Country Garden Services (SEHK:6098) Valuation After CFO Transition to Tian Tian and Strategic Role Shift for Huang Peng

Country Garden Services Holdings (SEHK:6098) just reshuffled its finance leadership, with long time executive Huang Peng stepping down as CFO to focus on incubation businesses and capital markets specialist Tian Tian stepping into the role.

See our latest analysis for Country Garden Services Holdings.

The reshuffle comes after a choppy stretch for the stock, with the latest share price at HK$6.37, a 1 day share price return of 1.92 percent but a 90 day share price return of negative 9.26 percent. The 1 year total shareholder return of 23.28 percent contrasts sharply with a 3 year total shareholder return of negative 62.56 percent, suggesting that recent momentum is rebuilding from a much weaker long term base as investors reassess both risk and recovery potential.

If you are weighing Country Garden Services against other ideas in a shifting property and services outlook, it could be worth exploring fast growing stocks with high insider ownership as a way to surface fresh, fast moving names with committed insiders.

With profits growing faster than revenue, an intrinsic value suggesting upside, and the stock hovering just below analyst targets, the real question is whether this is a genuine value gap or if markets already see the next leg of growth.

Price-to-Earnings of 14x: Is it justified?

Country Garden Services is trading on a 14x price-to-earnings multiple, roughly in line with peers, even as the share price reflects a steep multi-year drawdown.

The price-to-earnings ratio compares what investors pay today for each unit of current earnings, making it a useful yardstick for income-generating real estate service names like 6098. At 14x, the stock is almost exactly where our fair P/E estimate of 13.9x sits, implying the market is not significantly misaligned with our earnings-based valuation framework.

Against that backdrop, 6098 appears marginally cheap versus the peer average of 14.2x P/E, but slightly expensive versus the broader Hong Kong real estate industry at 13.5x P/E. If sentiment or earnings expectations shift, the multiple has room to move toward our fair ratio, potentially nudging the share price in either direction as investors recalibrate what they are willing to pay for each dollar of profit.

Explore the SWS fair ratio for Country Garden Services Holdings

Result: Price-to-Earnings of 14x (ABOUT RIGHT)

However, lingering exposure to China property stress and margin pressure from slower city services growth could quickly challenge assumptions about a smooth earnings recovery.

Find out about the key risks to this Country Garden Services Holdings narrative.

Another View: Discounted Cash Flow Signals Deeper Value

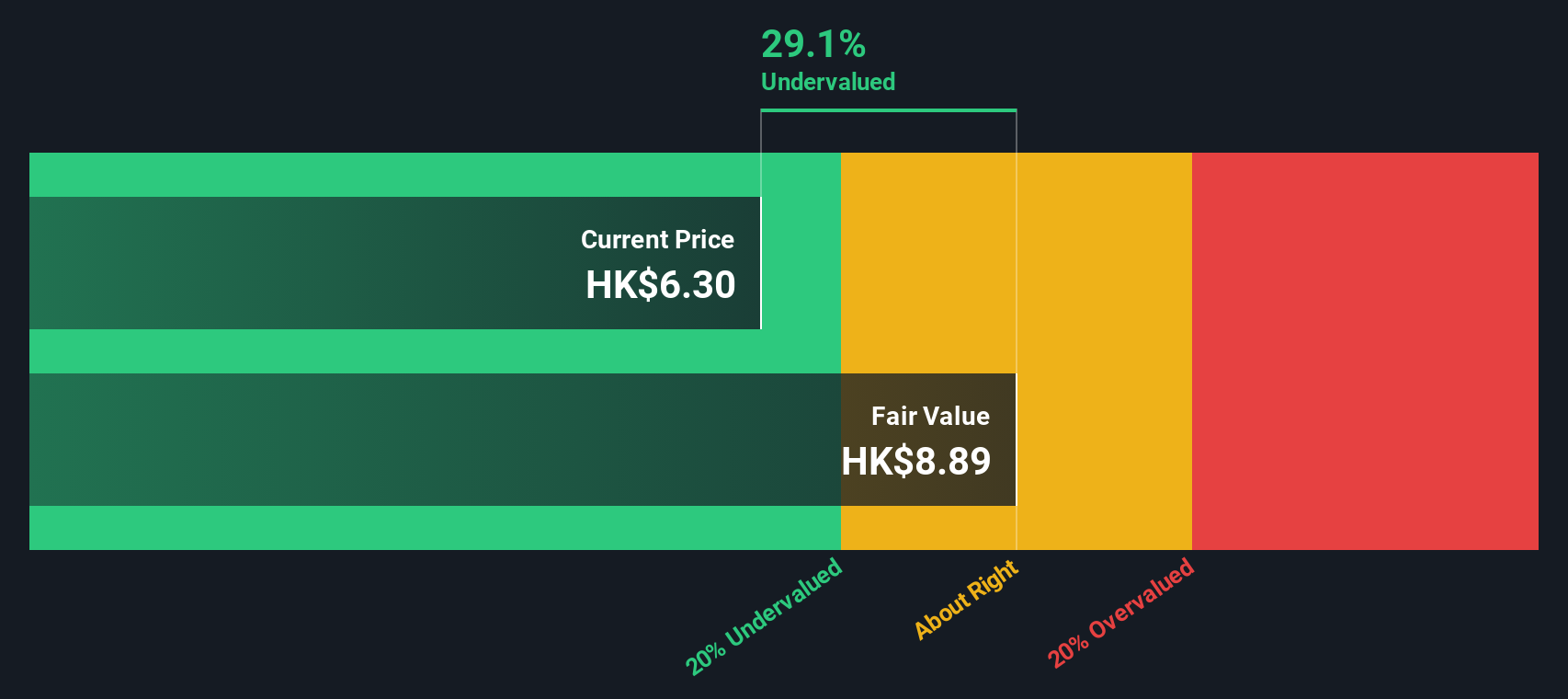

While the 14x earnings multiple indicates the price is around fair value, our DCF model suggests something different. It estimates fair value closer to HK$8.88, which is roughly 28 percent above the current HK$6.37 level. This raises a question: is the market still pricing in old fears, or is the model too optimistic about recovery?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Country Garden Services Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Country Garden Services Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Country Garden Services Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore additional opportunities by scanning focused stock lists on Simply Wall Street, so potential winners do not slip past unnoticed.

- Supercharge your search for potential mispriced opportunities by targeting companies trading below their cash flow characteristics with these 903 undervalued stocks based on cash flows.

- Explore innovation at the intersection of medicine and machine learning by filtering for companies in these 30 healthcare AI stocks.

- Explore developments in digital finance by focusing on companies in these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal