Will Thales' New AI Security Fabric Redefine Its Cybersecurity Edge and Broader Story (ENXTPA:HO)?

- Earlier this week, Thales launched its AI Security Fabric, introducing runtime protections for agentic AI, LLM-powered applications, enterprise data, and identities against threats such as prompt injection, data leakage, model manipulation, and insecure RAG pipelines.

- This move positions Thales as an early provider of end-to-end security for enterprise AI ecosystems, with further enhancements planned in 2026 to deepen its AI-focused cybersecurity offering.

- We’ll now examine how this new AI Security Fabric, especially its runtime protection for LLM-based applications, could reshape Thales’ investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Thales Investment Narrative Recap

To own Thales, you need to believe it can turn its broad defense, aerospace, and cyber footprint into durable earnings growth while managing integration and restructuring pressures. The AI Security Fabric launch supports the Cyber & Digital rebound narrative in the near term, but does not fundamentally change the key short term catalyst of restoring organic growth in that division or the execution risk if digital initiatives underperform.

Among recent announcements, the integration of Imperva’s data protection with Thales’ CipherTrust platform via Data Risk Intelligence is especially relevant, as it reinforces Thales’ push into higher value cybersecurity and secure data services. Paired with the new AI Security Fabric, this strengthens the argument that Thales can deepen its role in securing complex data and AI workloads, a capability that underpins expectations for higher quality, more recurring earnings in Cyber & Digital over time.

However, investors should also consider whether execution missteps in Cyber & Digital could limit the benefits of these AI security launches and...

Read the full narrative on Thales (it's free!)

Thales' narrative projects €26.5 billion revenue and €2.2 billion earnings by 2028. This requires 7.5% yearly revenue growth and about a €1.2 billion earnings increase from €1.0 billion today.

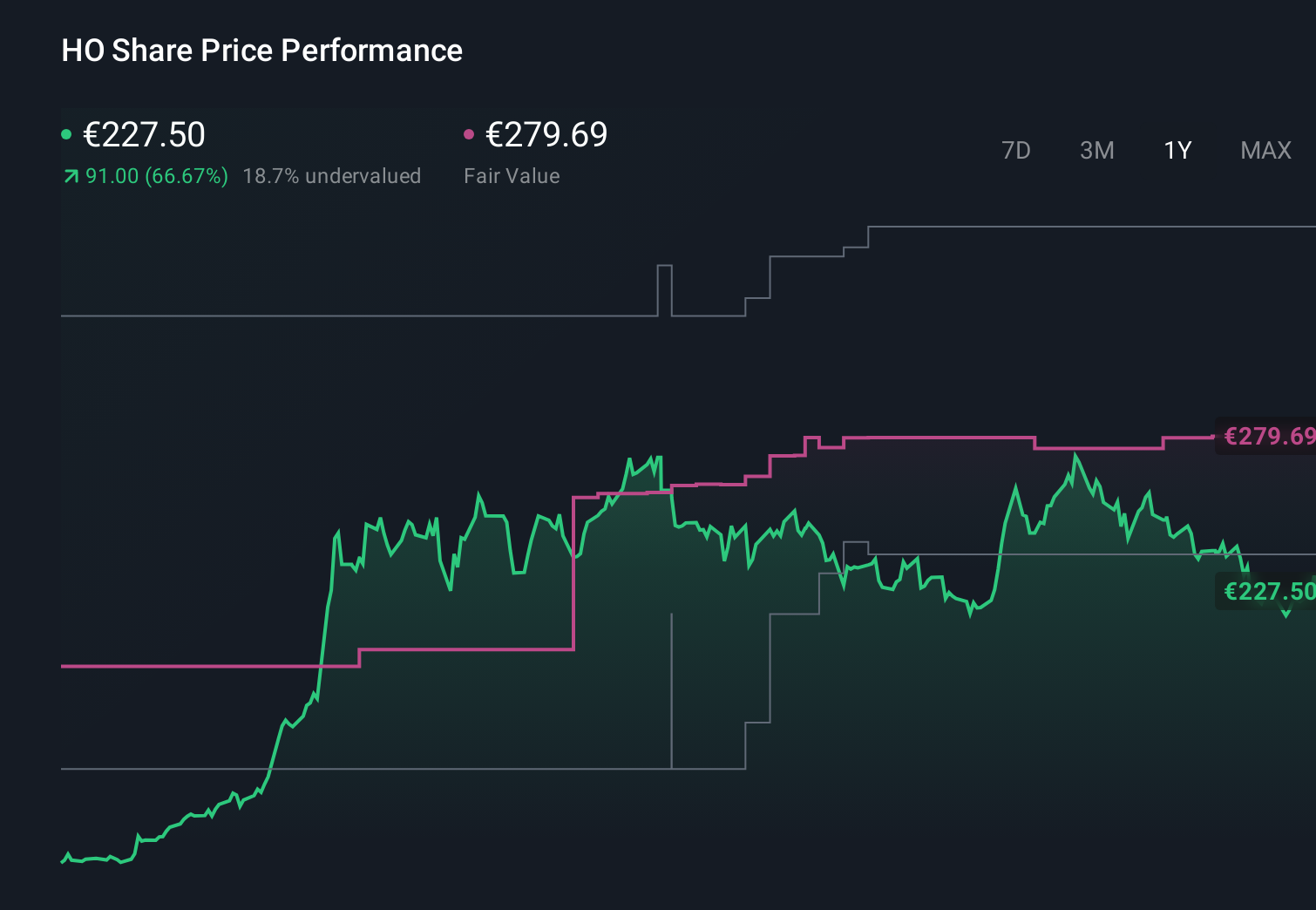

Uncover how Thales' forecasts yield a €279.69 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span roughly €163 to €367, showing a wide spread in expectations. Set against Thales’ reliance on a successful Cyber & Digital turnaround, this range underlines how differently investors weigh execution risk and potential upside.

Explore 9 other fair value estimates on Thales - why the stock might be worth as much as 59% more than the current price!

Build Your Own Thales Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thales research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Thales research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thales' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal