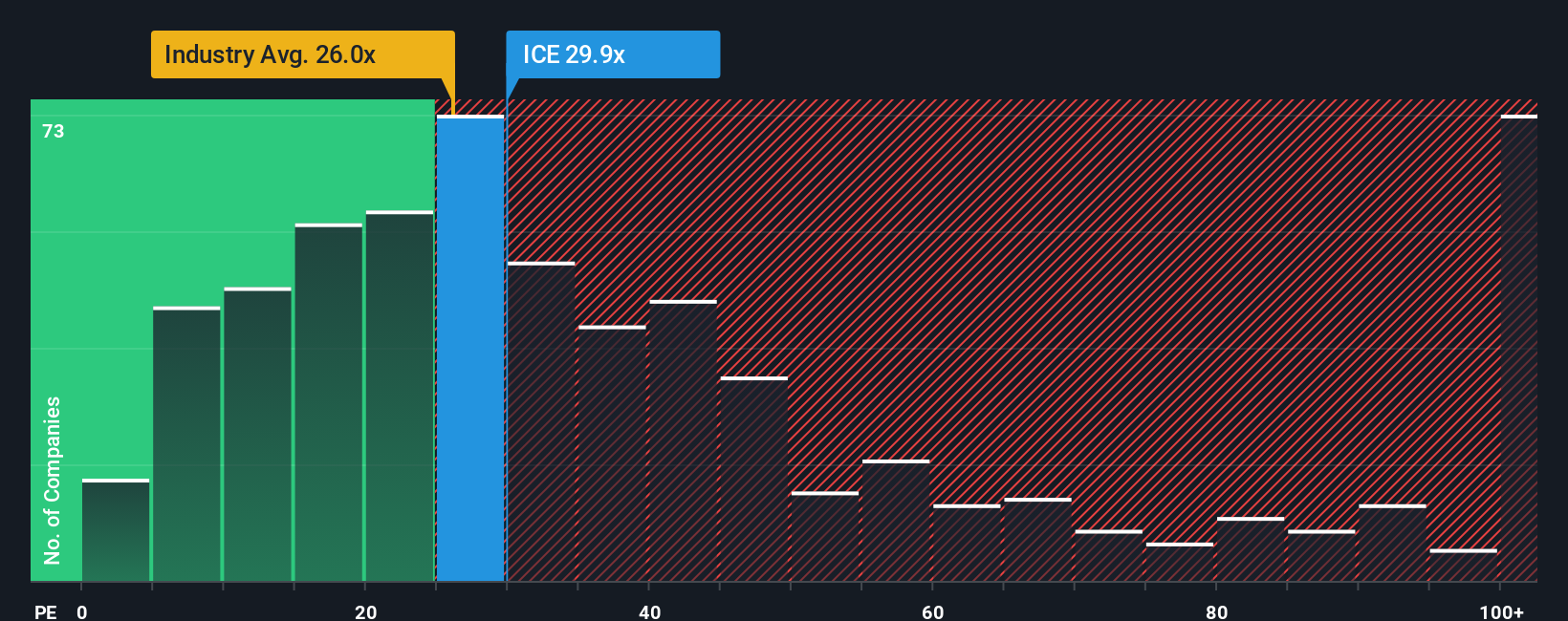

On a simple price to earnings basis, Intercontinental Exchange looks demanding, trading at 29.4 times earnings versus 25.2 times for the US Capital Markets sector and a fair ratio of just 16.1 times. Peers average an even richer 33.5 times, but that still leaves a lot of room for disappointment if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intercontinental Exchange Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a full narrative in just minutes, Do it your way.

A great starting point for your Intercontinental Exchange research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Intercontinental Exchange when some of the market’s most compelling opportunities are only a few clicks away in the Simply Wall Street Screener.

- Capitalize on mispriced quality by targeting these 908 undervalued stocks based on cash flows that combine solid fundamentals with meaningful upside potential before the crowd catches on.

- Ride the next wave of innovation by backing these 26 AI penny stocks positioned to benefit from breakthrough advances in automation, data analytics, and intelligent software.

- Lock in potential income streams with these 13 dividend stocks with yields > 3% that balance dependable cash returns with room for capital growth over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal