SCHOTT Pharma (XTRA:1SXP) FY 2025 Margin Slippage Tests Bullish Re‑Rating Narrative

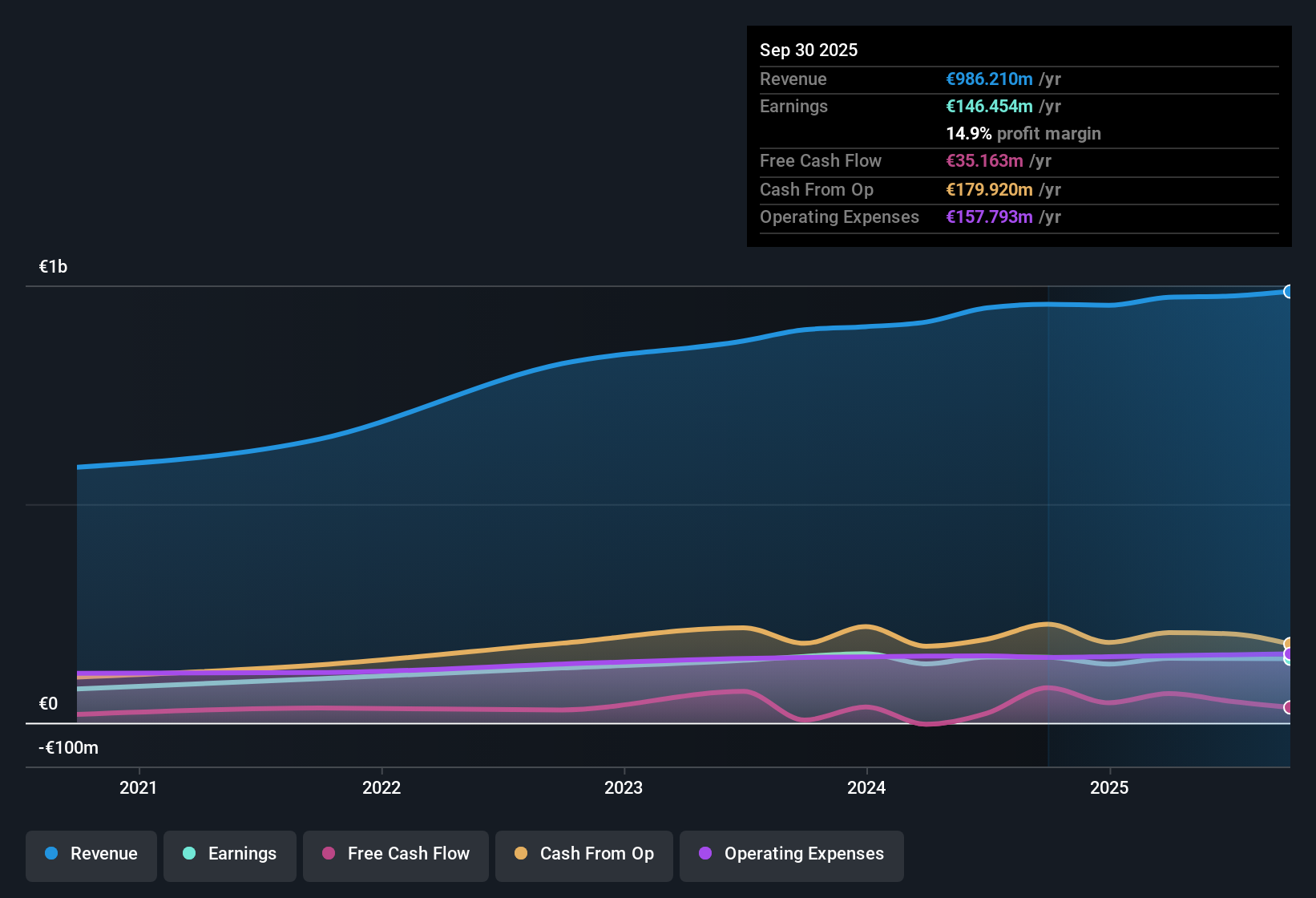

SCHOTT Pharma KGaA (XTRA:1SXP) has wrapped up FY 2025 with fourth quarter revenue of €247.6 million and basic EPS of €0.22, capping a trailing twelve month stretch that delivered €986.2 million in revenue and €0.97 in EPS. The company has seen quarterly revenue hover between €229.8 million and €256.5 million through FY 2025, with EPS ranging from €0.19 to €0.30, while trailing net income for the period came in at €146.5 million, pointing to solid but slightly thinner margins versus a year ago.

See our full analysis for SCHOTT Pharma KGaA.With the headline numbers on the table, the next step is to weigh these results against the dominant narratives around SCHOTT Pharma, highlighting where the latest margins and growth trends confirm the story and where they start to push back on consensus views.

See what the community is saying about SCHOTT Pharma KGaA

Margins Ease From 15.6% To 14.9%

- On a trailing basis, net profit margin is 14.9 percent, slightly down from 15.6 percent a year ago, while trailing net income slipped from 149.7 million euros to 146.5 million euros over the same period.

- Analysts' consensus view expects mix toward high value solutions and efficiency gains to support margin expansion, yet the small pullback in trailing margin shows that:

- Current profitability is still high quality but not yet reflecting the move from about 15.1 percent toward the projected 17.5 percent margin over the next three years.

- Capacity ramp up costs and softness in some traditional products can weigh on margins even as the business gradually tilts toward higher value packaging.

Valuation Signals Deep Discount

- With the share price at 15.14 euros and DCF fair value at about 42.38 euros, the stock trades at roughly a 64 percent discount and on a 15.6 times P E that sits well below the 35.6 times industry average and 59.7 times peer average.

- What stands out for the bullish side is that this low multiple is paired with forecast growth, as:

- Earnings are projected to rise about 13.2 percent per year and revenue about 7.7 percent per year, building on roughly 9.5 percent annual earnings growth over the past five years.

- This combination of growth and a large gap to DCF fair value heavily supports a value oriented bullish case, even though trailing earnings slipped slightly year on year.

Growth Plans Versus Softer Legacy Lines

- Quarterly EPS over FY 2025 ranged from 0.19 euros to 0.30 euros and net profit on a trailing basis eased from about 149.7 million euros to 146.5 million euros, while management also highlights underutilization in polymer syringes and muted demand in some core vials.

- Critics in the bearish camp focus on whether high value solutions can fully offset this softness, pointing out that:

- Heavy capital spending on new capacity, including double digit million euro ramp up costs, has already reduced free cash flow such as the drop to 17 million euros in a recent quarter compared with 34 million euros a year earlier.

- If demand in legacy products and polymer syringes stays weak, these investments could weigh on profitability longer, limiting how quickly earnings can grow from the current 146.9 million euros base toward the 225.9 million euros that analysts model for around 2028.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SCHOTT Pharma KGaA on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers shaping up another way, then turn that view into your own narrative in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding SCHOTT Pharma KGaA.

See What Else Is Out There

SCHOTT Pharma KGaA is pushing for higher value growth, but softer legacy demand, ramp up costs, and thinner margins are pressuring earnings and cash flow.

If you want businesses already delivering consistent expansion instead of waiting for a turnaround, use our stable growth stocks screener (2103 results) today to uncover companies with steadier earnings momentum and fewer execution headaches.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal