LifeStance Health Group (LFST) Valuation After Strong Earnings Beat and Raised Full‑Year Guidance

LifeStance Health Group (LFST) just posted a standout quarter, with revenue up 16% year over year, beating expectations and prompting management to lift full year guidance above peers, a combination that immediately boosted investor confidence.

See our latest analysis for LifeStance Health Group.

The upbeat earnings report has arrived after a volatile spell, with a 90 day share price return of about 33% starting to rebuild confidence following a weaker year to date and a slightly negative 1 year total shareholder return. Overall momentum now looks to be turning constructive as investors reassess the company’s growth profile and risk backdrop.

If LifeStance’s rebound has your attention, this could be a good moment to compare it with other specialist providers by exploring healthcare stocks for potential opportunities across the sector.

With revenue growth accelerating, guidance moving higher, and the share price already rebounding, the key question now is whether LifeStance remains undervalued or if the market is already pricing in the next phase of its growth.

Most Popular Narrative Narrative: 18% Undervalued

With LifeStance closing at $6.91 against a narrative fair value near the mid eight dollar range, the story hinges on sustained growth and a sharp profitability turn.

The continued and accelerating demand for mental health services in the U.S, driven by increasing public awareness and access to insurance coverage, is expected to expand LifeStance's addressable market and support sustained double digit revenue growth in the coming years.

Curious how double digit growth, rising margins, and a premium future earnings multiple all fit together, this narrative stitches those aggressive assumptions into one cohesive valuation playbook.

Result: Fair Value of $8.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained reimbursement pressure or intensifying digital competition could cap visit growth and margins, quickly undermining the bullish valuation setup.

Find out about the key risks to this LifeStance Health Group narrative.

Another View, Market Pricing Risks

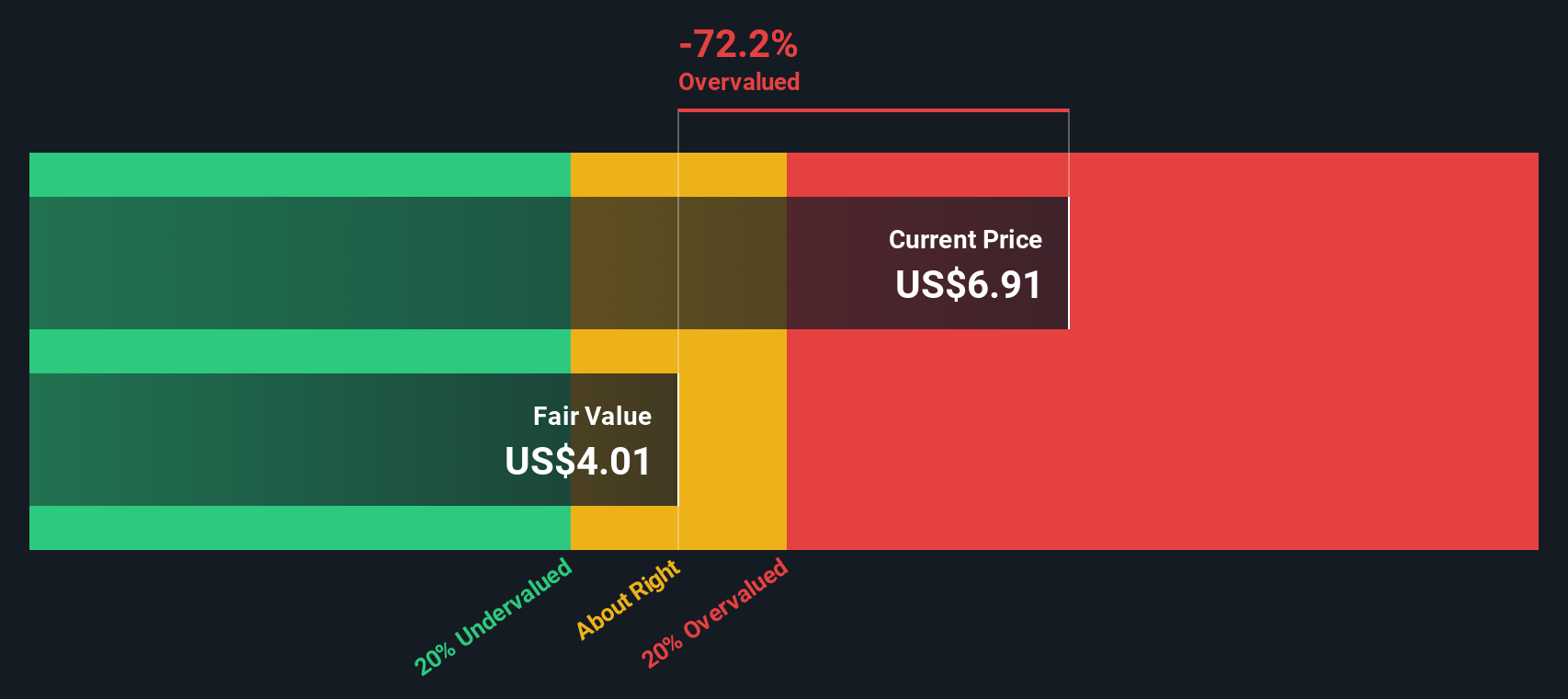

While the narrative pins fair value around the mid eight dollar range, our SWS DCF model paints a cooler picture. On those cash flow assumptions, LFST screens as overvalued at roughly $6.91 versus a fair value closer to $4. That gap raises a simple question: what if growth or margins fall short?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own LifeStance Health Group Narrative

If you see the outlook differently or want to dig into the numbers yourself, you can build a full narrative in just minutes. Do it your way.

A great starting point for your LifeStance Health Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If LifeStance has sparked your interest, do not stop here. The smartest moves often come from comparing it with fresh ideas uncovered through powerful stock screeners.

- Capitalize on potential mispricings by zeroing in on companies trading below their estimated worth through these 908 undervalued stocks based on cash flows that highlight compelling value opportunities.

- Catch high potential innovations early by scanning these 26 AI penny stocks that tap into accelerating breakthroughs and real world adoption of artificial intelligence.

- Strengthen your portfolio income by targeting reliable payers with these 13 dividend stocks with yields > 3% that focus on yields above 3% backed by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal