Eos Energy Enterprises (EOSE): Valuation Check as Tax Credit Rush and Restructuring Drive Volatile Rally

Eos Energy Enterprises (EOSE) jumped after traders latched onto a powerful one-two setup: a looming December 31 clean energy tax credit deadline and the company’s ongoing financial restructuring to shore up liquidity.

See our latest analysis for Eos Energy Enterprises.

The stock is still giving back part of a sharp multi month rally, with a recent 30 day share price return of minus 14.07 percent, but a powerful 90 day share price return of 80.98 percent and 1 year total shareholder return of 336.47 percent, suggesting momentum is cooling rather than collapsing.

If this kind of volatility has your attention, it could be a good moment to broaden your watchlist and scout fast growing stocks with high insider ownership for other fast moving opportunities.

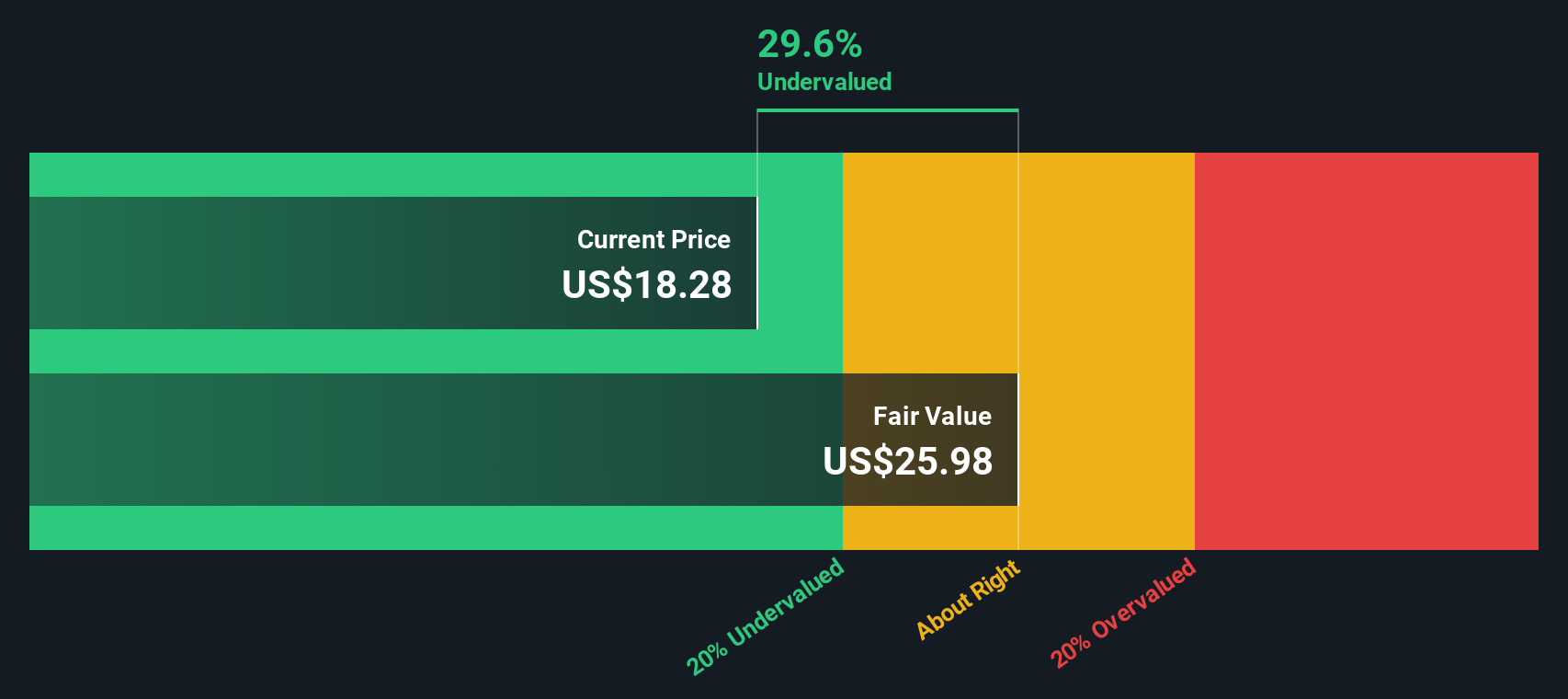

With shares still trading at a modest discount to analyst targets despite explosive revenue growth, but deep losses and heavy cash burn, is Eos Energy a misunderstood bargain, or is the market already pricing in years of future expansion?

Most Popular Narrative Narrative: 9.7% Undervalued

Compared with the latest close of $14.84, the most widely followed narrative pegs Eos Energy’s fair value a little higher, implying modest upside if its aggressive growth path plays out.

Recent U.S. climate legislation (e.g., the Big Beautiful Bill and production tax credits) and incentives for domestic content are increasing the competitiveness of Eos's American-made solutions, enabling the company to benefit from federal support and potentially higher margins and order volume versus offshore competitors.

Curious how this policy tailwind turns into a richer valuation story? The narrative leans on breakneck revenue expansion, margin transformation, and a future earnings multiple more often reserved for mature industry leaders. Want to see the bold forecasts behind that jump from deep losses to substantial profits, and how they roll up into today’s fair value estimate?

Result: Fair Value of $16.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps on scaling production or any setback around financial transparency could quickly challenge the bullish growth and valuation narrative around Eos Energy.

Find out about the key risks to this Eos Energy Enterprises narrative.

Another Take on Value

Our DCF model paints a less generous picture, putting fair value nearer $9.92, which makes today’s $14.84 share price look overvalued rather than cheap. If the story really plays out as the growth narrative suggests, is the market already paying tomorrow’s price today?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eos Energy Enterprises for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eos Energy Enterprises Narrative

If you see the story differently or would rather lean on your own due diligence, you can build a complete narrative in just minutes: Do it your way.

A great starting point for your Eos Energy Enterprises research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to stay ahead of the next big move, put the Simply Wall St Screener to work and uncover stocks that fit your strategy before everyone else does.

- Target growth potential by scanning these 26 AI penny stocks that could ride the next wave of intelligent automation and data driven disruption.

- Lock in income opportunities with these 13 dividend stocks with yields > 3% that aim to keep cash flowing into your portfolio year after year.

- Position for bold upside by reviewing these 80 cryptocurrency and blockchain stocks shaping the future of digital finance and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal