Has Western Digital’s 259.7% Surge in 2024 Left Room for Further Upside?

- If you are wondering whether Western Digital is still a smart buy after its huge run, or if you have missed the boat, this breakdown will walk through what the current share price really implies.

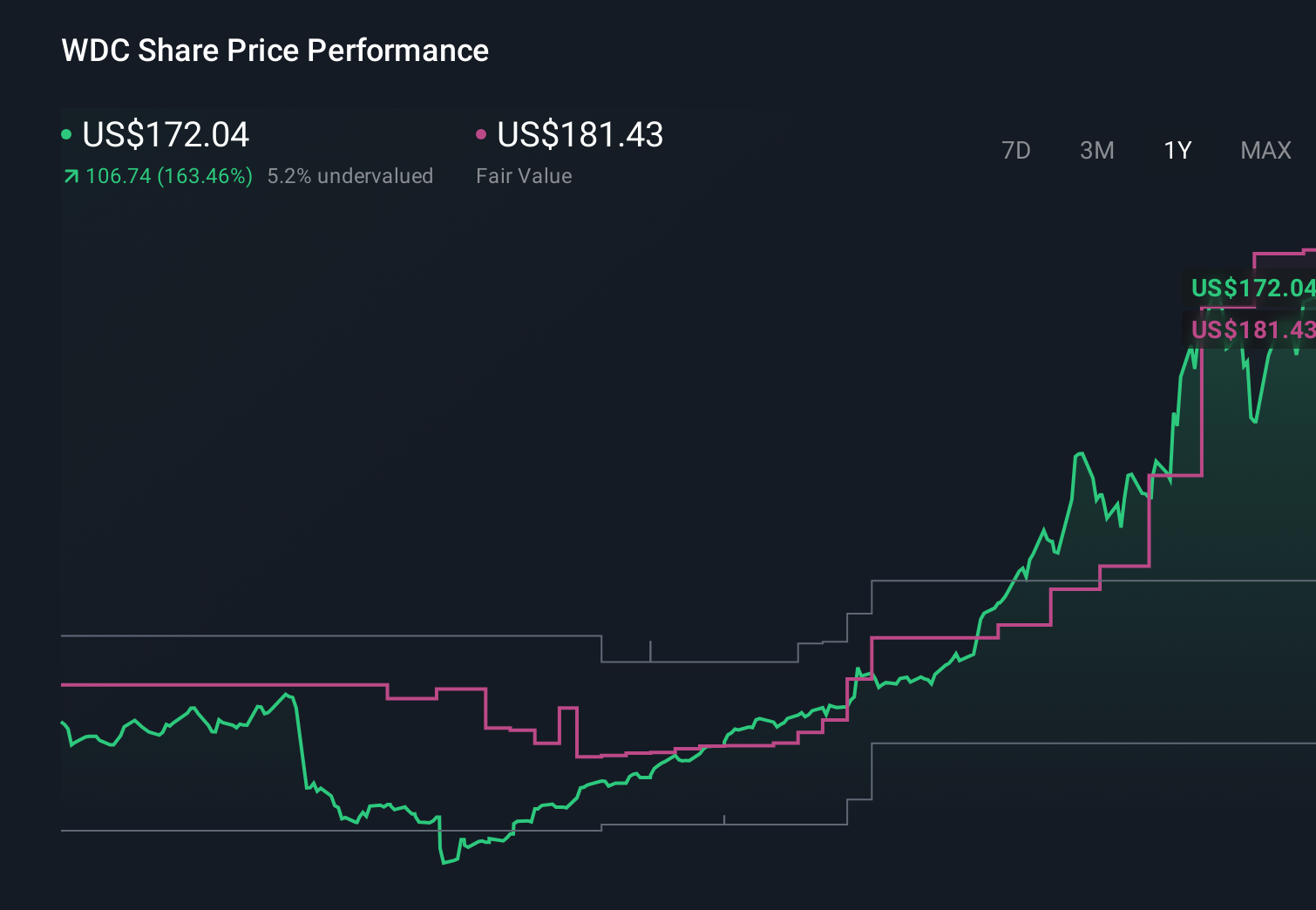

- The stock has been on a tear, climbing 4.4% over the last week, 11.7% over the past month, and an eye catching 185.0% year to date, with a massive 259.7% gain over the last year.

- Those moves have been driven by growing optimism around storage demand for AI data centers and solid state drives, along with ongoing industry capacity discipline that has tightened supply and supported pricing. Investors are also responding to Western Digital's progress on strategic initiatives like separating its flash and HDD businesses, which many see as a potential unlock for further value.

- Even after that surge, Western Digital only scores a 3/6 valuation check score, so we are going to unpack what different valuation approaches say about the stock today and then finish with an even more intuitive way to think about its true worth.

Approach 1: Western Digital Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth today by projecting the cash it can generate in the future and discounting those cash flows back to the present. For Western Digital, the model used is a 2 Stage Free Cash Flow to Equity approach based on cash flow projections.

Western Digital currently generates trailing twelve month Free Cash Flow of about $1.8 billion. Analyst forecasts and subsequent extrapolations suggest this could rise to roughly $4.3 billion by 2030, with a structured path of growing cash flows over the next decade as demand for storage and AI related infrastructure expands.

When these projected cash flows are discounted back, the model estimates an intrinsic value of about $231.49 per share. Compared to the current share price, this implies the stock trades at roughly a 23.8% discount. This suggests that the market may not be fully pricing in the expected improvement in profitability and cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Western Digital is undervalued by 23.8%. Track this in your watchlist or portfolio, or discover 908 more undervalued stocks based on cash flows.

Approach 2: Western Digital Price vs Earnings

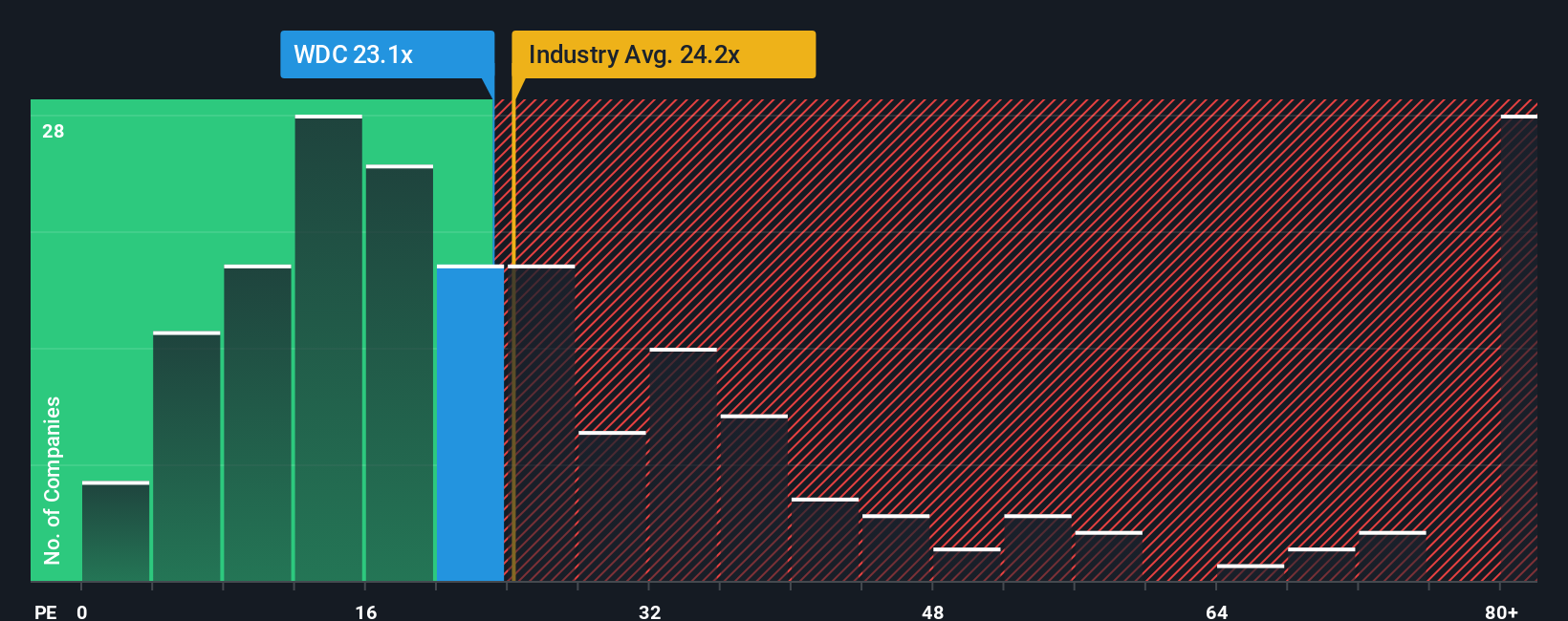

For a company that has moved back into solid profitability, the price to earnings (PE) ratio is a useful yardstick because it links what investors are paying directly to the profits the business is generating today. The higher the expected growth and the lower the perceived risk, the more investors are typically willing to pay in the form of a higher PE multiple.

Western Digital currently trades on a PE of about 23.2x. That is a bit above the broader Tech industry average of roughly 22.7x, and also higher than the peer group average of around 20.4x, which on a simple comparison might suggest the stock is getting a growth premium.

Simply Wall St takes this a step further with its proprietary Fair Ratio, which estimates what a reasonable PE should be once Western Digital’s earnings growth outlook, profit margins, risk profile, industry positioning, and market cap are all factored in. For Western Digital, that Fair Ratio is a much higher 33.6x, implying the current 23.2x multiple does not fully reflect those fundamentals and growth drivers.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Western Digital Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Western Digital’s future with numbers like revenue, earnings, margins, and ultimately a fair value estimate.

A Narrative is your story about a company, captured as a set of assumptions and forecasts that link what you believe is happening in the business and industry to a concrete financial outlook and valuation, rather than relying only on static multiples or one off models.

On Simply Wall St’s Community page, used by millions of investors, Narratives make this process accessible by turning your perspective into a dynamic fair value that can be compared directly to the current share price, helping you decide how Western Digital looks relative to your own criteria.

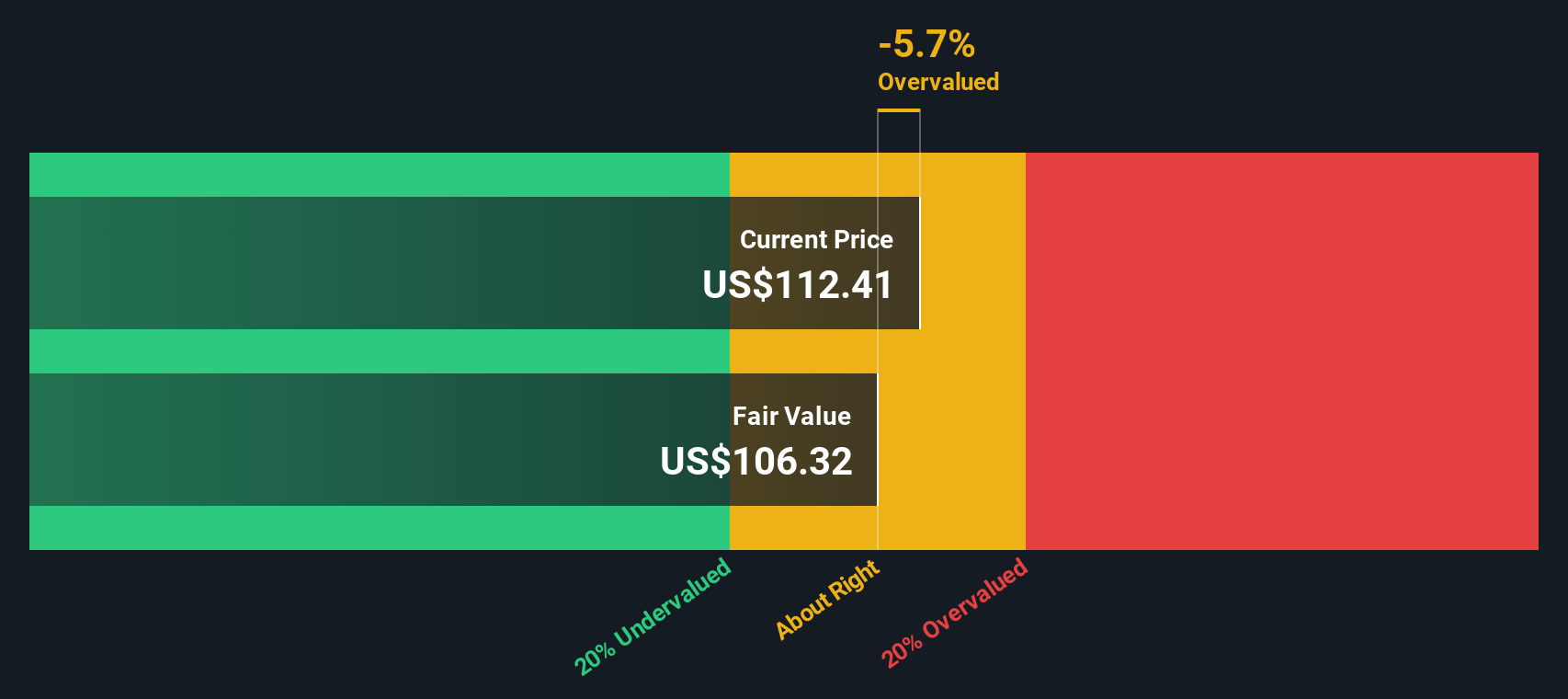

Because Narratives are updated automatically when fresh news, earnings, or guidance is released, your fair value view stays current, and you can see how different investors land anywhere from a cautious scenario closer to $62 per share to a more optimistic view around $110, reflecting genuinely different expectations for AI storage demand, margins, and long term execution.

Do you think there's more to the story for Western Digital? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal