Norsk Hydro (OB:NHY): Reassessing Valuation After Long‑Term Energy Deal for Tomago Smelter

The new Australian and New South Wales government deal to secure long term energy for the Tomago smelter puts a clearer floor under Norsk Hydro (OB:NHY)'s regional earnings and long range decarbonisation roadmap.

See our latest analysis for Norsk Hydro.

That backdrop helps explain why Norsk Hydro's NOK 75.8 share price sits on solid footing, with a 90 day share price return of 12.1 percent and a five year total shareholder return of 148.8 percent. Together, these signal momentum that investors are still willing to pay up for.

If you are weighing where else policy support and structural shifts could drive long term winners, this is a good moment to explore fast growing stocks with high insider ownership.

Yet with Norsk Hydro trading just above analyst targets but still screening as modestly undervalued on intrinsic metrics, investors face a key question: is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative Narrative: 2.2% Overvalued

With Norsk Hydro closing at NOK 75.8 against a narrative fair value near NOK 74.1, the story points to a modest premium that hinges on earnings quality and future cash flow strength.

Fair Value Estimate has risen slightly, from about NOK 72.1 to roughly NOK 74.1 per share, reflecting modestly higher long term earnings expectations.

Future P/E multiple has increased modestly, from roughly 11.0x to about 11.3x, implying a slightly higher valuation being placed on forward earnings.

Curious why flat to declining revenues can still support richer profit margins and a higher earnings multiple, even as discount rates edge up? The narrative leans on a powerful mix of margin rebuild, capital discipline, and selective growth bets to justify that premium. Want to see exactly how those moving parts combine into a single fair value number?

Result: Fair Value of $74.13 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering geopolitical tensions and a fragile demand backdrop in key downstream markets could quickly undermine margins and challenge the current valuation premium.

Find out about the key risks to this Norsk Hydro narrative.

Another Angle on Value

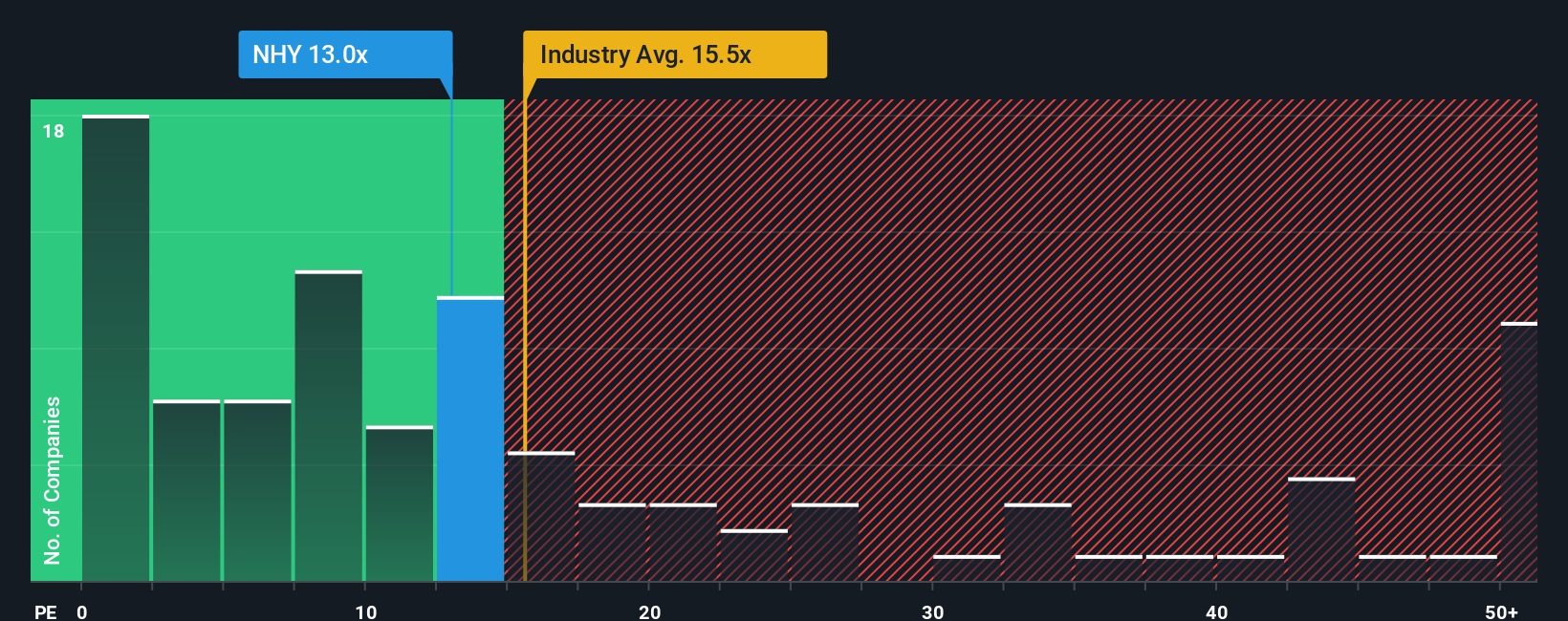

While the narrative model flags Norsk Hydro as about 2 percent overvalued, today’s price of 13.6 times earnings looks cheap next to peers at 18 times and a fair ratio near 21.1 times. If the market leans back toward that fair ratio, who is really early and who is late?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Norsk Hydro Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Norsk Hydro.

Ready for more investment ideas?

Before prices move without you, tap into fresh opportunities across sectors using the Simply Wall St Screener and keep your watchlist filled with high conviction ideas.

- Capture potential turnaround stories early by scanning these 908 undervalued stocks based on cash flows that still trade below their estimated cash flow value.

- Accelerate your growth hunt by targeting these 26 AI penny stocks positioned at the front edge of the artificial intelligence wave.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that can support compounding returns over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal