Assessing Western Union’s Valuation After Its Recent Share Price Rebound

Western Union (WU) has crept higher recently, with the stock up about 2% on the day, 9% over the past week, and roughly 17% in the past 3 months.

See our latest analysis for Western Union.

Even with this recent upswing in the share price, Western Union’s year to date share price return is still slightly negative. The latest momentum therefore looks more like a cautious re rating than a full trend change, especially given the modest 1 year total shareholder return.

If Western Union’s move has you watching the payments space more closely, it could be a good moment to broaden your scope and discover fast growing stocks with high insider ownership.

With earnings drifting and the share price still lagging long term, the key question now is whether Western Union’s lowly valuation reflects genuine structural challenges, or if the market is underestimating its cash generation and future growth potential.

Most Popular Narrative Narrative: 1.9% Overvalued

With Western Union last closing at $9.81 against a narrative fair value of $9.63, the story hinges on modest growth and disciplined capital returns.

The analysts have a consensus price target of $9.318 for Western Union based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $7.0.

Curious how a shrinking profit pool, slow top line expansion and a richer future earnings multiple can still add up to upside from here? The full narrative unpacks the revenue trajectory, margin compression and buyback assumptions driving this finely balanced fair value call.

Result: Fair Value of $9.63 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, escalating regulatory pressure and faster growing digital first rivals could undercut remittance volumes and margins, which may force analysts to rethink today’s finely balanced outlook.

Find out about the key risks to this Western Union narrative.

Another Angle on Valuation

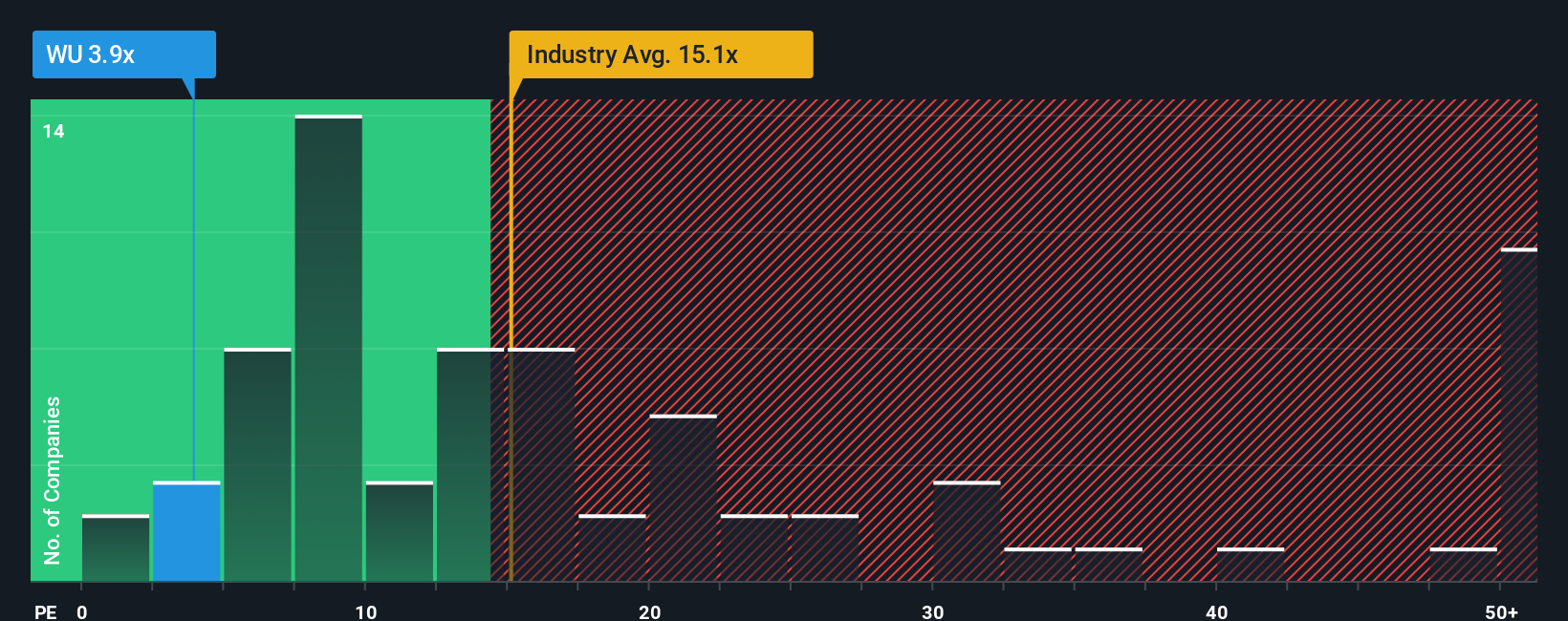

While the narrative fair value suggests Western Union is slightly overvalued, its 4x price to earnings ratio looks deeply discounted versus peers at 14.7x and a fair ratio of 11.4x. If the market edges even partway toward that fair ratio, is today’s caution leaving upside on the table?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Western Union Narrative

If the story here does not quite fit your view, you can dive into the numbers yourself and build a tailored narrative in minutes, Do it your way.

A great starting point for your Western Union research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before the market moves without you, put Simply Wall St’s powerful tools to work and uncover fresh opportunities that match your strategy and risk profile.

- Capture potential mispricings by targeting companies trading below their intrinsic value through these 908 undervalued stocks based on cash flows.

- Position yourself early in transformative technology trends by scanning these 26 AI penny stocks shaping the next wave of innovation.

- Strengthen your income stream with reliable payouts by focusing on these 13 dividend stocks with yields > 3% offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal