Oxford Industries (OXM) Valuation After Weak Q3, Johnny Was Impairment and Cut Guidance

Oxford Industries (OXM) just delivered a tough third quarter, with flat sales, a much wider loss driven by a roughly $61 million Johnny Was impairment, and sharply lowered guidance that rattled the stock.

See our latest analysis for Oxford Industries.

The market reaction has been brutal, with the share price down roughly 56% year to date and the three year total shareholder return slipping about 60%. However, Friday’s 9% one day share price rebound hints that some investors see capitulation rather than a permanent reset.

If this kind of volatility has you rethinking your watchlist, it could be a good moment to explore other apparel and retail names through fast growing stocks with high insider ownership as potential fresh ideas.

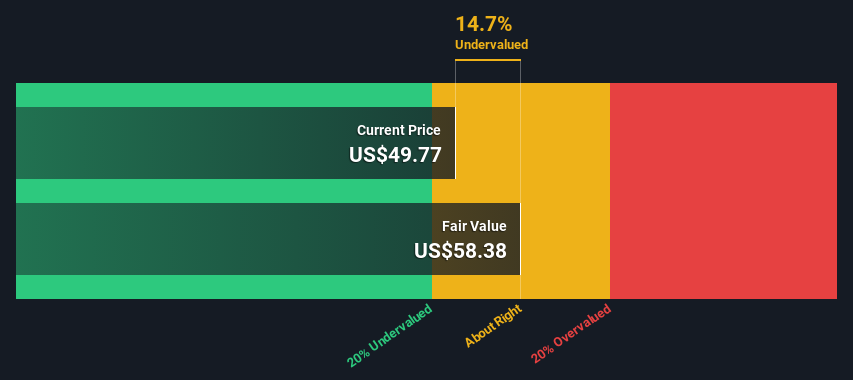

With shares now trading roughly in line with trimmed analyst targets and sentiment deeply negative, the key question becomes whether Oxford Industries is a classic value trap or a contrarian entry point with future growth already priced in.

Most Popular Narrative: 26.3% Undervalued

With Oxford Industries last closing at $34.84 versus a narrative fair value around the mid $40s, the valuation hinges on modest growth and margin compression still supporting today’s price.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.9x on those 2028 earnings, up from 7.5x today. This future PE is lower than the current PE for the US Luxury industry at 19.8x.

Curious why a slower growing, margin pressured business still commands a higher future earnings multiple, yet sits below its implied value today? The narrative rests on a delicate mix of tepid sales growth, shrinking profitability, and a rerating in how the market prices those future profits. Want to see exactly how those assumptions combine to create a higher fair value than the current share price suggests? Read on to unpack the full narrative math behind this setup.

Result: Fair Value of $47.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this setup could easily unravel if weak consumer demand persists and wholesale challenges deepen, forcing heavier promotions that further erode already pressured margins.

Find out about the key risks to this Oxford Industries narrative.

Another View: DCF Flips the Story

While the narrative fair value points to upside, our DCF model paints a starkly different picture, suggesting fair value around $15.54, well below the current $34.84 share price and implying Oxford Industries may be overvalued. Which lens is most appropriate for evaluating a cyclical, fashion driven business?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Oxford Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Oxford Industries Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom Oxford Industries view in just minutes: Do it your way.

A great starting point for your Oxford Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, consider using the Simply Wall St Screener to surface focused, high conviction stock ideas tailored to your strategy.

- Capitalize on beaten down quality by targeting potential bargains among these 908 undervalued stocks based on cash flows that still generate strong cash flows.

- Focus on structural growth shifts by zeroing in on these 26 AI penny stocks positioned to benefit from accelerating adoption of artificial intelligence.

- Strengthen your income stream by pinpointing these 13 dividend stocks with yields > 3% that can potentially support more reliable long term payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal