Deere (DE) Valuation Check After Trump Pricing Pressure and Softer Profitability Guidance

Deere (DE) just got hit from two directions at once: a softer earnings outlook and public pressure from President Donald Trump to cut equipment prices, and the stock has been feeling that squeeze.

See our latest analysis for Deere.

Even with the recent pullback after the earnings update and political pressure, Deere’s 15.93% year to date share price return and 11.62% one year total shareholder return suggest momentum is still broadly positive, supported by ongoing dividend payments and fresh boardroom experience from Cargill’s CEO.

If Deere’s mix of machinery, policy noise, and long term value creation has you reassessing your playbook, it could be worth exploring fast growing stocks with high insider ownership for other potential standouts.

With earnings guidance softening, political heat on pricing, and a still double digit intrinsic discount to fair value, is Deere now trading below its true potential, or are investors already paying up for its next leg of growth?

Most Popular Narrative Narrative: 7.7% Undervalued

With Deere last closing at $484.80 against a most popular narrative fair value near $525, the story leans toward upside driven by future earnings power.

Analysts expect earnings to reach $8.6 billion (and earnings per share of $33.21) by about September 2028, up from $5.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $9.8 billion in earnings, and the most bearish expecting $5.9 billion.

Curious how flat revenues, rising profit margins, and a lower forward earnings multiple can still support a higher fair value than today’s price? The narrative connects those moving parts into one tight valuation case that is anything but obvious on the surface.

Result: Fair Value of $525.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising tariffs and a deeper, longer agricultural downturn could easily erode margins and delay the earnings recovery implied in today’s valuation.

Find out about the key risks to this Deere narrative.

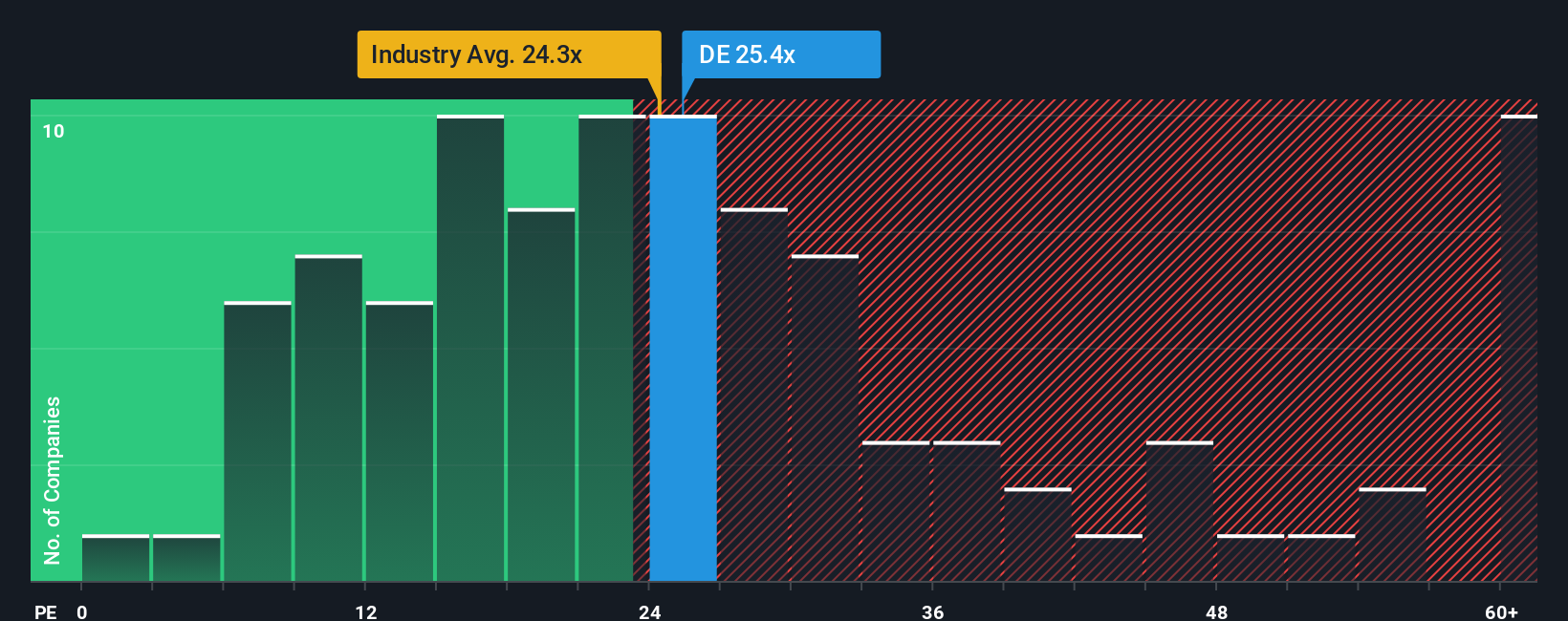

Another Angle on Value: What the P E Says

While the narrative fair value suggests upside, Deere’s 26.1x P E sits slightly above both the US Machinery industry at 26x and peers at 23.7x, yet below its 34.5x fair ratio. That mix hints at both rerating potential and downside risk if sentiment sours. Which of those factors matters more to you?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Deere Narrative

If you see Deere’s story differently or want to test your own assumptions against the numbers, you can build a custom narrative in minutes, Do it your way.

A great starting point for your Deere research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity, head into the Simply Wall St Screener now and uncover fresh ideas before other investors crowd into the most promising trends.

- Catch powerful potential reratings early by scanning these 903 undervalued stocks based on cash flows that still trade below what their cash flows suggest they are worth.

- Capitalize on the AI wave by zeroing in on these 26 AI penny stocks that pair innovation with compelling growth trajectories.

- Strengthen your income strategy by targeting these 13 dividend stocks with yields > 3% that can keep paying you while markets shift around them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal