GreenMobility A/S (CPH:GREENM) Stocks Shoot Up 28% But Its P/S Still Looks Reasonable

GreenMobility A/S (CPH:GREENM) shares have continued their recent momentum with a 28% gain in the last month alone. The annual gain comes to 221% following the latest surge, making investors sit up and take notice.

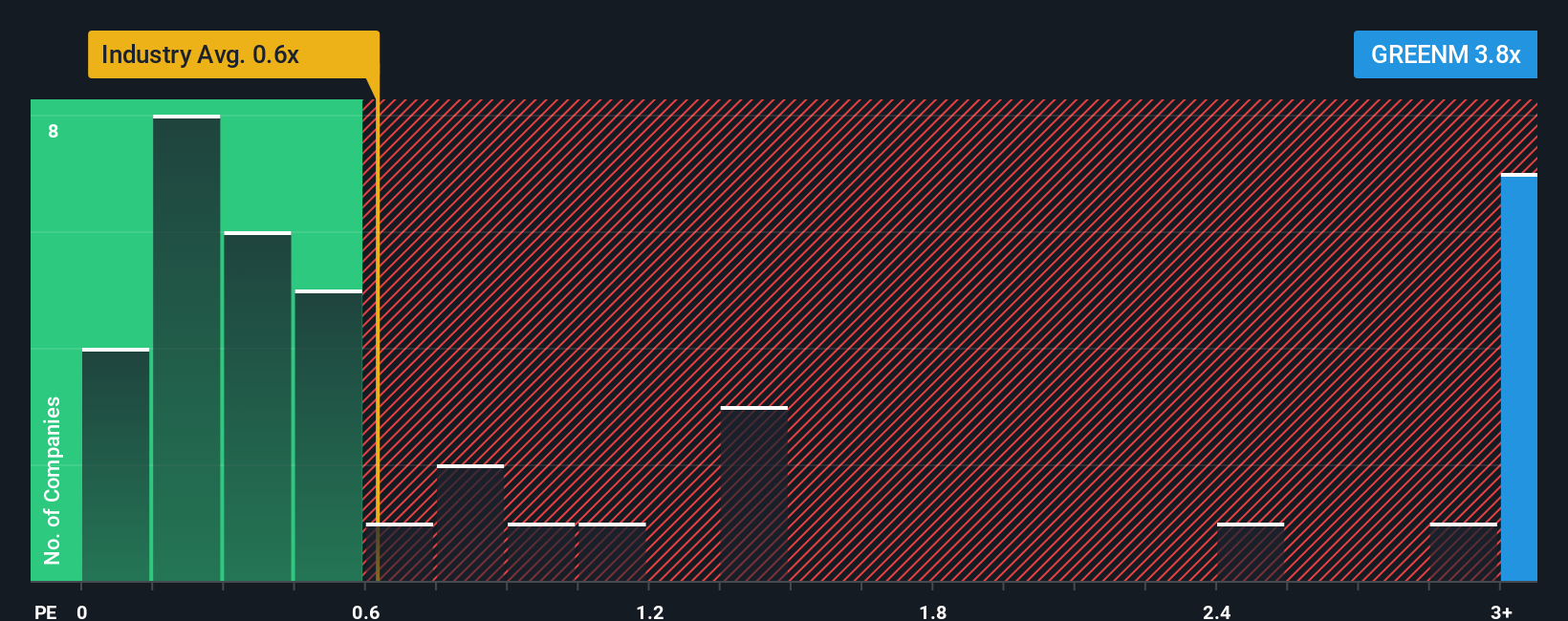

Following the firm bounce in price, given around half the companies in Denmark's Transportation industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider GreenMobility as a stock to avoid entirely with its 3.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for GreenMobility

How Has GreenMobility Performed Recently?

Recent times have been quite advantageous for GreenMobility as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on GreenMobility will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, GreenMobility would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 51%. The latest three year period has also seen an excellent 86% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 0.5%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why GreenMobility's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does GreenMobility's P/S Mean For Investors?

The strong share price surge has lead to GreenMobility's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's no surprise that GreenMobility can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for GreenMobility (of which 1 is potentially serious!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal