Assessing Aramark’s (ARMK) Valuation After Its Cheaper 2030 Term Loan B Repricing

Aramark (ARMK) just secured a better deal on its massive 2030 Term Loan B, trimming pricing by 25 basis points on 2.4 billion dollars, a quiet but meaningful improvement in its financing costs.

See our latest analysis for Aramark.

The refinancing lands at a time when Aramark’s 1 year total shareholder return is slightly negative, even as its 3 year and 5 year total shareholder returns remain solidly positive. This suggests that longer term momentum is intact, while near term enthusiasm has cooled.

If this kind of balance sheet tune up has you rethinking your watchlist, it might also be worth exploring fast growing stocks with high insider ownership for other interesting ideas.

With the stock down over the past year despite healthy multiyear returns, improving earnings, and nearly 20 percent upside to analyst targets, is Aramark quietly undervalued, or is the market already baking in its next leg of growth?

Most Popular Narrative Narrative: 16.1% Undervalued

With Aramark last closing at 37.42 dollars against a narrative fair value of about 44.60 dollars, the valuation hinges on how far its growth can stretch.

Significant investments in technology and AI for dynamic menu planning, supply chain efficiency, and contract management are driving measurable margin expansion, with AOI increasing 60 bps year-over-year, and expected to continue boosting net margins and profitability over time.

Want to see how steady contract wins, rising margins, and a reset profit multiple all combine into this premium valuation story? The narrative spells out the revenue ramp, the earnings build, and the future multiple that must hold for this upside to be realized.

Result: Fair Value of $44.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost pressures and ongoing client-driven delays to contract starts could compress margins and push the anticipated earnings inflection further out.

Find out about the key risks to this Aramark narrative.

Another View: Cash Flows Tell a Different Story

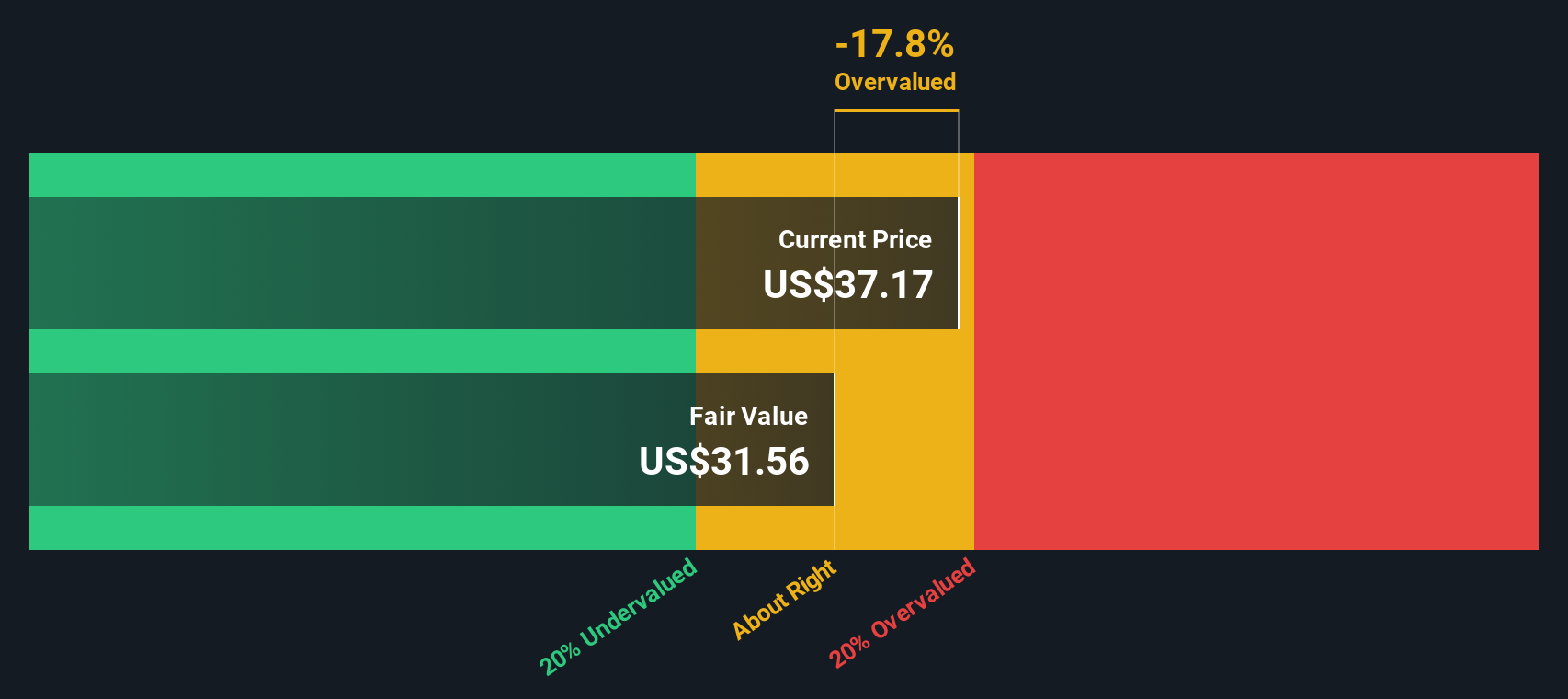

While the narrative based on future earnings points to upside, our DCF model paints a cooler picture, suggesting Aramark is trading above its fair value of 30.05 dollars. If the cash flows are right and the optimism is not, how much margin of safety is really here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aramark for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aramark Narrative

If you see the data differently or prefer to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Aramark research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single opportunity when an entire universe of data backed ideas is a click away. Broaden your edge with focused screeners now.

- Capture potential mispricings by scanning these 903 undervalued stocks based on cash flows, which combine solid fundamentals with attractive cash flow based valuations before the crowd catches on.

- Position yourself for the next wave of innovation by targeting these 26 AI penny stocks, which are shaping real world applications of artificial intelligence.

- Strengthen your income strategy by reviewing these 13 dividend stocks with yields > 3%, which pair reliable payouts with businesses built to endure changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal