Live Oak Bancshares (LOB): Reassessing Valuation After Financial Restatement and Investor Investigation

Live Oak Bancshares (LOB) is back in the spotlight after an investor rights firm launched a probe into its recent financial restatement tied to cash flow misclassifications and potential disclosure issues. Investors are understandably reassessing both trust and valuation.

See our latest analysis for Live Oak Bancshares.

The legal probe lands after a choppy stretch for the stock, with a 13.32% 30 day share price return helping claw back some ground even as the year to date share price return sits in negative territory and the 1 year total shareholder return remains weak compared with a still respectable 3 year total shareholder return. This suggests near term sentiment is fragile while the longer term story has not completely broken.

If this situation has you rethinking where you want to take risk, it could be a good moment to explore fast growing stocks with high insider ownership for fresh ideas beyond the banking space.

With earnings still growing, a fresh Chief Risk Officer in place and the stock trading at a notable discount to analyst targets, the key question is whether this reset signals a buyable mispricing or a market that already anticipates Live Oak’s next leg of growth.

Most Popular Narrative: 15.9% Undervalued

With Live Oak Bancshares last closing at $35.31 against a narrative fair value of $42, the current share price sits meaningfully below the storyline investors are modeling in.

Analysts expect earnings to reach $328.0 million (and earnings per share of $7.1) by about September 2028, up from $56.1 million today. The analysts are largely in agreement about this estimate.

Curious how a regional bank earns such bold profit projections and a richer future multiple than many peers? This narrative reflects an aggressive mix of growth, margin expansion and disciplined dilution that could influence what investors are willing to pay. Want to see the full playbook behind that valuation change?

Result: Fair Value of $42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative could unravel if regulatory changes hit SBA lending harder than expected or if digital investments fail to deliver operating leverage.

Find out about the key risks to this Live Oak Bancshares narrative.

Another View: Multiples Tell a Richer Story

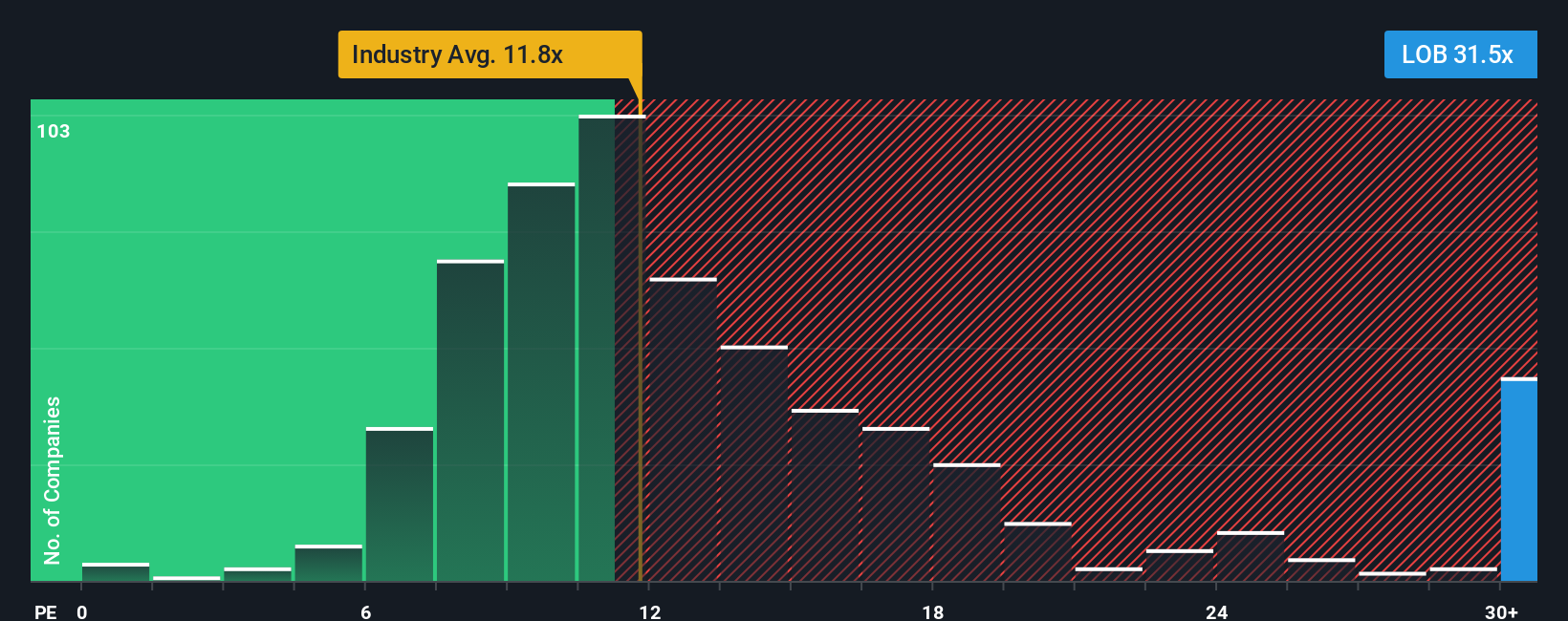

While the narrative fair value suggests upside, the current price already bakes in a lot of optimism. Live Oak trades on a price to earnings ratio of 23.6 times, well above the US banks industry at 11.9 times and our fair ratio estimate of 20.5 times. That premium narrows the margin of safety. Is the upside really as generous as it looks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Live Oak Bancshares Narrative

If you see this differently or prefer to lean on your own research, you can quickly build a custom view in just minutes: Do it your way.

A great starting point for your Live Oak Bancshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put your research edge to work by scanning targeted stock ideas from our screeners so you do not miss the next big winner.

- Capture potential market mispricings by running through these 908 undervalued stocks based on cash flows that may offer strong cash flow upside.

- Ride structural growth trends in automation and data by reviewing these 26 AI penny stocks shaping the future of intelligent software.

- Strengthen your income stream by assessing these 13 dividend stocks with yields > 3% that can support reliable long term payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal