National Vision (EYE): Reassessing Valuation After Upgraded Guidance and New 2030 Profitability Roadmap

National Vision Holdings (EYE) just hit a fresh 52 week high after lifting its full year revenue outlook and unveiling a 2030 growth plan focused on profit expansion and multi year cost savings.

See our latest analysis for National Vision Holdings.

The rally around the upgraded outlook comes after a powerful run, with a year to date share price return of about 168 percent, even as the 5 year total shareholder return remains negative. This suggests momentum is rebuilding as investors reassess its long term earnings potential.

If this kind of turnaround story has your attention, it could be worth exploring other retail and service names with strong insider alignment and growth potential via fast growing stocks with high insider ownership.

Yet with the shares now near 52 week highs, trading at a modest discount to analyst targets but still loss making, the key question is whether there is real upside left here or whether markets are already pricing in the growth.

Most Popular Narrative Narrative: 12.4% Undervalued

With National Vision Holdings last closing at 28.83 dollars versus a narrative fair value of 32.90 dollars, the storyline leans toward upside if growth unfolds as expected.

Ongoing premiumization of the frame assortment (increasing frames over 99 dollars from 20% to 40% of mix) and new designer partnerships (e.g., Jimmy Choo, HUGO BOSS) are driving higher average tickets and validating the ability to move upmarket. This assortment evolution supports both near term gross margin expansion and a longer term shift in revenue mix.

Want to see what kind of revenue path and margin lift could justify this higher value? The narrative quietly bakes in ambitious profit scaling and a richer earnings multiple. Curious how those projections stack up against a near double digit discount rate and today’s still loss making base?

Result: Fair Value of $32.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks linger, from intensifying online eyewear competition to persistent optometrist shortages that could cap store productivity and pressure margins.

Find out about the key risks to this National Vision Holdings narrative.

Another View: Market Ratios Flash Caution

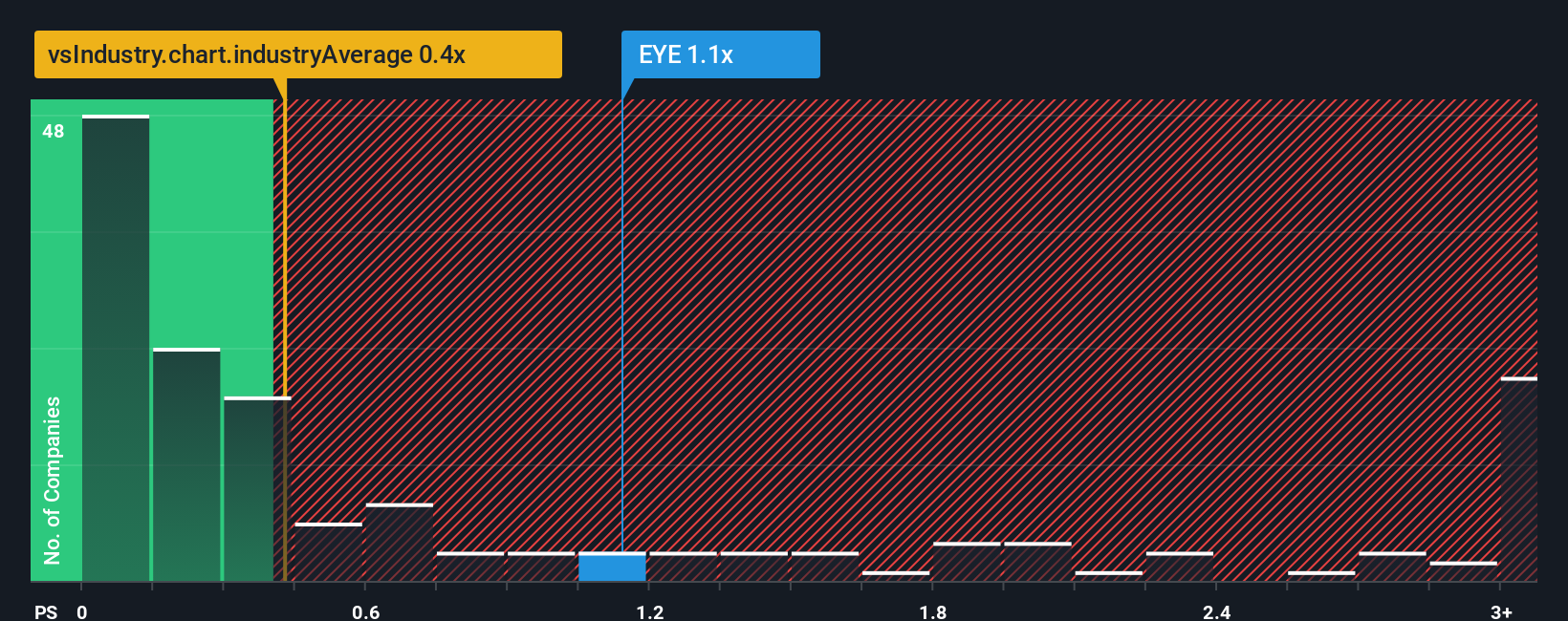

On sales, National Vision looks less forgiving. The stock trades on a price to sales ratio of 1.2 times, more than double the US Specialty Retail average of 0.5 times and slightly above its fair ratio of 1.1 times, which hints the market may already be paying up for the turnaround story.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own National Vision Holdings Narrative

If you see the story differently, or would rather rely on your own analysis, you can quickly build a customized view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding National Vision Holdings.

Ready for more actionable investment ideas?

Before you move on, lock in your next opportunities by scanning targeted stock ideas on Simply Wall Street, so potential winners do not slip past you.

- Capture potential mispricings by reviewing companies that look cheap on fundamentals through these 908 undervalued stocks based on cash flows and position yourself ahead of a possible re rating.

- Ride powerful structural trends by checking out these 30 healthcare AI stocks that blend innovation, data, and medical breakthroughs for long runway growth.

- Boost your income potential by focusing on reliable payers with these 13 dividend stocks with yields > 3% and build a portfolio that works harder while you wait.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal