East Japan Railway (TSE:9020): Valuation Check After Successful IoT Rail Resilience Trial in Indonesia

East Japan Railway (TSE:9020) just wrapped a seven month IoT field trial in Indonesia, using OKI’s zero energy sensors to remotely monitor rail slopes and reduce disaster related inspection workloads.

See our latest analysis for East Japan Railway.

The project lands at a time when sentiment has already swung firmly in East Japan Railway’s favor. The roughly 45 percent year to date share price return echoes a strong multi year total shareholder return and suggests momentum is still building rather than fading.

If this kind of infrastructure upgrade has you thinking about where else resilience and growth might be hiding, it could be worth exploring auto manufacturers next.

With shares hovering just below analyst targets after a powerful multi year rally, the question now is simple: is East Japan Railway still mispriced as a resilient growth compounder, or is the market already discounting its next leg higher?

Most Popular Narrative: 3% Overvalued

Compared with the latest close of ¥4,006, the most followed fair value estimate of ¥3,890 points to a market that may be running slightly ahead.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥3318.3 billion, earnings will come to ¥298.0 billion, and it would be trading on a PE ratio of 17.6x, assuming you use a discount rate of 8.8%.

Want to see what is baked into those revenue, earnings, and margin assumptions? The whole narrative leans on a profit profile more typical of market leaders rather than mature rail operators. Curious which future growth levers and capital return expectations are doing the heavy lifting in that valuation story?

Result: Fair Value of ¥3,890 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising fixed costs that outpace revenue, along with a growing reliance on one-off real estate gains, could quickly undermine the upbeat margin and valuation story.

Find out about the key risks to this East Japan Railway narrative.

Another Lens on Value

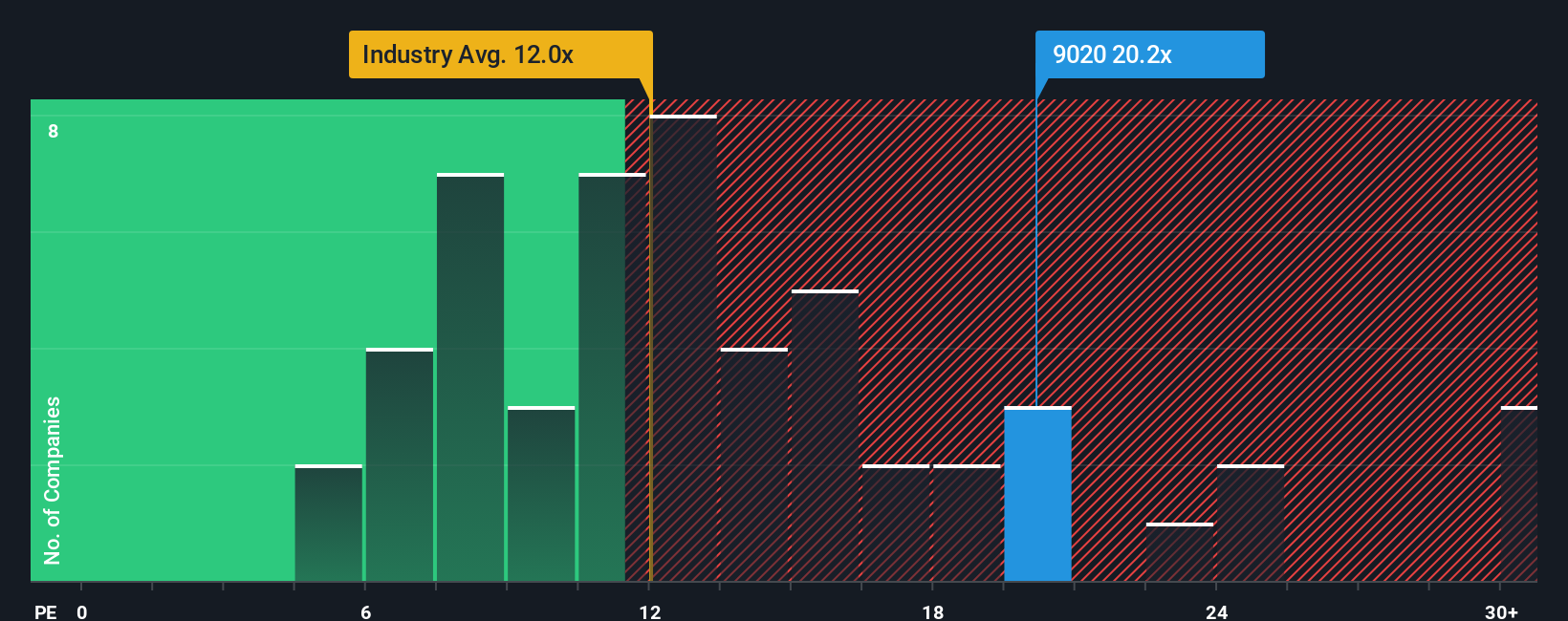

On earnings, East Japan Railway screens as richly priced, with its 19.5x price to earnings ratio sitting well above the JP Transportation average of 11.8x and peer average of 10.9x, even if a fair ratio of 21.8x suggests the market could still stretch further before rebalancing.

That gap cuts both ways: there is potential upside if profits surprise, but real downside if growth or margins slip and the market decides this premium story should trade closer to sector norms. Are you being paid enough for that multiple risk at this stage of the cycle?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own East Japan Railway Narrative

If you see the numbers differently or want to dig into the assumptions yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your East Japan Railway research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, explore your next potential move by scanning fresh opportunities that match your style instead of waiting for the market to surprise you.

- Look for potential mispricings by targeting companies trading below their cash flow value through these 908 undervalued stocks based on cash flows to identify candidates for your watchlist.

- Focus on structural growth themes by screening for cutting edge innovators using these 26 AI penny stocks and explore businesses using intelligent automation.

- Strengthen your portfolio’s income profile with cash distributions via these 13 dividend stocks with yields > 3% and filter for companies with yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal