Cal-Maine Foods (CALM): Valuation Check After Record Profits in a Challenging Egg Market

Cal Maine Foods (CALM) is back in the spotlight after delivering record profits in a tough egg market, and that strength is drawing fresh attention to the stock.

See our latest analysis for Cal-Maine Foods.

The stock has cooled off after its earnings pop, with a roughly 20% 3 month share price pullback and 1 year total shareholder return of about minus 12%. However, longer term returns above 200% over 5 years suggest momentum is moderating, not broken.

If Cal Maine’s run has you rethinking your watchlist, this could be a smart moment to explore fast growing stocks with high insider ownership for other high conviction ideas.

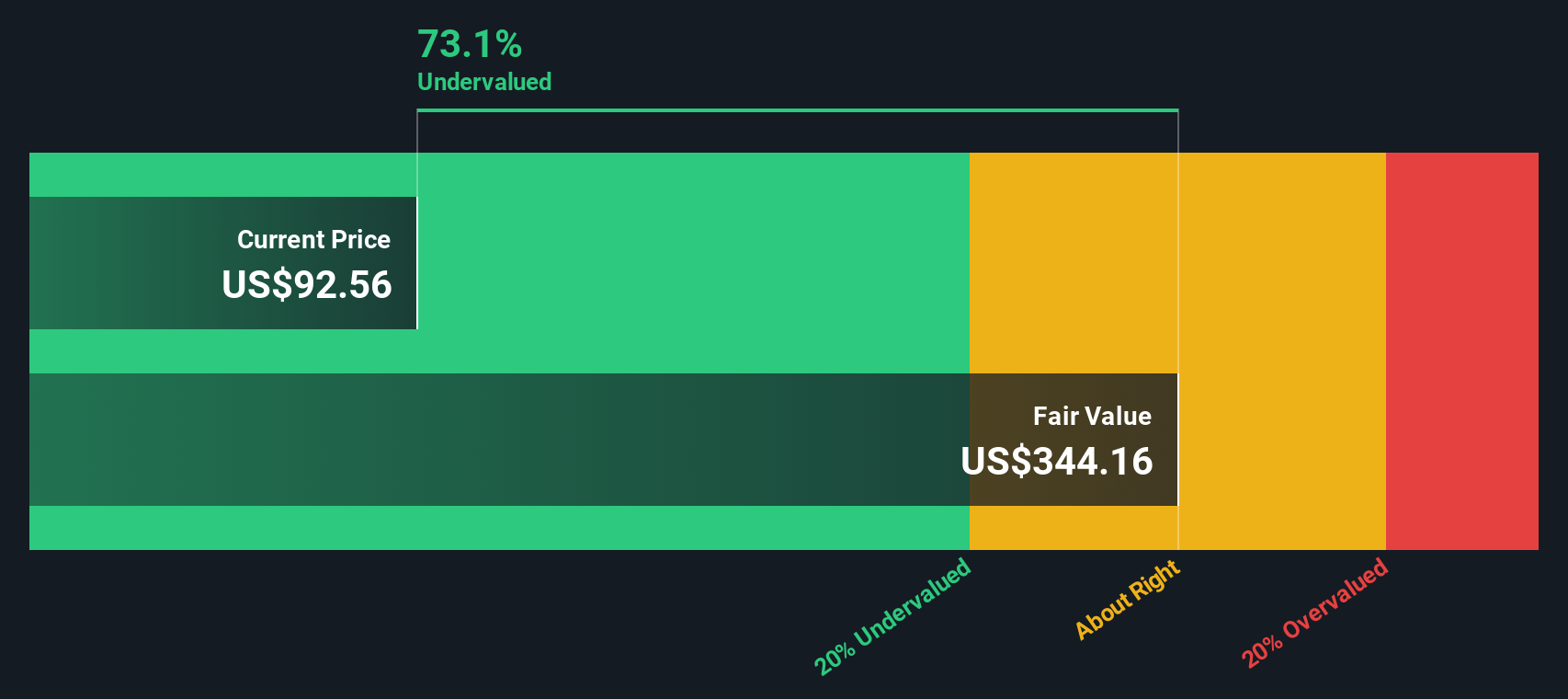

With profits at record highs but revenue and earnings growth decelerating, and the share price still trading at a modest discount to analyst targets, investors face a key question: is this a buying opportunity, or is the market already pricing in future growth?

Price to Earnings of 3.3x: Is It Justified?

On a price to earnings basis, Cal Maine Foods looks deeply discounted, with a 3.3x multiple at a last close of $86.89 versus far richer peer valuations.

The price to earnings ratio compares what investors pay today for each dollar of current earnings, and for a profitable, mature food producer it is a key yardstick. At just 3.3x earnings, while profits have grown rapidly and margins recently expanded, the market appears to be heavily discounting the durability of those earnings.

Relative to the broader US food industry, where average price to earnings multiples sit around 20x, Cal Maine Foods is trading at a fraction of sector norms. It is also roughly in line with its own estimated fair price to earnings ratio of 3.4x, a level our analysis suggests the market could reasonably move toward if investors gain confidence in the company’s earnings power.

Explore the SWS fair ratio for Cal-Maine Foods

Result: Price-to-Earnings of 3.3x (UNDERVALUED)

However, egg prices are notoriously cyclical, and with annual revenue and net income both declining, any sustained margin pressure could quickly erode today’s low valuation case.

Find out about the key risks to this Cal-Maine Foods narrative.

Another Way to Look at Value

Our DCF model paints a far more aggressive picture, putting fair value near $277.36 per share, around 69% above the current $86.89 price. If cash flows normalize rather than collapse, is the market underestimating the long term earnings power here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cal-Maine Foods for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cal-Maine Foods Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Cal-Maine Foods research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before the market’s next shift leaves you behind, use the Simply Wall St Screener to uncover focused opportunities that match your strategy and sharpen your edge.

- Capture high-upside potential by targeting beaten down opportunities through these 904 undervalued stocks based on cash flows that still boast strong cash flow support.

- Position yourself ahead of the next computing revolution by checking out these 27 quantum computing stocks as they push boundaries in processing power and innovation.

- Lock in income focused opportunities by scanning these 13 dividend stocks with yields > 3% that can help strengthen your portfolio’s cash return profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal