Is Capital One Still Attractive After Strong 2025 Rally and Discover Deal Ambitions?

- If you are wondering whether Capital One Financial is still a smart buy at these levels, you are not alone. This stock has quietly evolved from a traditional card lender into a diversified financial player that valuation focused investors cannot ignore.

- With the share price around $237.87, the stock is up 3.1% over the last week, 12.7% over the past month, and 33.1% year to date, building on multi year gains of 30.5% over 1 year, 178.1% over 3 years, and 184.2% over 5 years.

- Those moves have come as investors digest Capital One's ongoing push deeper into digital banking and its high profile strategic initiatives that aim to cement its position as a top tier national franchise. At the same time, shifting expectations around interest rates and credit quality have reshaped how the market prices big consumer lenders, and Capital One has been right in the middle of that narrative.

- Despite that backdrop, Capital One only scores 2/6 on our valuation checks, suggesting pockets of undervaluation but also areas where the price may already reflect the good news. Next, we will unpack what different valuation methods say about the stock today and then finish with a way to tie those numbers into the bigger investment story.

Capital One Financial scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Capital One Financial Excess Returns Analysis

The Excess Returns model estimates what Capital One can earn above its cost of equity on each dollar of shareholder capital, then capitalizes those extra earnings into an intrinsic value per share.

For Capital One, the starting point is a Book Value of $170.52 per share, rising to a Stable Book Value of $184.10 per share based on weighted future estimates from 8 analysts. Against this equity base, analysts expect Stable EPS of $22.39 per share, implying an Average Return on Equity of 12.16%.

Crucially, the model compares this expected profitability with a Cost of Equity of $16.02 per share, producing an Excess Return of $6.37 per share. That positive gap suggests Capital One is projected to generate value above what investors require, and that these excess returns can compound as book value grows.

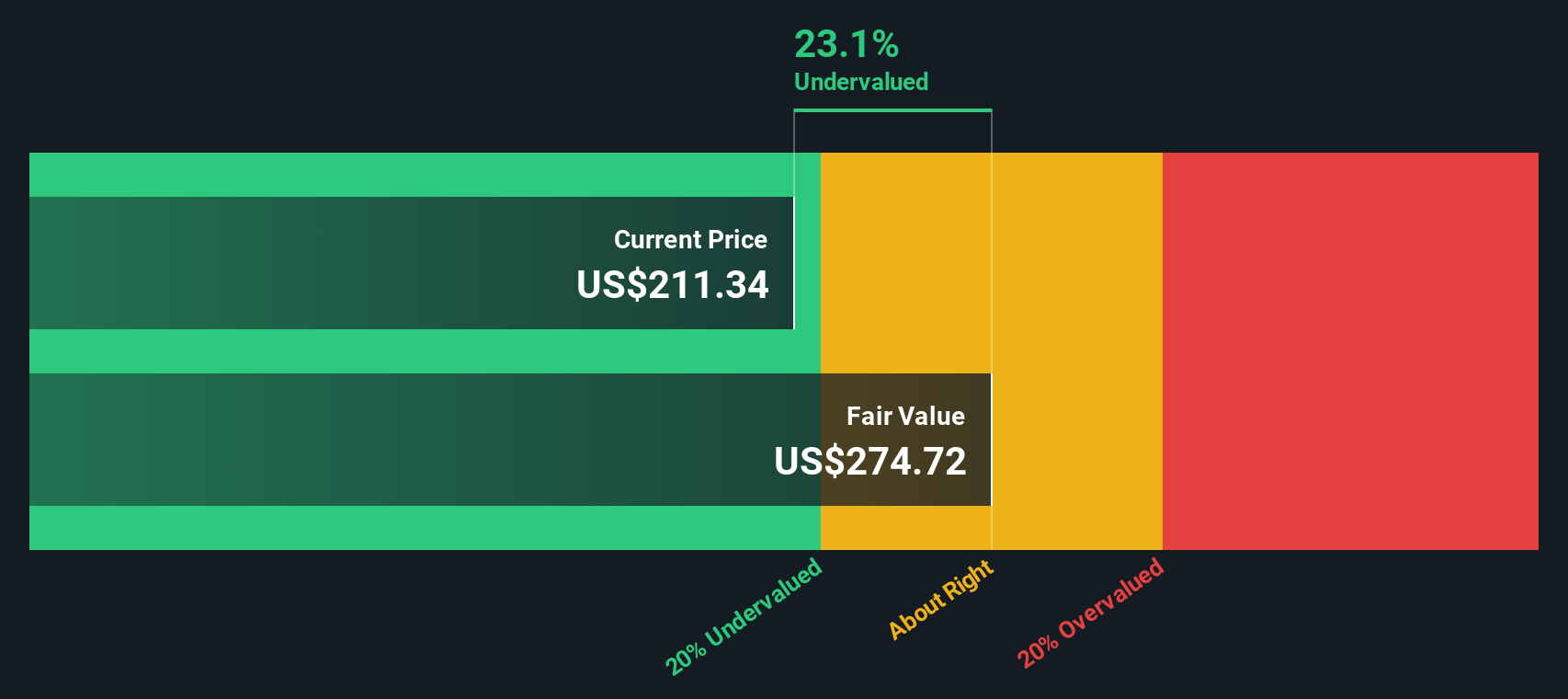

Putting these inputs together, the Excess Returns model arrives at an intrinsic value of roughly $301.10 per share. This implies the stock is about 21.0% undervalued versus the recent price around $237.87.

Result: UNDERVALUED

Our Excess Returns analysis suggests Capital One Financial is undervalued by 21.0%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Capital One Financial Price vs Earnings

For a profitable lender like Capital One, the price to earnings ratio is a useful shorthand for how much investors are willing to pay today for each dollar of current earnings. In general, companies with stronger and more durable growth, and lower perceived risk, often trade on a higher PE ratio. Slower growing or riskier names tend to trade on lower multiples.

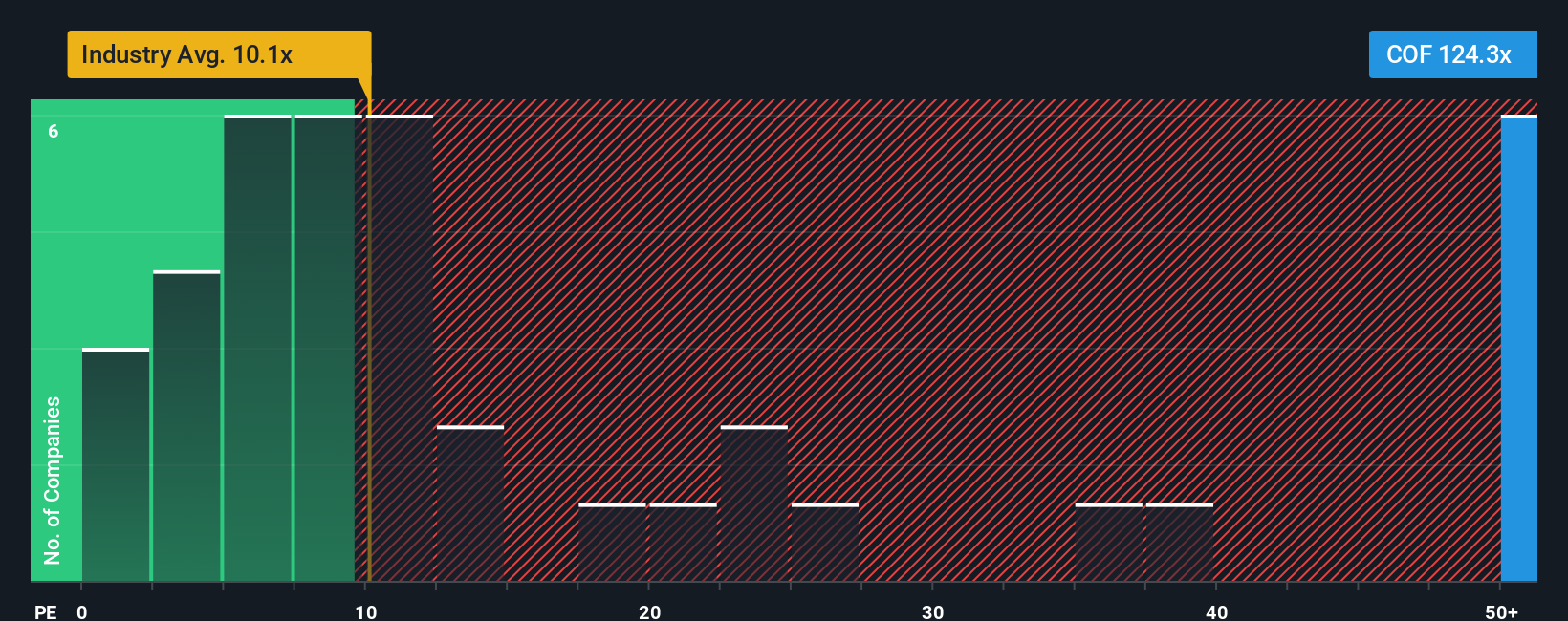

Right now, Capital One trades on a PE of about 131.38x, which sits far above the Consumer Finance industry average of roughly 9.49x and also well ahead of the broader peer group average of 28.57x. To move beyond simple comparisons, Simply Wall St calculates a Fair Ratio, which is the PE multiple the stock should trade at given its earnings growth outlook, profitability, industry, market cap and risk profile. In Capital One's case, that Fair Ratio is estimated at 30.91x, making it a more tailored yardstick than raw peer or sector averages.

Compared with this Fair Ratio, the current 131.38x multiple looks stretched, indicating that the market may be pricing in far more optimism than the fundamentals justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Capital One Financial Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple tool on Simply Wall St's Community page that lets you write the story behind your numbers. It does this by linking your view of Capital One Financial's strategy, growth and risks to a financial forecast and a fair value, then automatically comparing that fair value with the current share price to guide buy or sell decisions. It updates dynamically as new news or earnings arrive. One investor might build a bullish Narrative around the Discover acquisition, strong revenue growth near 32 percent a year and a fair value closer to the higher analyst target of about 265 dollars. Another might focus on integration risks, margin pressure and competition to justify a more cautious Narrative and a fair value nearer 160 dollars, all within an accessible, story driven framework used by millions of investors.

Do you think there's more to the story for Capital One Financial? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal