Wall Financial (TSX:WFC) Q3 Net Margin Expansion Reinforces Bullish Valuation Narrative

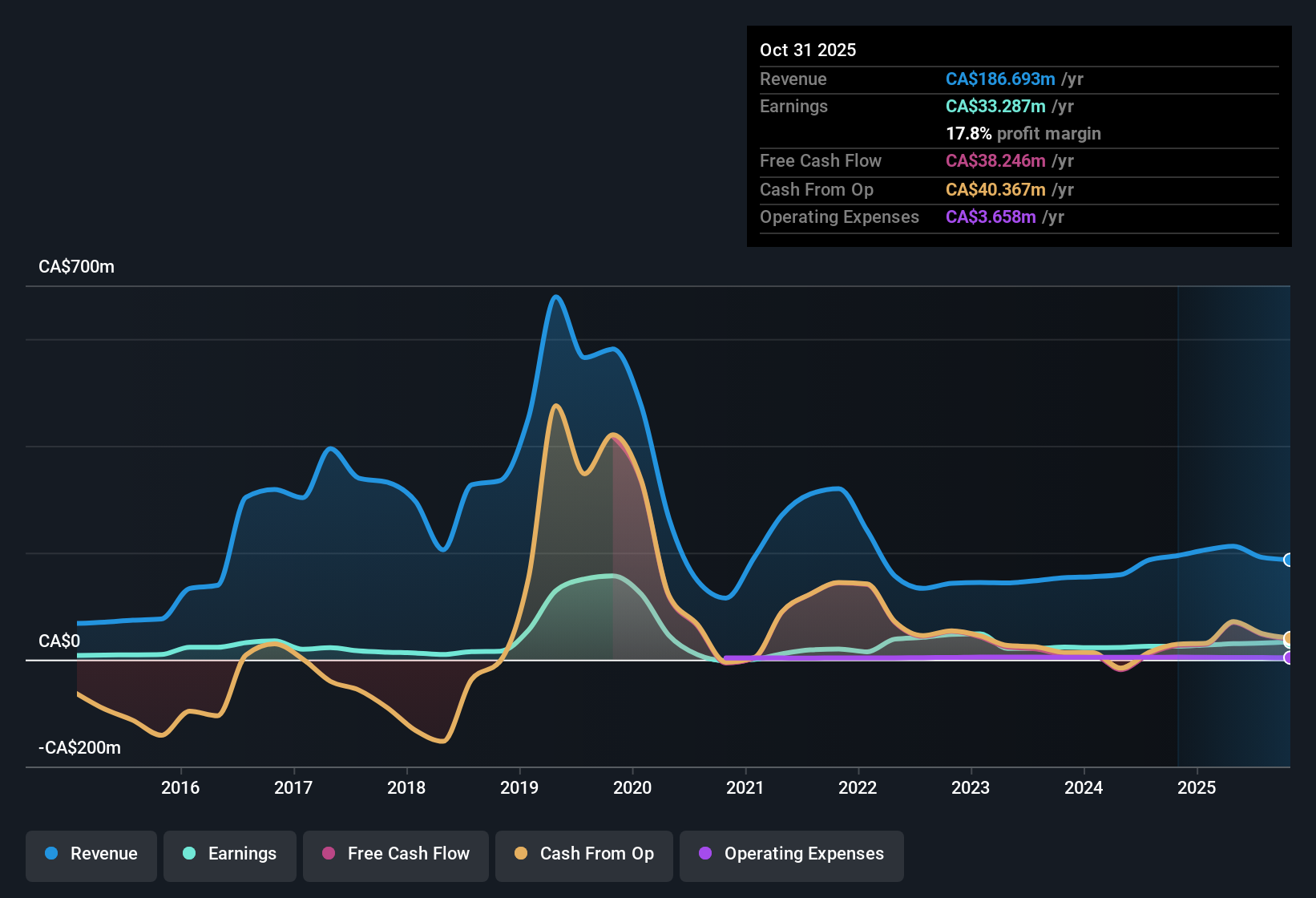

Wall Financial (TSX:WFC) has posted Q3 2026 results showing revenue of about CA$48.9 million and basic EPS of roughly CA$0.37, set against a backdrop of solid trailing 12 month performance that includes basic EPS of about CA$1.04 and net income of roughly CA$33.3 million. Over the last few quarters, the company has seen revenue move from around CA$53.6 million in Q3 2025 to CA$48.9 million in Q3 2026, while quarterly basic EPS has shifted from about CA$0.30 to CA$0.37, with trailing net margins stepping up materially in the same period, giving investors a cleaner, more profitable earnings profile to digest.

See our full analysis for Wall Financial.With the headline numbers on the table, the next step is to see how this improving earnings profile lines up with the most widely held narratives around Wall Financial and where those stories might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Strengthen as Net Profit Climbs to CA$11.9 Million

- Net income in Q3 2026 reached about CA$11.9 million compared with roughly CA$9.6 million in Q3 2025, and trailing 12 month net profit is around CA$33.3 million with margins up to 17.8 percent from 12.8 percent a year earlier.

- What stands out for a bullish view is that profitability is improving faster than revenue, with trailing 12 month earnings up 33.5 percent while total revenue over that same period sits at about CA$186.7 million.

- That faster earnings growth rate versus the five year annualized 15.2 percent suggests the recent period has been unusually strong at converting sales into profit.

- At the same time, the Q3 2026 net income of roughly CA$12.0 million shows the company is maintaining that higher margin profile even as quarterly revenue is lower than the CA$72.5 million peak seen in Q2 2025.

Trailing EPS Near CA$1.04 Supports Cheaper P/E

- Trailing 12 month basic EPS is about CA$1.04 while the stock trades near CA$16.10, implying a P E of roughly 15.5 times that sits slightly below the peer average of 16.2 times and the North American real estate industry average of 15.8 times.

- From a bullish angle, the combination of that P E discount and faster earnings growth than the five year trend supports the idea that the market is not fully crediting the current profitability.

- Consensus style thinking would usually expect a premium multiple when earnings have grown 33.5 percent over the last year and margins have risen to 17.8 percent, yet Wall Financial still trades at a modest discount to peers on this measure.

- Investors comparing this to a DCF fair value of about CA$25.61 per share also see that the current price embeds a wide gap even though trailing EPS and margin trends are pointed in the right direction.

DCF Fair Value Sits Well Above CA$16.10

- The stock price of roughly CA$16.10 is about 37 percent below a DCF fair value estimate of CA$25.61, even as trailing 12 month net income has climbed to around CA$33.3 million and earnings have been growing at 33.5 percent over the last year.

- From a more cautious perspective, critics highlight that this valuation gap exists alongside a flagged weakness in interest coverage, so the discount is not pure upside.

- The analysis notes that interest payments are not well covered by earnings, which means that even with higher net margins of 17.8 percent the capital structure still brings financial risk into the picture.

- That tension between a seemingly attractive discount to DCF fair value and the leverage risk helps explain why the market might be slower to close the roughly CA$9.50 per share gap implied by those figures.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Wall Financial's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Despite stronger margins and attractive valuation signals, Wall Financial’s elevated leverage and weak interest coverage leave its earnings story more fragile than headline growth suggests.

If you want companies where balance sheet strength backs up the earnings narrative, use our solid balance sheet and fundamentals stocks screener (1944 results) today to focus on businesses built to handle financial strain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal