Johnson Controls International (NYSE:JCI): Valuation Check After CFO’s Insider Stock Purchase and Ongoing Growth Initiatives

Johnson Controls International (NYSE:JCI) just drew fresh attention after EVP and CFO Marc Vandiepenbeeck bought roughly $554,000 of stock, a move that often signals management has confidence in the company’s prospects.

See our latest analysis for Johnson Controls International.

That confidence lines up with a stock that has been quietly grinding higher, with a 90 day share price return of 6.45 percent and a standout year to date share price return of 45.36 percent. The five year total shareholder return of 174.10 percent shows momentum has been building for some time, supported by steady dividend payments and initiatives like AI enabled Sensormatic analytics and the new renewable natural gas partnership.

If this kind of strategic shift in buildings and infrastructure has your attention, it is also worth exploring aerospace and defense stocks for other industrial names reshaping how critical systems are designed and managed.

Yet with the shares up more than 45 percent this year and still trading below consensus price targets, investors have to ask whether Johnson Controls is genuinely undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative: 12.9% Undervalued

Set against Johnson Controls International’s last close of $114.76, the most widely followed narrative points to a fair value nearer $132. This frames upside that depends heavily on execution in HVAC, services, and data center focused infrastructure.

The raised upper bound of the price target range reflects increased conviction that management’s guidance is achievable, with upside potential if end market strength in data centers and critical infrastructure persists.

Want to see what is really baked into that upside, from margin expansion ambitions to bold earnings power assumptions, and why the valuation leans toward growth stock territory rather than a typical industrial multiple anchor?

Result: Fair Value of $132 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained margin expansion is not guaranteed, as both restructuring complexity and tougher data center competition are capable of quickly eroding the current upside story.

Find out about the key risks to this Johnson Controls International narrative.

Another Lens on Valuation

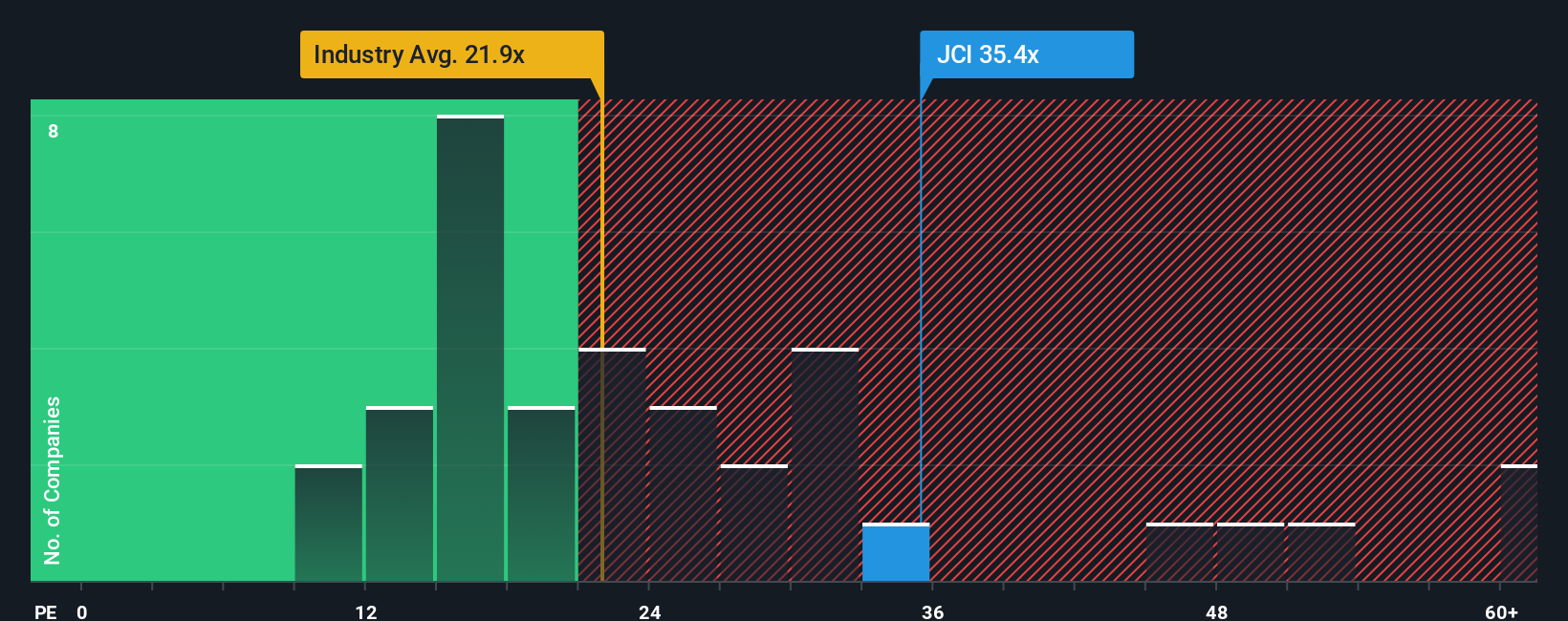

Looked at through earnings multiples, the story is less comfortable. JCI trades on a 40.8 times P E ratio, above the US Building industry at 20.2 times and even our fair ratio of 36.9 times. This suggests today’s price already bakes in rich expectations. What happens if growth normalizes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Johnson Controls International Narrative

If this perspective does not quite align with your own thinking, or you would rather dig into the numbers yourself, you can craft a fresh view in just a few minutes, Do it your way.

A great starting point for your Johnson Controls International research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, consider scanning fresh opportunities on the Simply Wall St Screener so the next breakout does not pass you by.

- Review these 908 undervalued stocks based on cash flows that pair solid fundamentals with potential upside.

- Explore these 26 AI penny stocks that reflect how automation, data, and intelligent systems are influencing a range of industries.

- Assess these 13 dividend stocks with yields > 3% that combine current yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal