nCino (NCNO) Valuation Check After New $100 Million Buyback and Upgraded Earnings Guidance

nCino (NCNO) just checked two big boxes investors care about, delivering solid third quarter growth and then greenlighting a fresh $100 million share repurchase program that underscores management’s confidence in the business.

See our latest analysis for nCino.

Even with the new buyback and upbeat guidance following its third quarter results and AI focused product push, nCino’s 1 year total shareholder return of negative 28.17 percent and year to date share price return of negative 23.77 percent suggest momentum has been fading rather than building from previous highs.

If this kind of reset in sentiment has you rethinking your watchlist, it could be a good moment to scout other high growth tech and AI names using high growth tech and AI stocks.

With shares still trading well below past peaks despite a new buyback, improving profitability and AI driven growth, is nCino quietly undervalued here, or is the market already pricing in its next leg of expansion?

Most Popular Narrative Narrative: 28.3% Undervalued

With nCino closing at $25.47 against a narrative fair value of $35.54, the story points to meaningful upside if the growth path holds.

Expanding the nCino platform's capabilities beyond core loan origination into onboarding, analytics, commercial pricing, and incentive compensation provides robust cross sell or up sell opportunities, increasing average contract value and driving both top line revenue and margin expansion over time.

Want to see how this expansion story justifies a premium future earnings multiple and richer margins, despite modest revenue growth? Unlock the full valuation blueprint behind that target price.

Result: Fair Value of $35.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and slower than expected international expansion could derail the bullish narrative and limit both revenue growth and margin upside.

Find out about the key risks to this nCino narrative.

Another Angle on Valuation

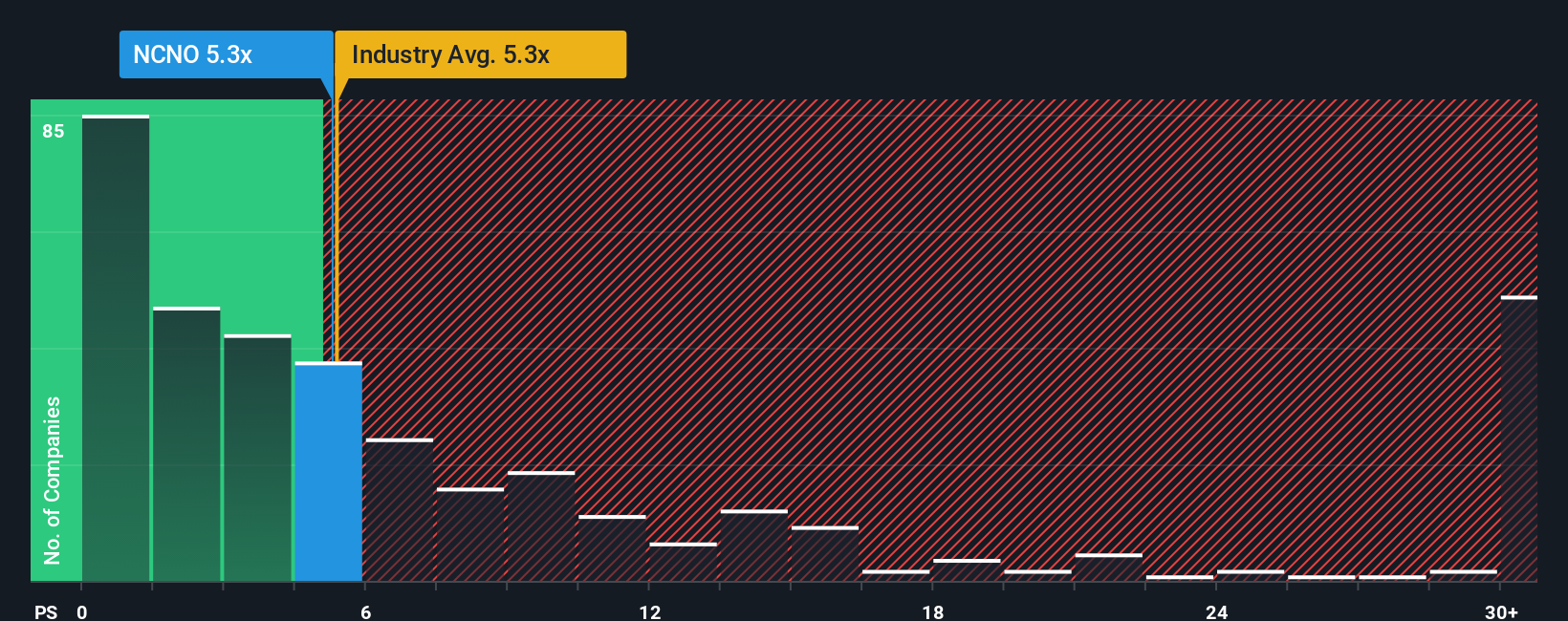

Multiples tell a more cautious story. nCino trades on a price to sales ratio of 5 times, only slightly below peers at 5.2 times and the broader US software sector at 5.1 times. This is well above a fair ratio of 3.2 times and suggests limited margin of safety if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own nCino Narrative

If you see the numbers differently or want to put your own thesis to the test, build a personalized nCino story in minutes: Do it your way.

A great starting point for your nCino research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready for your next move beyond nCino? Use the Simply Wall St Screener to pinpoint fresh opportunities before they show up on everyone else’s radar.

- Target big potential in small packages by scanning these 3609 penny stocks with strong financials that pair tiny share prices with surprisingly solid financial foundations.

- Supercharge your portfolio’s growth angle by zeroing in on these 26 AI penny stocks positioned to benefit most from the AI transformation wave.

- Lock in stronger long term income prospects by focusing on these 13 dividend stocks with yields > 3% that can boost your yield without stretching your risk tolerance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal