Evaluating PACCAR (PCAR) After Earnings Concerns Drive Fresh Scrutiny of Its Valuation

PACCAR (PCAR) is back on traders radar as worries about softer upcoming earnings and revenue collide with a fresh round of executive promotions and dividends, raising the question of whether the recent dip is justified.

See our latest analysis for PACCAR.

The stock has cooled slightly in the last session, but a 16.7 percent 1 month share price return alongside a 131 percent 5 year total shareholder return suggests long term momentum is still firmly intact, even as earnings worries and chunky dividends reset expectations.

If this mix of payout strength and cyclical risk has you thinking more broadly about industrial names, it could be worth scouting aerospace and defense stocks for other ideas with similar risk reward profiles.

With PACCAR trading just above analyst targets yet still showing a hefty implied intrinsic discount, the next question is simple: is this cyclical pullback masking undervaluation, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 4% Overvalued

With PACCAR closing at $111.56 against a narrative fair value of about $107.28, this widely followed view implies the market is paying a slight premium for its future cash flows.

Ongoing investments in next-gen clean diesel, alternative powertrains, and connected vehicle services position PACCAR to capture future growth as fleets transition towards more efficient and zero-emission vehicles, supporting long-term top line and margin expansion. Rising adoption of digital fleet management and over-the-air telematics, combined with PACCAR's strengthening financial services and used truck business, is expected to increase customer lifetime value and support higher margin, recurring revenue, positively impacting future profitability.

Curious what kind of margin uplift, revenue runway, and future earnings power are baked into that modest premium and long term shift story? The full narrative unpacks the bold assumptions behind those forecasts and the valuation multiple they think PACCAR can sustain once this transition plays out.

Result: Fair Value of $107.28 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stretched valuations still face two clear pressure points: stubborn tariffs squeezing margins and a softer truck order backdrop threatening those upbeat 2028 earnings assumptions.

Find out about the key risks to this PACCAR narrative.

Another View: Multiples Paint a Cheaper Picture

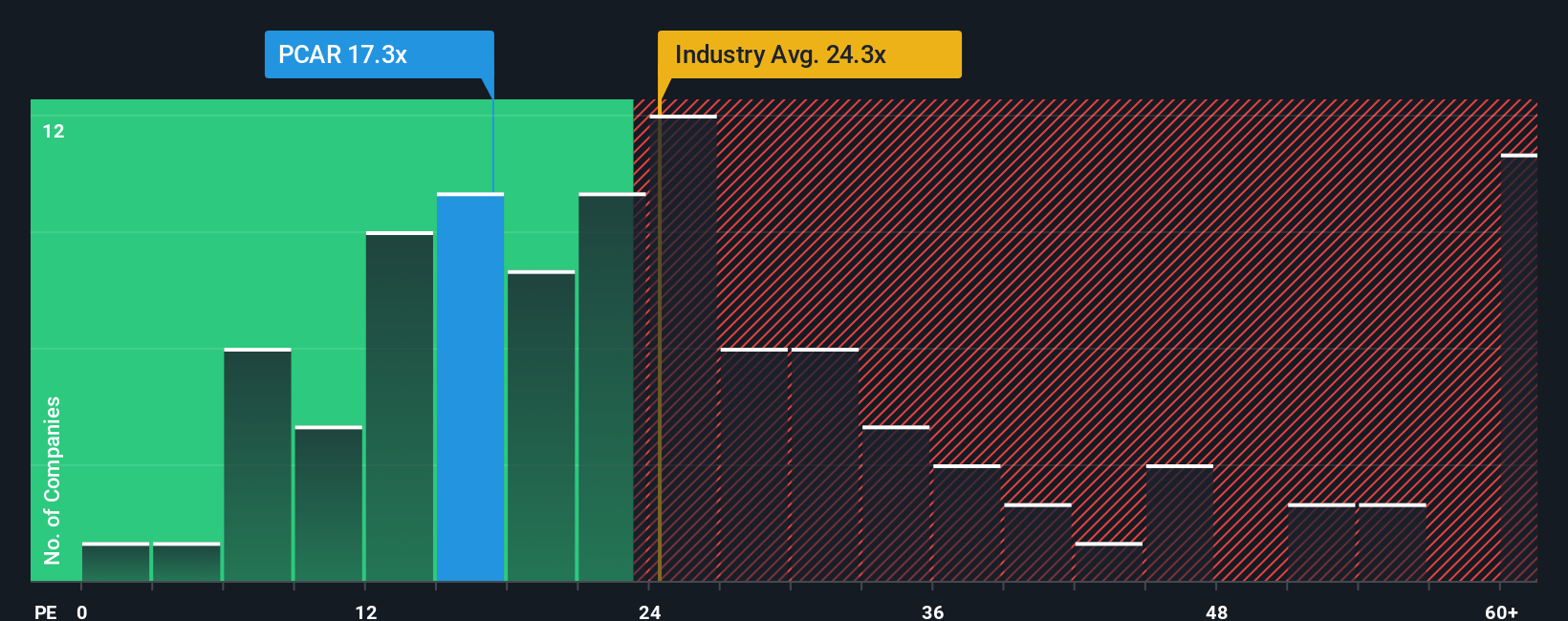

While the narrative fair value suggests PACCAR is slightly overvalued, its 21.8 times price to earnings looks attractive against peers at 24.9 times, the US Machinery sector at 26 times, and a fair ratio of 33 times. This hints at upside if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PACCAR Narrative

If you are not fully aligned with this view, or want to dive into the numbers yourself, you can build a custom thesis in minutes: Do it your way.

A great starting point for your PACCAR research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, you may want to explore your next potential opportunity with targeted stock ideas that match your style, so you are not limited to chasing yesterday's winners.

- Explore early-stage momentum with these 3611 penny stocks with strong financials to find smaller companies that show financial substance behind their low share prices.

- Focus on the center of potential productivity gains by using these 26 AI penny stocks to identify companies working to commercialize artificial intelligence at scale.

- Consider value-driven opportunities through these 908 undervalued stocks based on cash flows where strong cash flows and reasonable prices may support long-term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal