Henderson Land Development (SEHK:12) Valuation After Asia Property Awards Win and Renewed Investor Interest

Henderson Land Development (SEHK:12) just picked up multiple top gongs at the PropertyGuru Asia Property Awards, including Best Developer Asia, putting fresh attention on a stock that has already climbed about 27% this year.

See our latest analysis for Henderson Land Development.

The awards come on top of a strong share price run, with a year to date share price return of about 27% and a 1 year total shareholder return near 29%. This suggests momentum is still building as investors warm to its growth prospects and governance changes.

If this recognition has you rethinking the property sector, it might also be a good time to scout for opportunities among fast growing stocks with high insider ownership.

Yet with the shares now trading above analyst targets despite solid earnings growth, investors face a key question: is Henderson Land still undervalued amid its award winning streak, or are markets already pricing in its future upside?

Price-to-Earnings of 23.7x: Is it justified?

On a price-to-earnings basis, Henderson Land screens as expensive, with its 23.7x multiple sitting well above peers despite the latest HK$29.46 close.

The price-to-earnings ratio compares the current share price with per share earnings, effectively showing how much investors are willing to pay for each dollar of profit in a mature, cash generative real estate group.

Here, the market is assigning a far richer earnings multiple than both the Hong Kong real estate industry average of 13.5x and the peer average of 13.2x. Our DCF work suggests the fair price-to-earnings ratio is materially lower at 20.2x, a level the valuation could gravitate towards if sentiment or growth expectations soften.

This premium looks sizeable against sector norms, with Henderson Land trading on a price-to-earnings multiple that is more than 70% richer than the wider Hong Kong real estate industry and markedly above our own fair ratio estimate.

Explore the SWS fair ratio for Henderson Land Development

Result: Price-to-Earnings of 23.7x (OVERVALUED)

However, risks remain, including a potential correction from stretched valuations and any slowdown in Hong Kong or Mainland China property demand.

Find out about the key risks to this Henderson Land Development narrative.

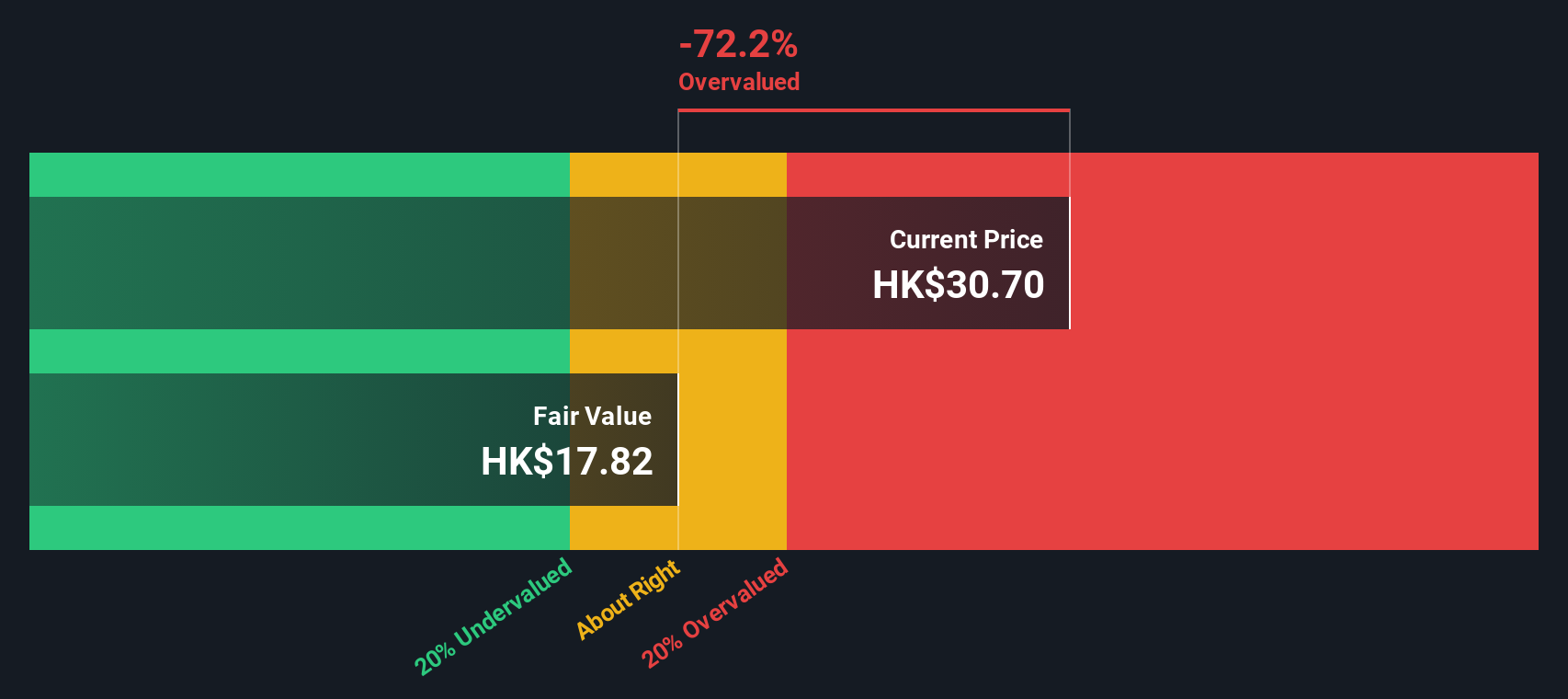

Another View: DCF Points to Deeper Overvaluation

Our DCF model paints an even starker picture, putting fair value at about HK$17.81 per share versus the current HK$29.46. That implies Henderson Land is trading at a hefty premium to its long term cash flow potential. This leaves investors to weigh how long optimism can keep the gap open.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Henderson Land Development for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Henderson Land Development Narrative

If you see things differently or want to dig into the numbers yourself, you can build a tailored view in just a few minutes: Do it your way.

A great starting point for your Henderson Land Development research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready to act on your next idea?

If Henderson Land has caught your attention this far, do not stop here. Let Simply Wall St's powerful screener help you uncover your next advantage right now.

- Capture potential mispricings by applying rigorous cash flow logic to these 908 undervalued stocks based on cash flows that the market may be overlooking.

- Explore structural growth trends by targeting innovation focused businesses through these 26 AI penny stocks with strong momentum and scalable models.

- Strengthen your income strategy by focusing on reliable payers using these 13 dividend stocks with yields > 3% to seek attractive yields supported by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal