Hang Lung Properties (SEHK:101) Valuation After Major West Nanjing Road Redevelopment Deal in Shanghai

Hang Lung Properties (SEHK:101) just signed a major partnership with Shanghai Join Buy Group to redevelop the former Westgate Mall on West Nanjing Road, a move that significantly expands its Shanghai footprint.

See our latest analysis for Hang Lung Properties.

The deal comes as Hang Lung Properties enjoys a strong rebound, with the share price up sharply this year on a robust year to date share price return of 49.43 percent. However, the five year total shareholder return of negative 36.39 percent shows that long term holders are still waiting for a full recovery, suggesting momentum is rebuilding from a low base rather than peaking.

If this Shanghai expansion has you thinking about where else growth and upgrades could surprise the market, it might be worth exploring fast growing stocks with high insider ownership.

With the share price rebounding and growth recovering from a low base, but the stock now trading only slightly below analyst targets, the key question is whether Hang Lung still offers upside or if markets already price in future gains.

Most Popular Narrative Narrative: 3.9% Undervalued

With Hang Lung Properties last closing at HK$9.16 against a narrative fair value of about HK$9.53, the valuation case rests on improving earnings power and steadier cash flows.

Large-scale mixed-use developments and expansions (e.g., Westlake 66, Pavilion, Center 66 Phase 2) in high-growth, well-connected locations are coming online, leveraging urban vibrancy and long-term secular demand for integrated spaces. This is likely to support step-up gains in recurring income and future earnings as pre-leasing shows solid momentum.

Want to see what sits behind that growth story? The narrative focuses on a powerful trio: accelerating revenue, expanding margins, and a richer future earnings multiple. Curious which assumptions really move the fair value dial and how a higher discount rate still points to upside? The full narrative unpacks the exact projections and timing that support this modest undervaluation view.

Result: Fair Value of $9.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tenant sales weakness and structural office oversupply could undercut rental growth, pressuring margins and challenging the case for a higher earnings multiple.

Find out about the key risks to this Hang Lung Properties narrative.

Another Angle: Multiples Point To Rich Pricing

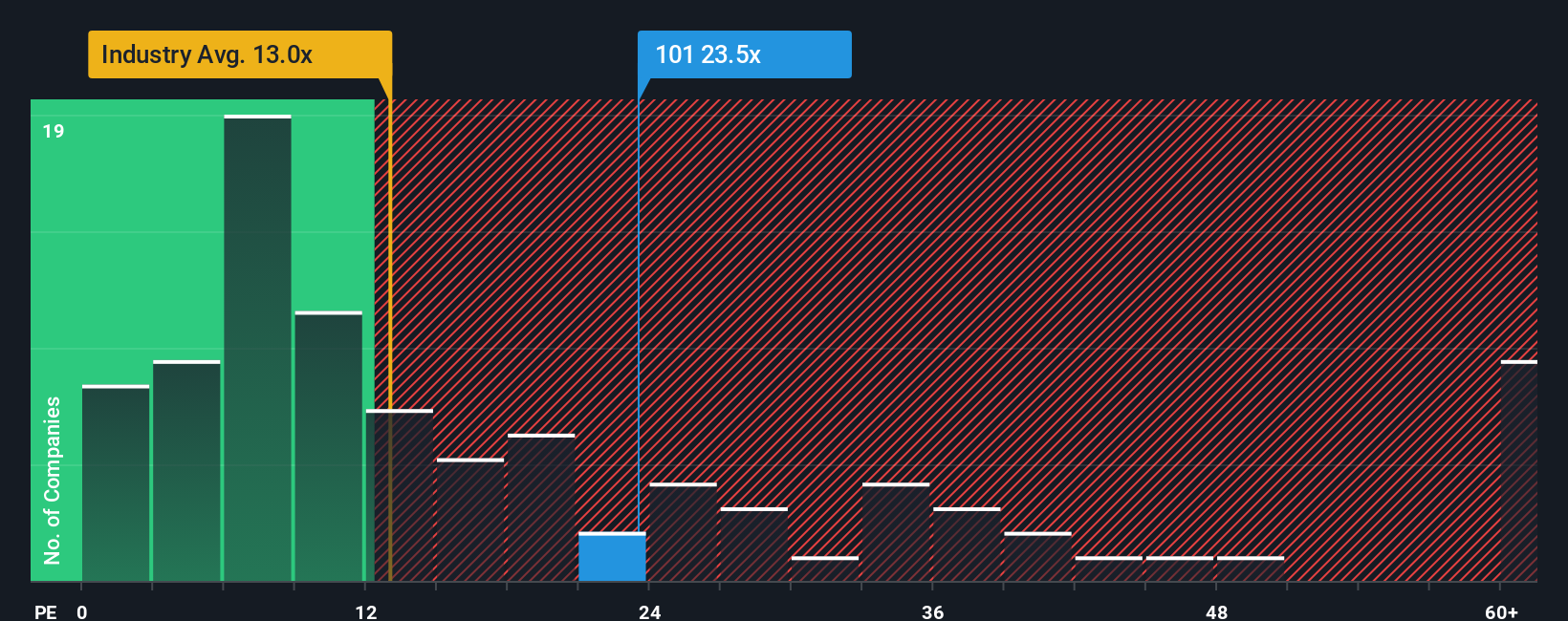

While the growth narrative sees modest upside, the market valuation tells a tougher story. Hang Lung trades on a 23.1x price to earnings ratio versus about 13.5x for the Hong Kong real estate industry and 14.4x for peers, and above a fair ratio of roughly 15.7x.

That gap suggests investors are already paying a premium for a recovery that still has execution and macro risks. This raises the chance that any disappointment on earnings or rental growth could hit the share price harder. Is this a quality rerating in progress, or optimism running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hang Lung Properties Narrative

If you see the story differently or want to stress test your own assumptions using the same data, you can build a complete narrative in just a few minutes: Do it your way.

A great starting point for your Hang Lung Properties research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a few high conviction watchlist candidates using our screeners so you are not left chasing the market later.

- Capture high-upside opportunities early by tracking these 3611 penny stocks with strong financials with improving fundamentals before broader market attention arrives.

- Explore opportunities in automation by using these 26 AI penny stocks to identify companies working to turn AI into durable earnings power.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that combine resilient cash flows with yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal