Sea (NYSE:SE): Assessing Valuation After a 34% Three-Month Share Price Pullback

Sea (NYSE:SE) has quietly slipped about 11% over the past month and roughly 34% in the past 3 months, even as revenue and net income continue to grow at a double digit clip.

See our latest analysis for Sea.

That recent 30 day share price slide sits against a still positive year to date share price return, along with a three year total shareholder return above 130%, suggesting long term believers have been rewarded even as short term momentum cools.

If Sea's pullback has you scanning for the next wave of high growth platforms, this could be a smart moment to explore high growth tech and AI stocks for fresh ideas.

With Sea now trading well below both its recent peak and consensus price target, yet still delivering robust revenue and profit growth, is this pullback a mispricing that rewards patient buyers or is the market already discounting its future expansion?

Most Popular Narrative Narrative: 34.9% Undervalued

With Sea closing at $125.02 against a narrative fair value near $192, the spread points to upbeat expectations around scaling margins and sustained top line growth.

Analysts are assuming Sea's revenue will grow by 19.7% annually over the next 3 years.

Analysts assume that profit margins will increase from 6.2% today to 14.0% in 3 years time.

If you are curious what kind of revenue runway and margin expansion could justify that change in value, especially with a richer future earnings multiple included, you can review the full narrative to see the financial blueprint behind this call.

Result: Fair Value of $192.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in e commerce and rising credit risk in its fintech loan book could quickly challenge the upbeat growth and margin narrative.

Find out about the key risks to this Sea narrative.

Another Angle on Valuation

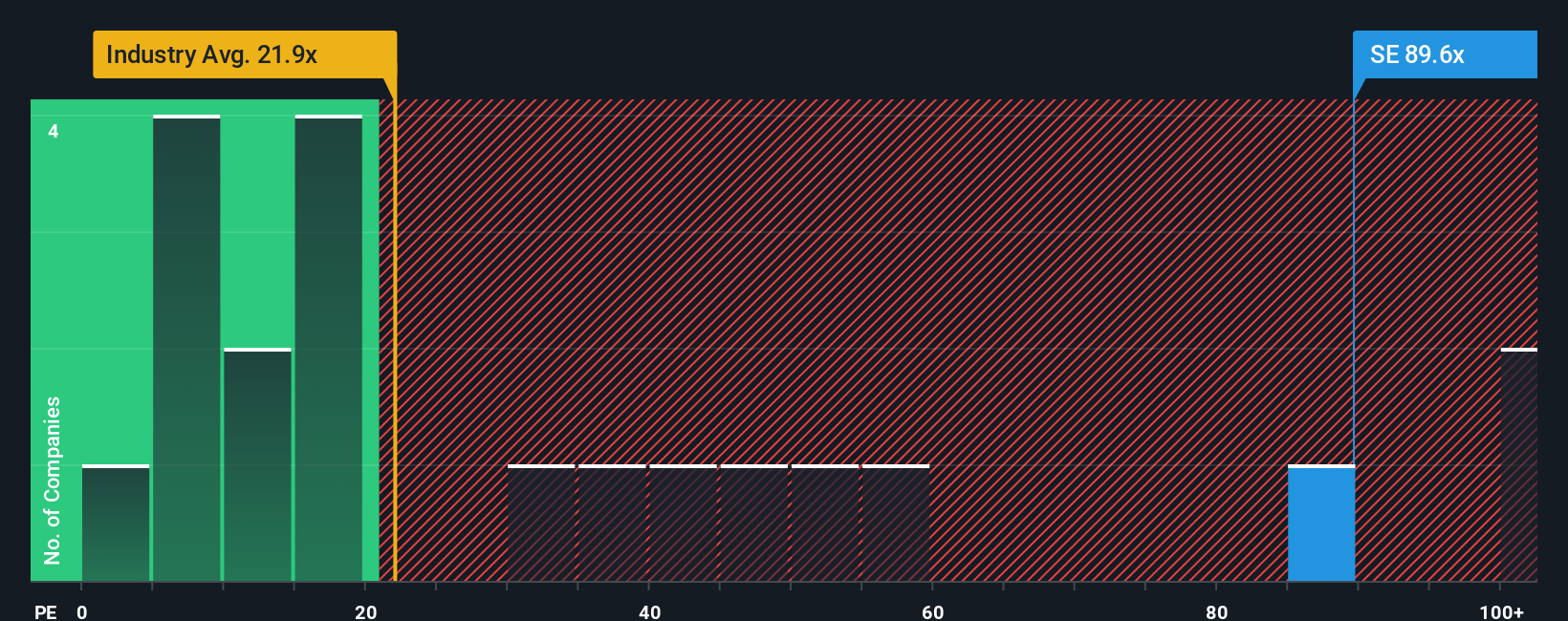

While the narrative fair value suggests Sea is 34.9% undervalued, its current price looks stretched when you focus on earnings. The stock trades on a 52.2x P/E, richer than both peers at 49.1x and the global Multiline Retail industry at 19.7x, and well above a 36.8x fair ratio our models point to. That gap hints at real downside risk if sentiment cools, even if growth stays on track, so how much premium are you comfortable paying for Sea's story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sea Narrative

If you see the numbers differently or want to stress test your own thesis, you can craft a full narrative in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Sea.

Ready for your next investing edge?

If Sea has your attention, do not stop here. Your next investing idea could be hiding in plain sight among other focused opportunities on Simply Wall Street.

- Capture asymmetric upside by scanning these 3611 penny stocks with strong financials where small shifts in execution can translate into outsized returns for early, selective investors.

- Position yourself at the intersection of innovation and profitability through these 30 healthcare AI stocks pairing medical breakthroughs with intelligent automation and real revenue traction.

- Explore income potential with these 13 dividend stocks with yields > 3% and uncover companies offering attractive yields backed by sustainable cash flows, not just headline percentages.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal