Reassessing 1st Source (SRCE) Valuation After Its Recent Share Price Outperformance

Recent performance puts 1st Source (SRCE) on investor radar

1st Source (SRCE) has quietly outperformed many regional peers, with the stock up about 7% over the past month and 14% year to date, prompting fresh interest in its valuation.

See our latest analysis for 1st Source.

That steady climb, with a roughly mid teens year to date share price return and a much stronger multiyear total shareholder return, suggests momentum is building as investors reassess the bank’s growth and risk profile at a share price of $65.82.

If 1st Source’s recent strength has you rethinking where regional banks sit in your portfolio, it could be worth exploring fast growing stocks with high insider ownership for other potential standouts.

With shares still trading below Wall Street’s target and some models pointing to a steeper intrinsic discount, the key question now is whether 1st Source remains a compelling value or if the market already reflects its future growth.

Price-to-Earnings of 10.9x: Is it justified?

On a Price to Earnings ratio of 10.9 times versus a last close of $65.82, 1st Source looks modestly cheaper than many banking peers.

The Price to Earnings multiple compares what investors pay today for each dollar of the bank’s current earnings, a core yardstick for profitable, mature lenders. For 1st Source, a 10.9 times multiple sits below the 12.9 times peer average, which hints the market may be applying a discount despite its solid profitability and track record of earnings growth.

Compared with the broader US Banks industry average of 12 times, 1st Source’s 10.9 times multiple still screens as lower, reinforcing the impression of a valuation gap. However, when stacked against an estimated fair Price to Earnings level of 10.3 times, the current multiple is slightly richer, implying the share price may already reflect part of its quality and growth, and that any repricing could lean toward this fair ratio over time.

Explore the SWS fair ratio for 1st Source

Result: Price-to-Earnings of 10.9x (ABOUT RIGHT)

However, risks remain, including sensitivity to credit quality in a slower economy and pressure on net interest margins if funding costs rise faster than expected.

Find out about the key risks to this 1st Source narrative.

Another view: SWS DCF points to deeper value

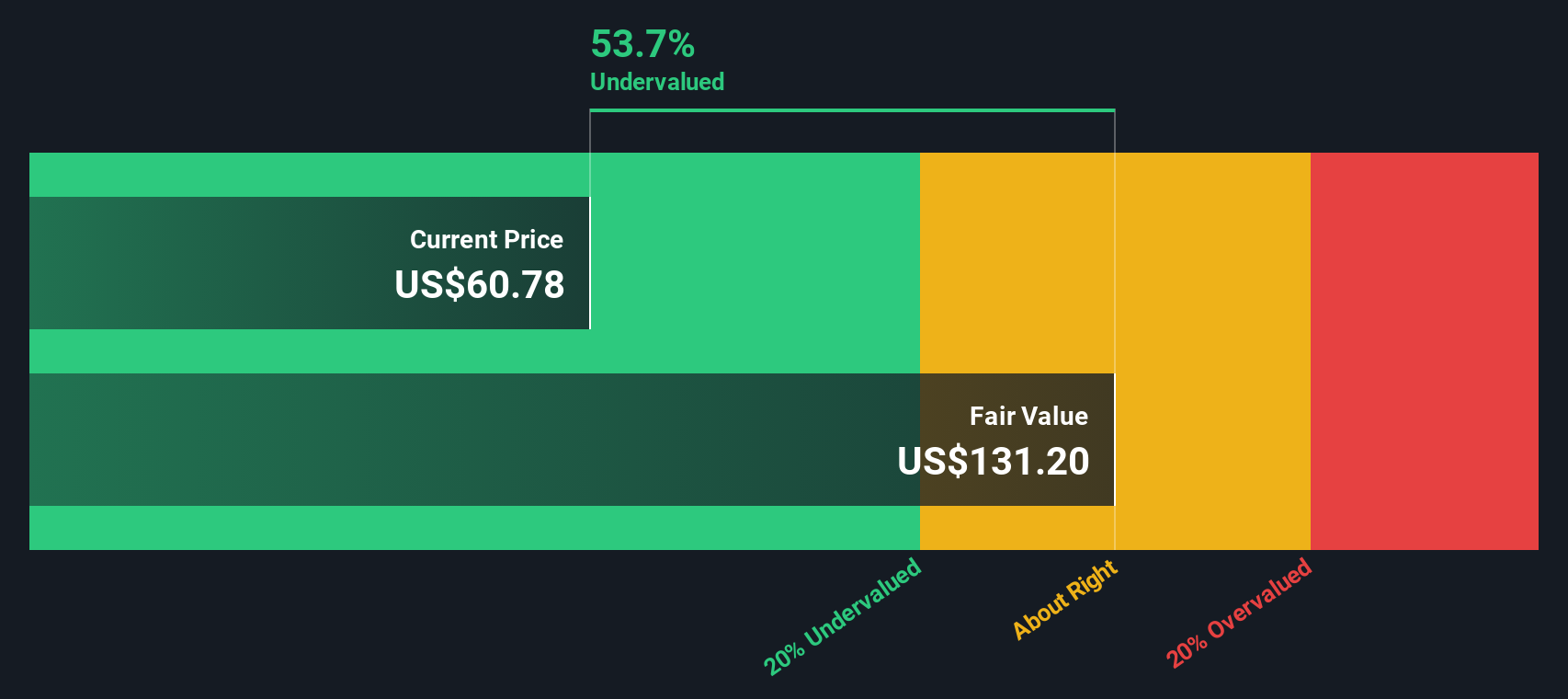

Our DCF model paints a very different picture. On this view, 1st Source’s fair value sits around $131.20 a share, almost double the current $65.82 price, suggesting the market may be heavily discounting its long term cash generation.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out 1st Source for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own 1st Source Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a personalised view in just minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding 1st Source.

Ready for your next investing move?

Keep your edge sharp by acting on fresh opportunities now, not someday, and let the Simply Wall Street Screener surface ideas you will not want to miss.

- Capture potential mispricings early by running with these 907 undervalued stocks based on cash flows that the market may be overlooking today but rewarding tomorrow.

- Tap into accelerating innovation by targeting these 26 AI penny stocks positioned to benefit as artificial intelligence reshapes entire industries.

- Build a steadier income stream by focusing on these 13 dividend stocks with yields > 3% that can support returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal