Dowa Holdings (TSE:5714): Assessing Valuation After Yen-Driven Share Price Strength and Market Outperformance

Dowa Holdings (TSE:5714) jumped after the weaker yen and a record setting Topix backdrop pushed the stock up more than 6%, taking it to 5 year highs as investors positioned ahead of key central bank meetings.

See our latest analysis for Dowa Holdings.

Zooming out, Dowa’s strong session builds on a clear upswing, with a roughly 51% year to date share price return and a 5 year total shareholder return of about 106%, suggesting momentum is still building rather than fading.

If Dowa’s surge has you thinking about what else could be gaining traction, this is a good moment to explore auto manufacturers as another way to tap into yen driven themes.

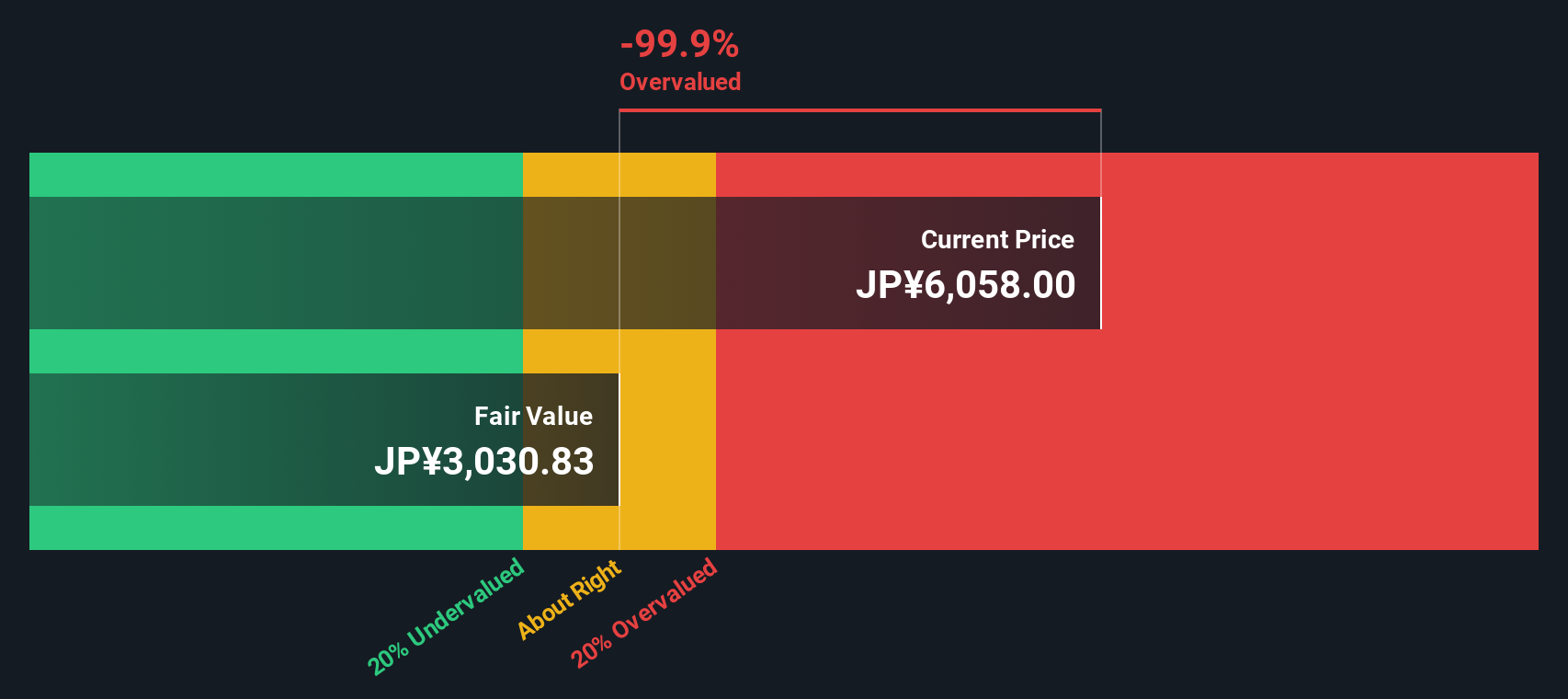

Yet with shares now at five year highs and trading above analyst targets, investors face a key question: is Dowa still undervalued on its improving fundamentals, or has the market already priced in the next leg of growth?

Price-to-Earnings of 19.8x: Is it justified?

On a price-to-earnings ratio of 19.8 times, Dowa trades above our estimated fair P E of 16.2 times and well above its own discounted cash flow value, even after the latest close at ¥6,736.

The price to earnings multiple compares what investors pay today for each unit of current earnings, a crucial lens for a diversified industrial and materials group like Dowa where profits can be cyclical and sensitive to metal prices and recycling volumes.

At 19.8 times earnings, the market is assigning a premium that looks rich relative to our fair ratio estimate of 16.2 times. This implies the share price has moved ahead of what the SWS regression based fair multiple suggests the fundamentals currently warrant.

That premium becomes more striking when set against the domestic Metals and Mining average of 12.1 times. This underscores that investors are paying a materially higher earnings multiple than is typical for the sector, even though Dowa is not projected to deliver hyper growth style expansion.

Explore the SWS fair ratio for Dowa Holdings

Result: Price-to-Earnings of 19.8x (OVERVALUED)

However, sustained yen strength or a downturn in metal prices and recycling volumes could quickly compress margins and challenge the premium valuation investors now pay.

Find out about the key risks to this Dowa Holdings narrative.

Another View Using Our DCF Model

Our DCF model paints a tougher picture, with an estimated fair value of ¥4,113.91 versus the current ¥6,736, implying Dowa may be significantly overvalued. If cash flows drive prices in the long run, is today’s optimism simply pulling future returns forward?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dowa Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dowa Holdings Narrative

If you would rather lean on your own judgement and dig into the numbers yourself, you can craft a tailored view in just a few minutes, Do it your way.

A great starting point for your Dowa Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before the market shifts again, use the Simply Wall St Screener to spot fresh opportunities that match your strategy and keep potential winners on your radar.

- Capitalize on mispriced quality by reviewing these 907 undervalued stocks based on cash flows that could offer stronger long term return potential than headline names.

- Target structural growth trends through these 30 healthcare AI stocks positioned at the intersection of medical innovation and next generation automation.

- Position ahead of the next speculative wave by tracking these 80 cryptocurrency and blockchain stocks riding the build out of blockchain and digital asset ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal