Novavax (NVAX) Valuation Check as FDA Scrutiny Rises and Activist Pushes for Possible Sale

Novavax (NVAX) is back in the spotlight after a controversial FDA memo signaled tougher vaccine approval standards, just as an activist shareholder ramps up pressure for a potential sale of the company.

See our latest analysis for Novavax.

Those cross-currents help explain why, at a share price of $6.57, Novavax has a weak short term share price return and a deeply negative multi year total shareholder return. This suggests momentum is still fading despite flashes of optimism around milestones and deal news.

If you are weighing Novavax against other vaccine and drug makers, this could also be a good moment to explore opportunities across healthcare stocks and see how different risk reward profiles compare.

With shares down sharply over one, three, and five years but trading at a steep discount to analyst targets, is Novavax now an unloved vaccine player poised for a rebound, or is the market correctly discounting its future growth?

Most Popular Narrative: 49.9% Undervalued

Compared to Novavax's last close at $6.57, the most followed narrative sees almost double that level as fair value, hinging on a radical business-model pivot.

Ongoing cost optimization and the shift to a leaner, partnership-focused operational model (with substantial SG&A reductions and Sanofi absorbing additional costs) position Novavax for improved gross and net margins, supporting an accelerated path to sustained profitability and stronger long-term earnings.

Want to see what kind of shrinking revenues can still justify a richer multiple than many tech names, and why margins matter more than growth here? The key is how earnings, profit share, and a surprisingly punchy future valuation multiple work together in this narrative. Curious which specific profit and discount-rate assumptions make that upside case hang together? Dive in to decode the full playbook behind this fair value call.

Result: Fair Value of $13.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside hinges on partners like Sanofi hitting milestones and COVID-19 demand holding up; both of these factors could easily disappoint.

Find out about the key risks to this Novavax narrative.

Another View: Market Signals vs Narrative Upside

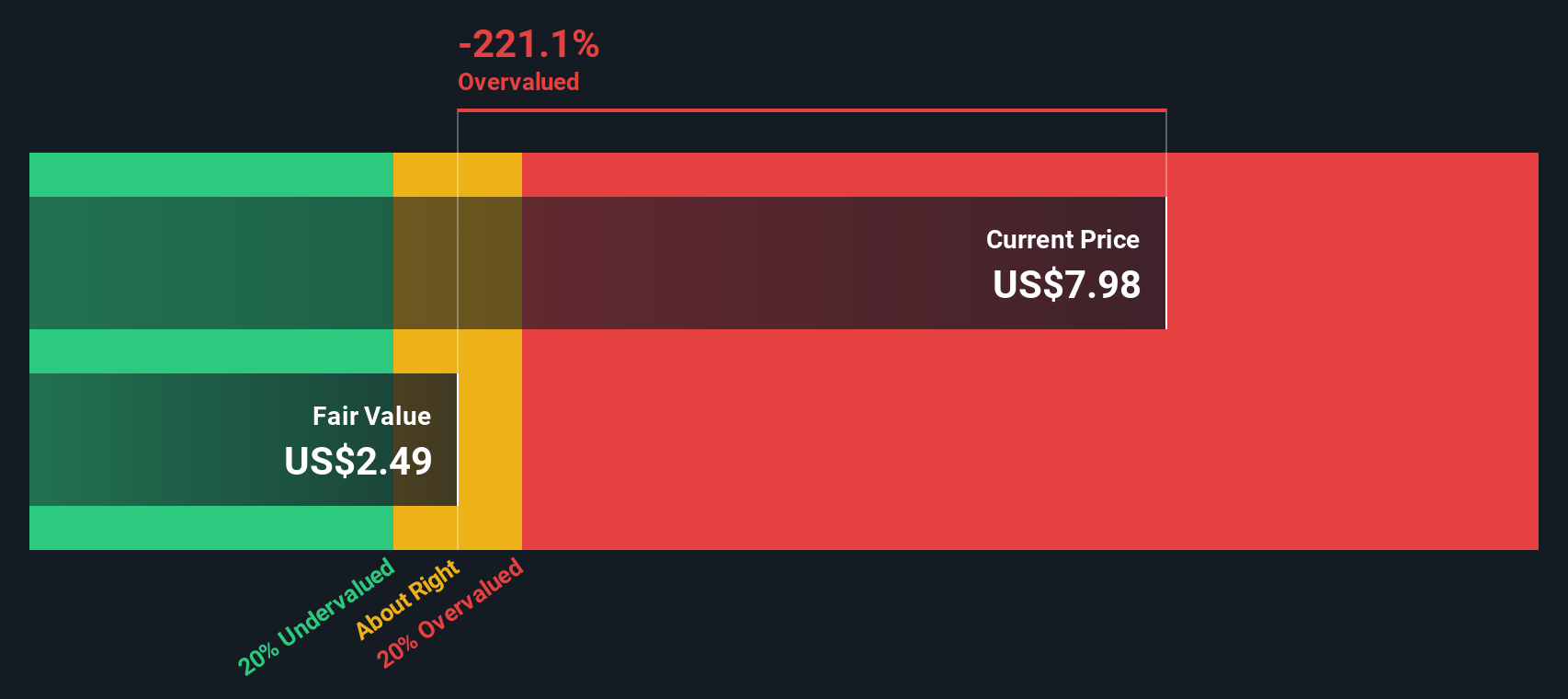

While the narrative based fair value of $13.11 frames Novavax as almost 50% undervalued, our SWS DCF model points the other way, with a fair value of $4.57 and the shares looking overvalued at current levels. Which set of assumptions feels closer to how you see Novavax's future cash flows playing out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Novavax for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Novavax Narrative

If you see Novavax differently or want to stress test your own assumptions using the same tools, you can build a full narrative in minutes: Do it your way.

A great starting point for your Novavax research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investment move?

Do not stop with one stock; use the Simply Wall Street Screener to uncover focused opportunities that match your style and help you stay ahead of the crowd.

- Capture potential high growth momentum by searching for overlooked names among these 3611 penny stocks with strong financials that have solid balance sheets and compelling trajectories.

- Position your portfolio for the next tech wave by targeting innovators powering machine learning and automation with these 26 AI penny stocks before they hit mainstream headlines.

- Seek attractive income streams by scanning these 13 dividend stocks with yields > 3% that combine regular payouts with fundamentals that may appeal to long term investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal