Unibail-Rodamco-Westfield (ENXTPA:URW): Reassessing Valuation After Major Leadership Changes and Strategy Shift

Unibail-Rodamco-Westfield (ENXTPA:URW) is back in focus after a flurry of boardroom changes, with long time chairman Jean-Marie Tritant stepping down and deal veteran Kathleen Verelst stepping up as Chief Investment Officer.

See our latest analysis for Unibail-Rodamco-Westfield.

Those leadership moves come as investors have already pushed Unibail-Rodamco-Westfield’s share price to €91.4, with a strong year to date share price return of 24.3 percent and a three year total shareholder return of around 100 percent, suggesting momentum is building around the turnaround and capital recycling story.

If you like the idea of repositioning stories and management driven change, this could be a good moment to explore fast growing stocks with high insider ownership.

But after a 100 percent three year return, a richer valuation and fresh leadership promising disciplined capital allocation, is Unibail-Rodamco-Westfield still trading below its true worth? Or is the market already pricing in the next leg of growth?

Most Popular Narrative Narrative: 11.6% Undervalued

With the most followed narrative putting fair value around €103.39 versus a €91.4 close, the current boardroom reset sits against a still supportive valuation backdrop.

The increasing demand for "experience driven" retail and mixed use destinations (integrating entertainment, dining, wellness, offices, and residential) directly benefits URW's premium assets, as shown by outperforming footfall, high pre letting levels, and diversified tenant mixes, underpinning occupancy rates and enabling higher net operating margins.

To see what kind of earnings leap and margin upgrade this story is built on, and which future profit multiple ties it all together, read on.

Result: Fair Value of €103.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher funding costs or delays to planned asset disposals could quickly challenge the bullish margin story that investors are starting to buy into.

Find out about the key risks to this Unibail-Rodamco-Westfield narrative.

Another Lens On Valuation

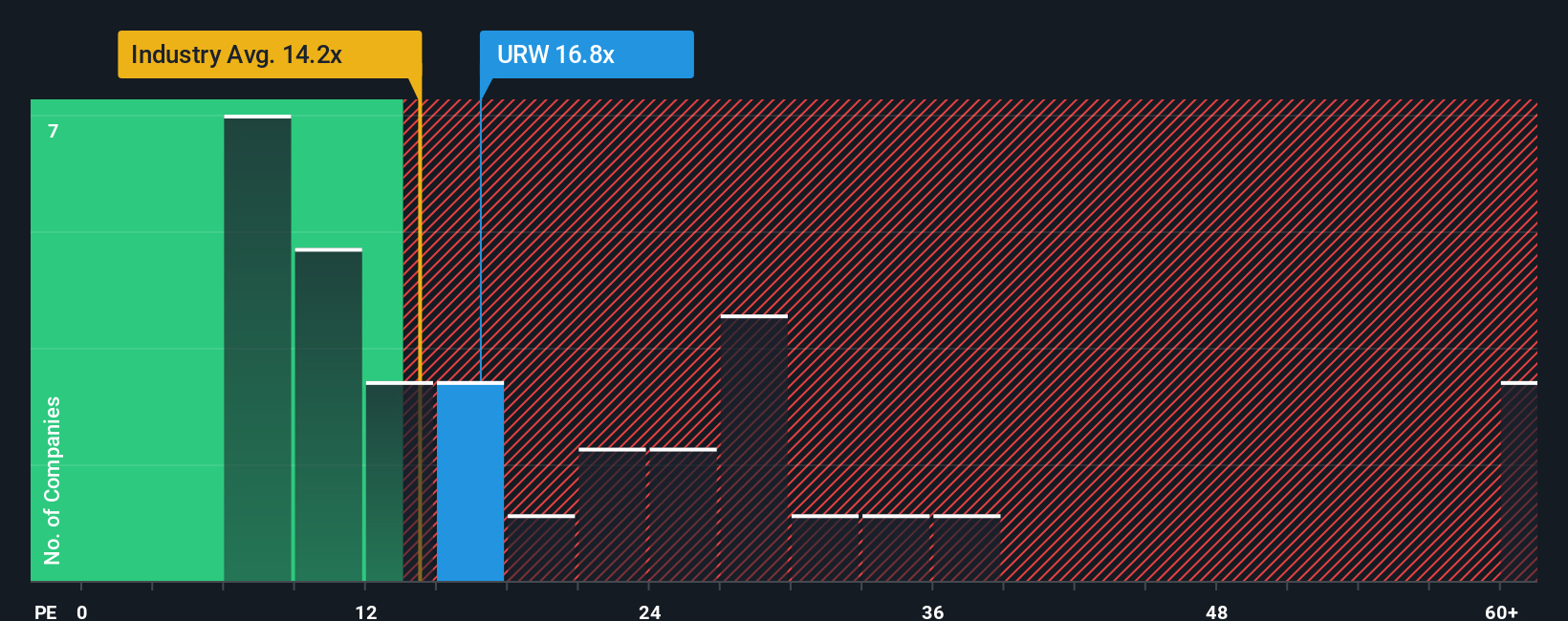

On earnings based metrics, the picture looks less forgiving. URW trades on around 17 times earnings compared with 16 times for the wider European Retail REITs group, while our fair ratio sits nearer 15.1 times. That richer multiple narrows the safety margin, so how much upside is really left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Unibail-Rodamco-Westfield Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just minutes, Do it your way.

A great starting point for your Unibail-Rodamco-Westfield research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Use the momentum from your Unibail-Rodamco-Westfield research and identify your next move with targeted ideas you may want to consider.

- Explore income potential by targeting dependable payers through these 13 dividend stocks with yields > 3% that can support a resilient, yield-focused portfolio.

- Focus on structural trends by positioning around these 30 healthcare AI stocks related to diagnostics, treatment, and data-driven medicine.

- Look for potential mispriced opportunities with these 908 undervalued stocks based on cash flows that flag businesses trading below what their cash flows imply.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal