Sectra (OM:SECT B) Q2 2026: Margin‑Driven EPS Jump Reinforces Bullish Profitability Narrative

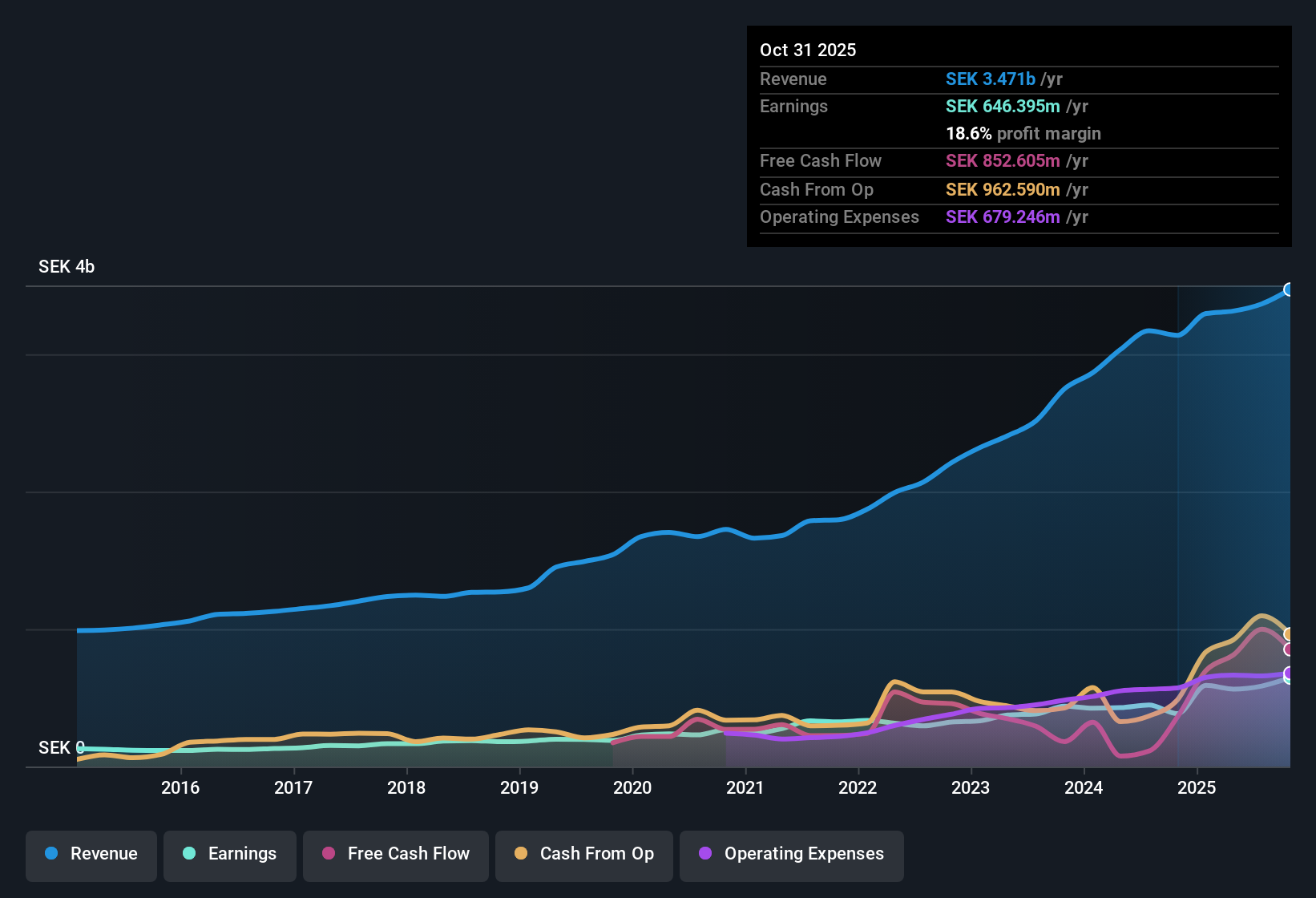

Sectra (OM:SECT B) has turned in a solid Q2 2026 print, posting revenue of SEK878 million and EPS of SEK0.77 as the latest chapter in a year where trailing twelve month revenue reached about SEK3.5 billion and EPS came in at roughly SEK3.35. The company has seen quarterly revenue move from SEK773 million in Q2 2025 to SEK878 million in Q2 2026, while EPS stepped up from SEK0.46 to SEK0.77 over the same period, pointing to healthier earnings power flowing through to the bottom line as margins do more of the heavy lifting.

See our full analysis for Sectra.With the numbers on the table, the next step is to see how this mix of revenue, EPS and margin trends lines up with the big narratives investors have been trading on over the past year.

See what the community is saying about Sectra

Margins Strengthen as Net Profit Climbs to SEK148 Million

- Net income excluding extra items increased to SEK148.4 million in Q2 2026 from SEK87.8 million in Q2 2025, while trailing twelve month net income reached SEK646.4 million with a net margin of 18.6 percent versus 12.3 percent a year earlier.

- Consensus narrative leans bullish on profitability improving as Sectra shifts more business to cloud and as-a-service models, and the margin uplift in the data gives that view some real backing.

- Trailing twelve month EPS moved from SEK1.99 to SEK3.35 over the last year, which lines up with the idea that higher recurring revenue and strong customer retention can support more profitable growth.

- At the same time, the note that large deployments can strain operating costs is not disproved here, because quarterly net income still fluctuates from SEK102.8 million in Q1 2026 to SEK148.4 million in Q2 2026 rather than moving in a straight line.

68 Percent Earnings Growth Meets SaaS Growing Pains

- Earnings over the last 12 months grew 68.1 percent year on year with a five year earnings growth rate of 17.1 percent per year, and trailing twelve month revenue reached about SEK3.5 billion compared with SEK3.1 billion a year earlier.

- What stands out against the more cautious parts of the consensus narrative is that strong recent growth is coming through even while the business is managing the friction of moving from hardware to software-as-a-service and relying on some big orders.

- Revenue over the last six reported quarters rose from SEK736.8 million in Q1 2025 to SEK878.2 million in Q2 2026, which suggests that the decline in nonrecurring hardware and the lumpiness from large contracts have not stopped the top line from rising overall.

- On the other hand, the spike in quarterly EPS to SEK1.37 in Q3 2025 versus SEK0.77 in Q2 2026 shows how one off items like patent related boosts or large implementations can still make the path of reported growth bumpy, just as the narrative warns.

Premium P E Relies on Future Growth Delivering

- The stock trades on a trailing P E of 79.2 times, well above the Global Healthcare Services industry average of 32.8 times and a peer average of 56.1 times, and also sits above the DCF fair value of SEK157.25 compared with the current share price of SEK265.60.

- Consensus narrative argues that steady double digit growth and firmer margins can justify a rich multiple, but the numbers in the analysis show that a lot of that optimism is already embedded in the valuation.

- Forecast revenue and earnings growth of roughly 13.9 percent and 13.7 percent per year are solid, yet they are being capitalized at more than double the industry P E, which leaves less room for disappointment if those growth rates slow.

- The fact that the share price is above the DCF fair value estimate of SEK157.25 means anyone buying at SEK265.60 is effectively betting that Sectra will either grow faster or stay more profitable than the current model assumes, rather than getting in at a clear discount.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sectra on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

If you see the numbers from a different angle and want to put your own spin on the story, you can shape a full narrative in minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sectra.

See What Else Is Out There

Sectra’s premium valuation, lumpy quarterly earnings and reliance on big contracts mean investors carry meaningful execution risk and limited room for disappointment.

If you want strong growth prospects without paying such a rich multiple, use our these 904 undervalued stocks based on cash flows now to uncover companies where the upside still outweighs the expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal